Cross-border ecommerce brands face unique challenges when managing fraud – but having the right knowledge will help reduce occurrences.

Three types of ecommerce fraud and how to preempt them:

1. Criminal Fraud

2. Friendly Fraud

3. Reseller Fraud

Prevalence of ecommerce fraud

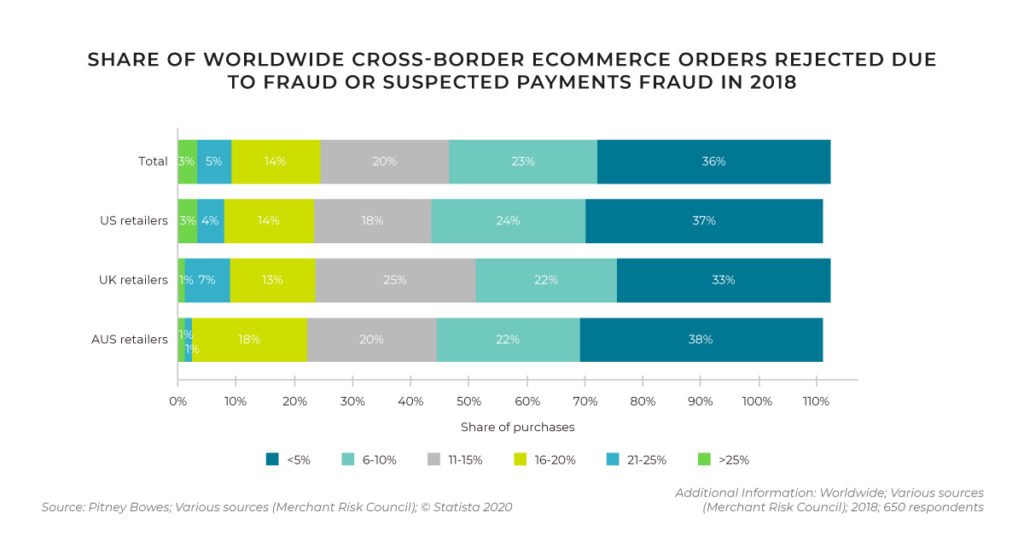

Fraud has long been a risk for online merchants, but brands operating internationally face additional challenges. Each market has its own risk profiles, so applying blanket fraud controls could lead to lost sales due to false positives. Retailers need to have the knowledge, experience and capability to optimize each market appropriately. Recently, online fraud has been on the rise, with credit card chargebacks – which the merchant absorbs – rising 20% year on year. More sophisticated methods of fraud are developing annually and require ecommerce brands to have more advanced technology and awareness to protect their customers and their businesses.

Here are three types of fraud all ecommerce brands should be aware of:

Criminal fraud

With 92% of ecommerce fraud committed in online transactions in 2017 using a credit card, criminal fraud – using stolen credit cards – is a major issue for ecommerce brands. Credit card fraud rose a further 18.4% in 2018 and continues to rise.

Conor Walsh, Head of Payments at ESW, said, “Criminal fraud is where bad actors attempt to purchase goods using stolen credit/debit card credentials, often sold on the dark web. This kind of fraud is most prominent in relation to goods with a high resale potential (e.g. sporting goods and shoes). Although this is not an example of sophisticated fraud, the application can exhibit sophistication. For instance, using software (Bots) to automate purchase attempts, while changing characteristics of the order (email, shipping address, IP address, device ID, etc.). Chargebacks are almost always the result of this kind of activity. As such, merchants must manage orders carefully.”

Friendly fraud

This is generally not organised criminal activity. Rather, individual shoppers abusing generous returns policies offered by merchants, or initiating chargebacks as a shortcut to receiving a refund. This type of fraud can be challenging to detect, as feeding returns data into fraud screening tools/platforms is often overlooked or viewed as a lower priority for implementation.

Friendly fraud tends to happen when a customer buys an item and then contacts the credit card issuer to

- Dispute the charge,

- Claim that the item never arrived

- Claim that they returned the item and did not receive a refund.

- Claim they don’t remember making the purchase so their card must be compromised.

Walsh said, “When addressing the chargeback aspect of Friendly Fraud it is important that a merchant’s fraud/chargeback team has access to delivery (last mile shipping) data, as the ability to be able to link delivery of product to the purchaser really helps successful outcomes when mounting a chargeback defense.”

Reseller activity

This is where shoppers bulk purchase goods – often through multiple orders in an attempt to avoid Duties and Taxes – for commercial resale, generally on marketplaces. This is technically not fraud. But it is an abuse of merchant terms and conditions. This is damaging to brand-conscious merchants who are invested in providing the best possible shopping and after-sales experience.

Walsh said, “This type of activity is unlikely to lead to a chargeback, but volumes could result in issues with Customs in destination markets. Also, it can lead to product availability issues for genuine shoppers, where resellers can be quite adept at quickly consuming promotional/discounted product as it becomes available for purchase on a merchant’s web site.”

Conclusion

Managing the many types of online fraud is an intrinsic part of running an ecommerce business. Brands and retailers need to leverage mitigating technologies processes and resources to minimize risk, reduce chargeback and other costs, and protect both their brand and customers.