Fraud is no longer just an occasional nuisance; it’s a costly threat. According to Juniper Research, financial losses were projected to exceed $48 billion in 2023. It’s no wonder, then, that brands with international DTC channels face unique challenges when it comes to managing fraud. Ecommerce fraud is an insidious adversary partly because fraudsters are becoming increasingly sophisticated, using tactics that can lead to severe financial losses and harm your brand’s reputation.

But with the right knowledge and information, you can reduce fraud and increase checkout conversions and payment acceptance rates.

The Financial and Reputational Impact of Ecommerce Fraud

Beyond the financial hits, ecommerce fraud can damage your brand’s reputation.

Consumers hold brands responsible for protecting data and payment information. If your brand is hacked and the breach leads to customers’ payment information being used fraudulently, they may hold you responsible and stop shopping with you. Even worse, victims of fraud may take to social media resulting in a PR crisis.

These financial and reputational impacts highlight the need to stay vigilant and proactive. Being aware of common fraud tactics is the first step in defending your ecommerce platform and maintaining customer trust. If you have ecommerce channels in international markets, it is even more essential to have robust fraud prevention strategies and tactics in place.

The most efficient strategy for combatting fraud is to enlist a merchant of record who handles all aspects of a customer’s transaction and takes on the responsibility for fraud prevention.

While scams and schemes vary by market, here are four common types of ecommerce fraud, how you can fight them and how a merchant of record can help you do it efficiently.

Chargeback Ecommerce Fraud Explained

Chargeback fraud, or “friendly fraud,” is when a customer makes a legitimate purchase and receives the product but then disputes the transaction with their credit card issuer. Perceived as friendly at first glance, it’s anything but. In fact, by some measures, friendly fraud will represent 61% of all chargebacks this year.

This fraud is a business nightmare because winning a chargeback dispute is often challenging, even if you can prove that the customer received the product. Worse, each successful chargeback costs your company—the cost of the product, shipping fees and potential penalties from banks all add up.

Preventing and fighting chargeback fraud

Of course, there are steps you can take to prevent chargeback fraud. For example, you can make sure that your logistics partner provides thorough and robust transaction details including proof of delivery and records of any interactions with your customer. If you have proof that a package was delivered to your customer, it’s easier to dispute a chargeback claim.

Prevention is only one part of mitigating chargeback fraud damage. When a customer does file a fraudulent claim, you then begin the dispute resolution process. Given the sheer volume of claims – some fraudulent and others legitimate – handling resolution in house requires resources and expertise. And if you have ecommerce channels in multiple countries, dispute resolution is even more resource intensive.

Fighting chargeback fraud is easier if you engage a merchant of record as part of your international ecommerce strategy. A merchant of record takes on the responsibility for dispute resolution and is responsible for making sure transactions are legitimate. This takes the burden off of your internal resources so you can focus on your core business functions.

The Intricacies of Reseller Abuse

Reseller abuse is a type of fraud where individuals exploit your ecommerce platform to buy large quantities of an item to resell them at a higher price. This practice can lead to skewed inventory forecasting by creating artificial demand spikes and leading you to believe there is more interest in a product than there actually is.

More than that, resellers can damage your reputation because once the product has left your warehouse, you have lost control over the brand experience. Someone who buys you product from a reseller most certainly won’t have the brand experience you intended which may lead them to not purchase from you again.

Sometimes fraudsters use automated tools or bots to buy highly popular or limited issue items before they sell out. Then, they sell the items at higher prices to customers who were unable to purchase the item at the original retail price.

Combatting resale abuse

To spot this kind of fraud, you’ll need an ecommerce platform and checkout that can detect suspicious behaviour like multiple purchases of high-demand product from a single shopper or single shipping address.

If your existing technology doesn’t include a mix of automated and human review, you are more likely to become a victim. This kind of fraud detection is expensive and resource intensive. Brands often find it is more efficient and cost effective to enlist a company like ESW that has robust reseller abuse technologies ready-to-use. In fact, ESW has thwarted reseller abuse fraud for multiple brands including billon-dollar fashion brands.

Understanding Refund Fraud

Refund abuse occurs when a customer requests a refund for a legitimate purchase, often while falsely claiming the product was defective or never arrived. It’s a tactic that fraudsters use to snag goods for free, creating substantial financial losses for businesses.

Phantom refunds are a growing problem and a double whammy for your brand. In this scheme, fraudsters create a return, but do not actually return the product. Instead, they return an empty box or even put a bag of sand in the return package to create the illusion of an item. Only when the box is opened at the return centre do you know that you’ve been scammed.

Rebuffing refund fraud

The first step to reducing the damage of refund fraud is to make sure your return and refund policies are robust and detailed while still being customer friendly. The second step is to have certain safeguards in place. For example, you need a reverse logistics partner that can track returned packages from the time a return leaves the shopper’s possession to the time it arrives at your returns centre. If your brand sells high-value products, you’ll want to inspect each return before issuing a refund. Manual inspections are time consuming and expensive but are essential.

The best solution for ensuring that you are not taken advantage of is to engage a third party to handle reverse logistics, refunds and appeasements. Companies like ESW have solutions that give you full visibility into what is being returned and why. We can also inspect returns to make sure you don’t see a financial hit from fraudulent returns.

The Ever-present Threat of Credit Card Fraud and Account Takeover

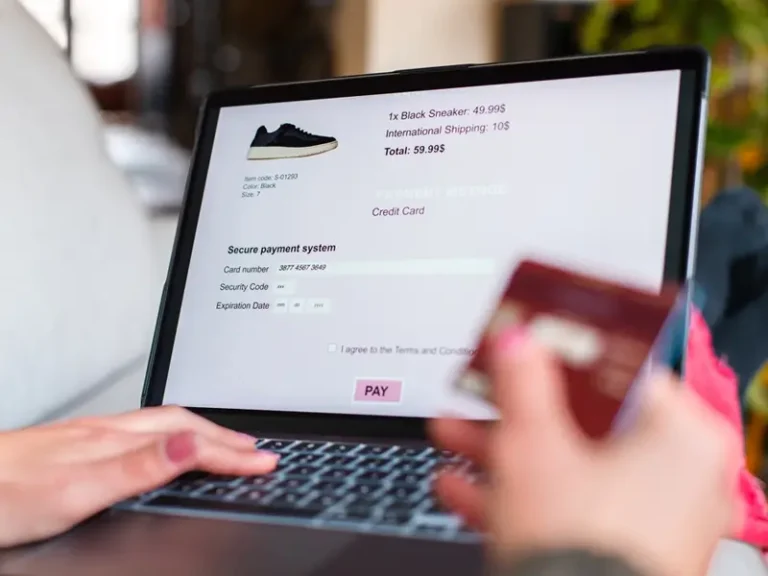

Credit card fraud and account takeovers present some of the most direct threats to ecommerce channels, where cybercriminals use stolen financial information to make unauthorised purchases. The ease of access to dark web deals has exacerbated these crimes.

A recent article noted that 60% of US credit card holders reported having had suspicious transactions on their cards at least once. Account takeovers occur when fraudsters gain control of a customer’s account, altering personal data and making undesired purchases.

Tackling takeover fraud

Just because credit card takeover is common does not mean that it is easy to fight. In fact, to properly combat credit card fraud, you need layers and layers of protection including advanced vetting, routing, risk scoring and more. To add to the complexity, you have to do all of this in a way that is undetectable by your shoppers. Legitimate shoppers expect the checkout experience to be fast and seamless, so you don’t want to delay or disrupt the flow.

Putting the proper pieces in place to make sure bad actors don’t exploit your systems requires expertise that you may not have in house. But that doesn’t mean that you can’t fight fraud. Organizations like ESW have the necessary systems already in place and can integrate with easily with your ecommerce platform. Our fraud prevention gives your shoppers the experience they expect while maintaining the highest security standards and payment acceptance rates.

Final Thoughts and Call to Action for Ecommerce Brands

Ecommerce fraud is an evolving battle. Being informed about the types of fraud, like chargeback fraud, reseller abuse, refund abuse, and credit card fraud, prepares your business to build better defenses.

Setting up those defences is time consuming and expensive – especially if you have a global DTC presence. Payment methods vary from market to market which means fraud schemes are also different. Monitoring all payments in all countries requires constant vigilance and ever-evolving technologies to stop fraud before it happens. Enlisting a partner or establishing a merchant of record relationship with your ecommerce platform provider is one way to protect yourself and your brand’s reputation. Reach out to learn more.