Holiday Peak, Higher Stakes

Every year, shoppers start their holiday buying earlier – and their expectations rise. They want speed, transparency, and trust at every step of the journey.

Ecommerce is reshaping this landscape: by 2027, it will account for 41% of global retail sales (up from just 18% in 2017). Cross-border ecommerce alone will surpass $4 trillion, and ESW’s Global Voices 2025 report shows the scale: more than 40% of shoppers placed up to 10 international orders last year, while another 37% placed between 11 and 50.

But global complexity is rising too. Inflation, tariffs, and geopolitical events influence shopper intent, while expectations differ sharply between markets. For brands, Q4 growth depends on meeting three universal shopper demands: transparent pricing, trustworthy experiences, and reliable delivery.

For a deeper exploration of cross-border shopping behaviors and market-by-market differences, see our extended guide:

This article focuses on what brands can do now to succeed this Q4.

Price: No Surprises at Checkout

Shoppers fill bigger carts in Q4, but they are also more cautious. Any unexpected fee can derail conversion when peak demand is at its highest.

- 39% of shoppers abandon carts due to unexpected costs.

- 45% are more price-conscious this year due to economic uncertainty, and 54% are actively looking to save money.

- Market intent diverges: shoppers in India, China, South Africa, UAE, and Brazil expect to spend more this holiday season, while around 40% in France, Mexico, and Argentina plan to spend less.

The Q4 expectation: A fully landed price upfront — product, duties, taxes, and shipping — shown in local currency with familiar payment options such as cards, digital wallets, or BNPL.

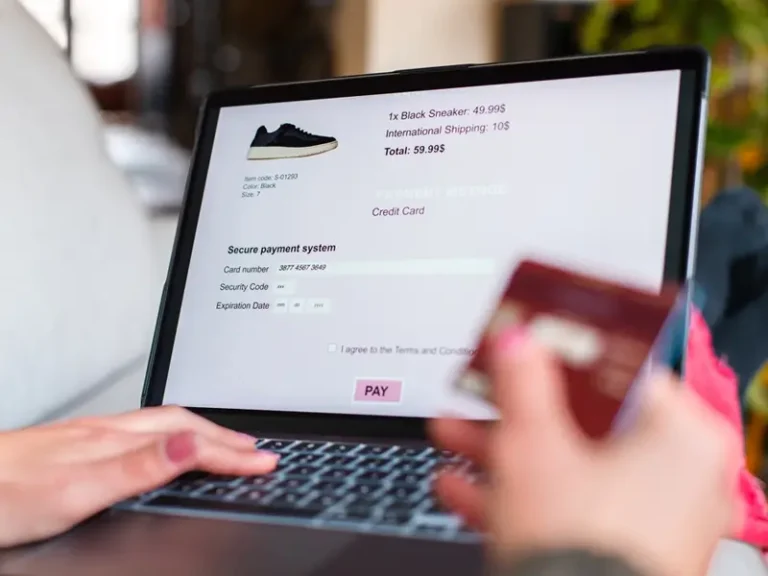

Trust: Secure, Local, Reassuring

Gift buyers are unforgiving: if they do not trust the checkout, they will not risk completing the order.

- 42% of global shoppers abandon carts due to payment security concerns.

- Security fears drive abandonment rates as high as 60% in India, 58% in UAE, and 52% in Mexico.

The Q4 expectation: A shopping experience that feels as safe and seamless as buying domestically. That means:

- Localised websites (language, currency, sizing).

- Trusted payments with visible security logos.

- Transparent, accessible return policies.

Returns are a trust signal too: in Argentina, Brazil, and Mexico, charging for returns can block the sale. In India, China, and UAE, shoppers are more accepting of return fees if the process is simple and fast.

Speed: Certainty, Not Just Speed

Holiday deliveries carry one unbreakable rule: arrive on time.

- Only 1% of shoppers will pay extra for faster shipping.

- 47% accept four to seven days if shipping is free.

- Local norms differ: 23% of Italians expect delivery in three days or less, while 13% of shoppers in Brazil, Australia, and Argentina are comfortable waiting two weeks.

The Q4 expectation: Clear, reliable delivery windows at checkout, plus returns that are fast and convenient (drop-off, pre-paid labels, or in-country hubs).

Q4 Shopper Expectations Checklist

- Fully landed pricing, no hidden costs

- Local currencies and familiar payment options

- Secure checkout with visible trust signals

- Delivery timelines clearly displayed at checkout

- Free or affordable shipping choices

- Simple, localized returns process

- Seamless localized shopping experience (language, sizing, currency)

- Transparent policies for duties, taxes, and refunds

Ready for Q4?

Meeting shopper expectations for price, trust, and speed is the key to unlocking holiday growth. Do not let cross-border complexity cost you peak-season sales.

Talk to a Peak Season Expert and plan your Q4 readiness with ESW today.