Cross-border ecommerce brands selling into new markets need to navigate import duties and taxes for each region to be compliant and provide excellent shopper experiences.

Ecommerce brands selling into international markets need to navigate the duties, taxes and customs requirements of these countries to be legally compliant and ensure there are no delays to deliveries, or additional costs to shoppers.

Difficulties of Cross-Border Duties and Taxes

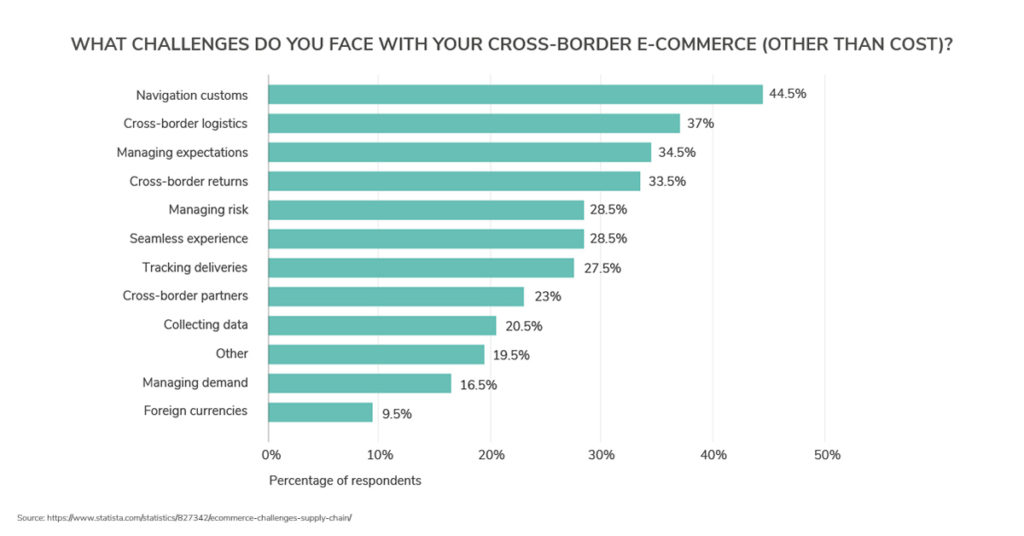

Cross-border ecommerce brands report navigating customs compliance as the most difficult aspect of operating internationally, with 51% of respondents citing this – even above logistics, returns and processing foreign currencies.

Brands must be compliant with trade regulations in all countries and territories they import into. Apart from the legal requirement, customer experience should always be a key priority, so minimising any shopper disruption due to non-compliant goods or insufficient paperwork will increase the customer’s confidence or loyalty in the brand – on the other hand, goods that are held by customs or incur an additional charge to the shopper will reflect poorly.

Reasons Why Governments Levy Import Duties and Taxes

- Protect domestic companies from foreign competitors

- Control the flow of certain products

- Raise revenue through taxes

Import duties and taxes are applied for a number of reasons. These range from giving domestic businesses an advantage over potentially cheaper products being sold into the market from other countries, to controlling certain products entering the market, or raising revenue.

Each nation sets its own duties and taxes but countries that are members of the World Trade Organisation (WTO) benefit from the same duty ‘rate’ as the importing country – if it’s also part of the WTO.

For example for apparel products made from wool or fine animal hair being imported into the US the Most Favoured Nation rate is 14% while the general duty rate for that HTS code (for countries that are not part of the WTO) is 28.5%.

Agreements Between Countries and Territories

Different types of agreements govern trade between countries. These help decide which rates of duties and taxes are applied to imports.

- FTAs – (free trade agreements): Agreement between two countries or regions. Reduced duty rates for all or certain products.

- MFNs (most favoured nation) – This is a favourable duty rate that pertains to a certain set of duties applicable between WTO countries.

- Preferential/Non-preferential Country Of Origin – The country of origin of goods is a factor in determining the amount of duty payable. Other factors include the type and value of the goods and this will have some influence on the amount of duty payable upon import.

Calculation and Collection of Import Duties and Taxes for Brands

Duties are determined by the country of importation however they can be influenced by any customs union (such as the EU), or agreements such as Most Favoured Nation (MFN), or Free Trade Agreement (FTA). If a country is part of the WTO then it must in principle apply the same duty rate to goods coming from any other country that is also part of the WTO.

The duties are collected by customs agents at the point of entry into the country of import. Cross-border brands selling into international markets will find that they may need – and are sometimes obligated to have – a broker to manage and pay the customs due on shipments, who will then invoice the company for payment. Depending on the Incoterm (international commerce terms that represent a universal term that defines a transaction between importer and exporter) chosen, either the duties and taxes are paid at checkout or paid by the shopper on receipt of goods. DDP (Delivery Duty Paid) is the only Incoterm that allows duties and taxes to be paid at checkout and is best practice for cross-border ecommerce brands as it is a superior experience for the shopper.

There are a number of different ways to calculate duties. These include:

- As a percentage of imported item value

- On a per product rate – eg $3 per pair of shoes

- Per pound/kilo rate – pay by weight

- Compounded duty – where it is calculated as a percentage with a minimum threshold.

Calculating Import Duties and Taxes for Shoppers

It is widely accepted that the best customer experience requires duties and taxes to be calculated pre-purchase, so the shopper is aware of (and can pay) the fully landed cost pertaining to their order. In order to calculate the correct duties and taxes for shoppers, the brand will need to have established the correct duties applicable for each product into each country that they are shipping to and add this calculation to the order value in the checkout. It is necessary for the brand to know exactly the HS Codes (worldwide classification) for the products, the particular agreement between import and export country, and sometimes freight and insurance – if the country calculates on a CIF basis (Cost, insurance, and freight is paid by the seller) – to determine the exact duty for the item. Additionally, certain countries add extra customs fees which may also form part of the calculation.

Glossary of Terms

Below is a guide to the common terms used in duties and taxes compliance.

HS Codes – HS Codes are a worldwide agreed classification for all products to determine what product is being imported or exported and what conditions and taxes are applicable. The first six digits are the same worldwide, but countries are free to further classify product by appending subsequent digits to identify the product in more detail, and assign a duty rate accordingly.

Documentation – any product being imported into a country needs to be accompanied with specific documentation that details the specific HS codes for the product in that country – for example if you import HTS 420221 (leather handbags) into Australia the specific requirements include an Import Permit for Wildlife and Wildlife Products document.

CITES certification – this is a specific document related to the Washington convention for the protection of flora and fauna. Sellers will need to have a CITES certificate for importation of products that may contain materials derived from some protected flora and fauna eg crocodile leather.

Country of Origin is where the good has been wholly obtained or where the last substantial transformation of the product has been carried out. This can have duties and tax implications for the brand. If for example a material is sourced in China but manufactured in Vietnam then the brand will be charged duties related to the agreement that Vietnam has with the importing country, not China. If the product were made in China but finished in Vietnam (with no significant transformation), then the duties would be related to the agreement between China and the country of import.

CIF – Under the Incoterms 2020 rules, CIF means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point. CIF is one of only two Incoterms 2020 rules that identify which of the parties must purchase insurance.

FOB –Free on board – this means the seller has fulfilled its obligation when the goods are loaded on the vessel nominated by the buyer at the named port of shipment. With FOB, the seller is responsible for loading the goods on the transport, while the buyer is responsible for everything else necessary to get the goods to the final destination.

Incoterms – international commerce terms: represent a universal term that defines a transaction between importer and exporter, so that both parties understand their tasks, costs, risks and responsibilities

Dangerous Goods – there are a number of products that are considered ‘dangerous goods’ such as lithium ion batteries, powder cosmetics and anything that contains liquids or alcohol such as perfume or nail varnish.

De minimus – value under which duty or duty and tax are not payable.

Conclusion

Navigating customs compliance for shipping goods into multiple countries is not an easy task for brands, but is essential to remaining legally compliant when selling into new markets and creating an excellent shopper experience. For brands selling into multiple countries, using a solution such as ESW’s will ensure that the process is as frictionless as possible.

To find out more about how If you would like to understand more about how Duties and Taxes apply to your cross-border ecommerce, contact an expert member of our team.