Brands see YOY growth across all days of ‘Peak Week’.

Although 2020 hasn’t been the year anyone was expecting, brands that had embraced their digital transformation and invested in the direct-to-consumer ecommerce channel – particularly those that had invested in omnichannel – have separated themselves from the pack. While brick and mortar stores faced lockdowns and widespread changes in shopper behavior, ecommerce and omnichannel offerings reaped the benefits.

Since May, monthly order volumes and revenues for ESW clients have been running ahead of Peak 2019, so the bar had been set high for Peak 2020. And it hasn’t disappointed – with massive growth across November, 2020 has truly seen the emergence of a ‘Black November’ shopping period, replacing the traditional ‘Peak Week’ around Black Friday.

Year on Year Growth Across the World

ESW clients have seen strong growth across all key metrics including order volume, AOV and revenue for the full month of November, and extending into December.

Diverse markets have seen up to 213% YOY order volume growth across the month of November with the top five markets being Israel (213%), Chile (207%), Saudi Arabia (203%), Singapore (174%) and Malaysia (166%).

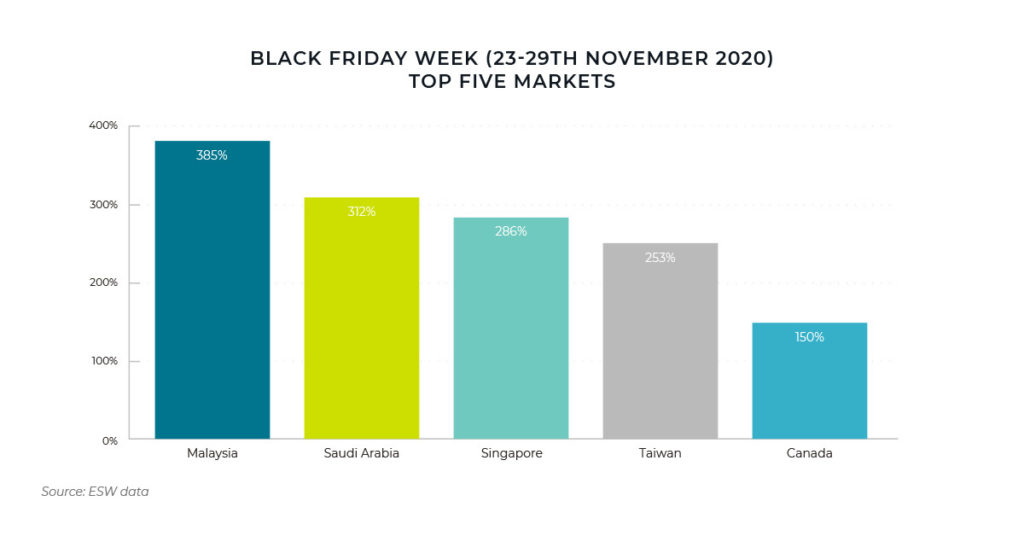

For the week ending on Black Friday (23-29th November) some countries saw even stronger figures – Malaysia (385%), Saudi Arabia (312%), Singapore (286%), Taiwan (253%) and Canada (150%).

Traditionally, the week beginning on the Wednesday before Thanksgiving has been the one to watch for ESW, and this year it didn’t disappoint. Revenue was up 36% for the week, easily beating 2019’s record-setting peaks. Tuesday 1st December (77%) was the day with the strongest YoY growth, followed by Wednesday 25th (71%). Clearly there is sustained appetite for international brands throughout the peak shopping period, so brands should plan for an extended sales period that spans both before and after Black Friday itself.

The countries with the highest order volumes during Peak Week alternated between Canada and the UK with the UK leading on Wednesday to Black Friday and Sunday, and Canada leading on Saturday, Cyber Monday and Tuesday. Peak hour was typically 8-9pm in the local time of the shopper’s country.

Category breakdown

While there is growth in every category, order volumes in the Luxury category were the standout performers, both in the week of Black Friday itself (236%) and across the whole of November (157%). Sports/Outdoor (65%) and Footwear (56%) were high performers in the week of Black Friday.

Global Device Breakdown and Shopper Behaviour

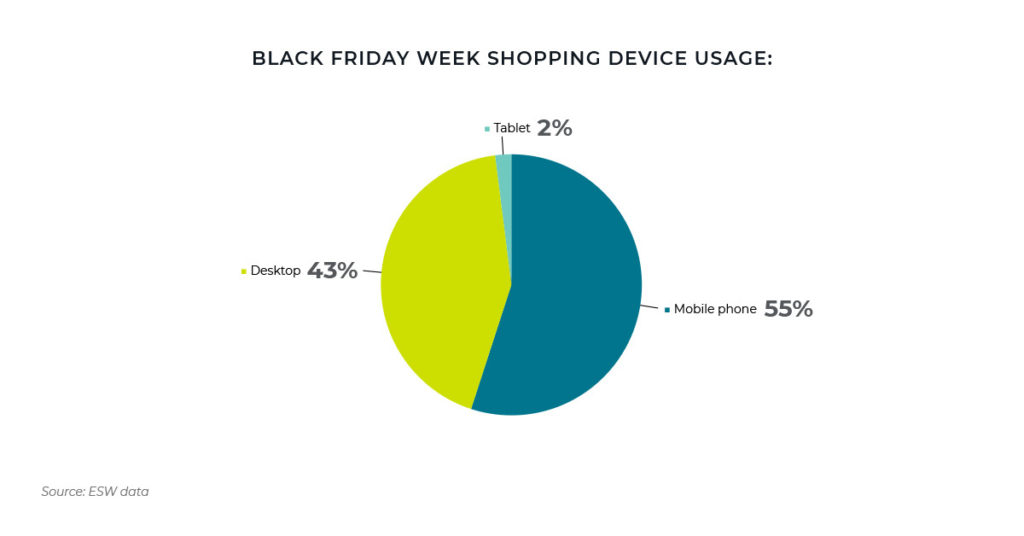

During Black Friday week, shoppers predominantly shopped on mobile phone (55%) compared to desktop (43%) or tablet (2%). Last year, the figures were almost reversed with desktop being the device of choice (50%), smartphone just behind at 44% and tablets at 7%. These figures indicate that shoppers are increasingly shopping on mobile (whether a trend/demographic change, or an enforced behaviour due to Work From Home orders), and brands should ensure their m-commerce experience is as frictionless as possible to ensure the best shopper experience.

Peak Season in the Future

It is clear that the pandemic has fundamentally changed shopper behavior, making online purchasing a more commonplace activity, and possibly removing the fear or hesitation some age groups may have had about shopping online. Undoubtedly, new demographics are adopting ecommerce as their channel of choice, particularly in the baby boomer generation. Ecommerce-optimised businesses look set to continue benefitting from this change in behaviour as we look to 2021 and beyond.

Brands are increasingly trying to reduce the heat on Black Friday itself, with sales and discounts running up to two weeks in advance, however the data show that shoppers will still shop for bargains predominantly on Black Friday and Saturday.

In the future it is likely that the push toward shopping on mobile will only increase, and that brands will need to accommodate this change through a superior mcommerce functionality and experience.