Insights into the growth of the European ecommerce market profiling payment methods, online shopper profiles, digital advertising, logistics and economy

Economy

The European Union is home to 748 million people with a total GDP of US$15.6 trillion. GDP per capita is €31,080 (approx US$37,050) as of 2019. There are a number of attractive ecommerce markets within Europe: From the obvious opportunities like Germany, Sweden, Norway and France, to less obvious opportunities like Romania and Italy.

Digital User Insights

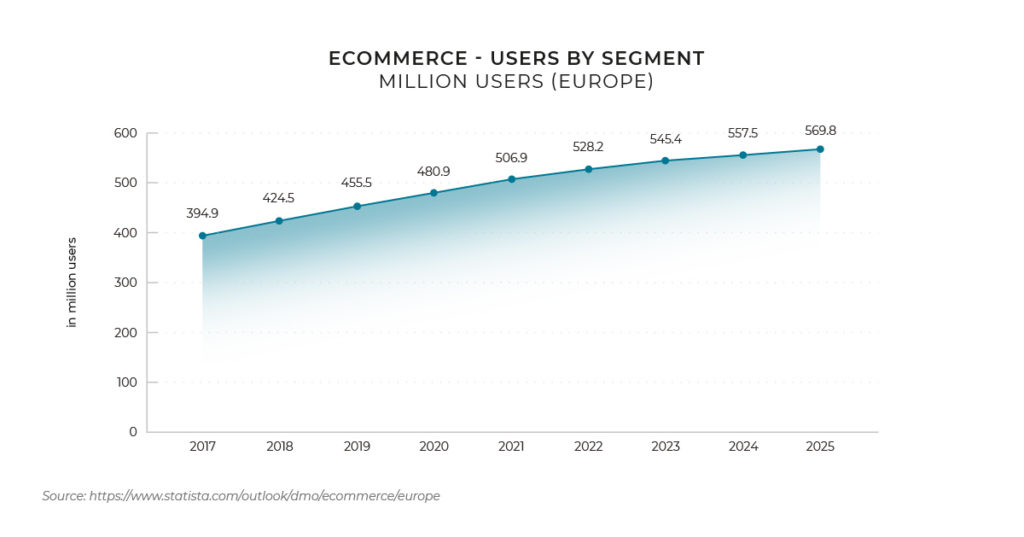

There are currently 506 million people shopping online in Europe, with almost 63 million new users expected to shop online by 2025.

Additionally, online shoppers are expected to spend more over time. The average user currently spends US$918 online, which will grow to US$998 by 2025.

Product Categories

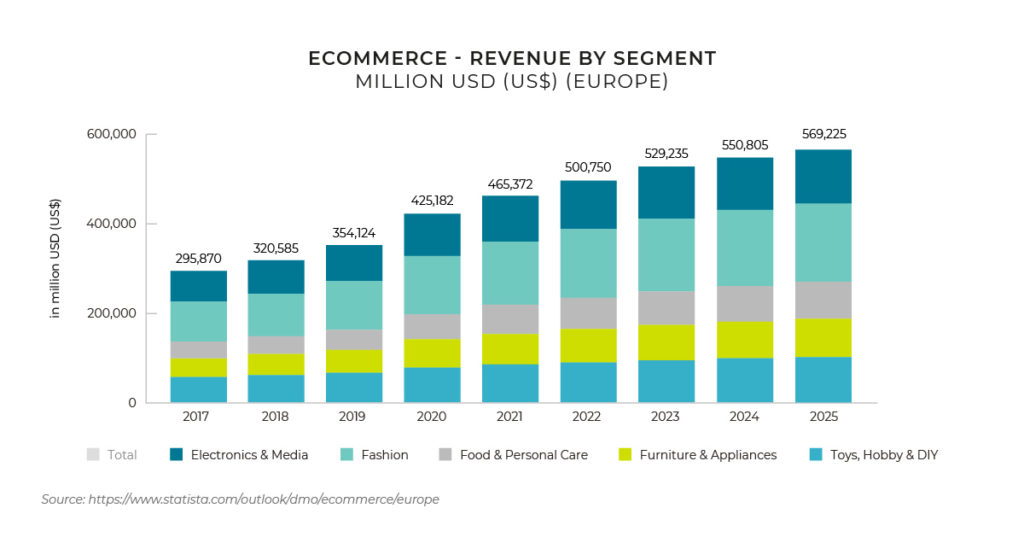

Total ecommerce revenue across all product categories is US$465 billion, expected to reach US$569 billion by 2025. Fashion is currently the leading product category accounting for US$143 billion market share. Electronics is the second leading product category accounting for US$103 billion.

By 2025, Fashion will continue to lead, valued at US$176 billion. Electronics and Media will take second place accounting for US$122 billion.

Logistics

The World Bank rates European logistics highly, with the region scoring 3.52 in the 2016 LPI index. This makes it the third highest-ranking region for logistics and delivery. Individually many of Europe’s countries are ranked among the best in the world for logistics, with Germany, Luxembourg, Sweden, the Netherlands, Belgium, Austria, and the United Kingdom all populating the World Bank’s top ten LPI ranking.

Preferred Online Payments

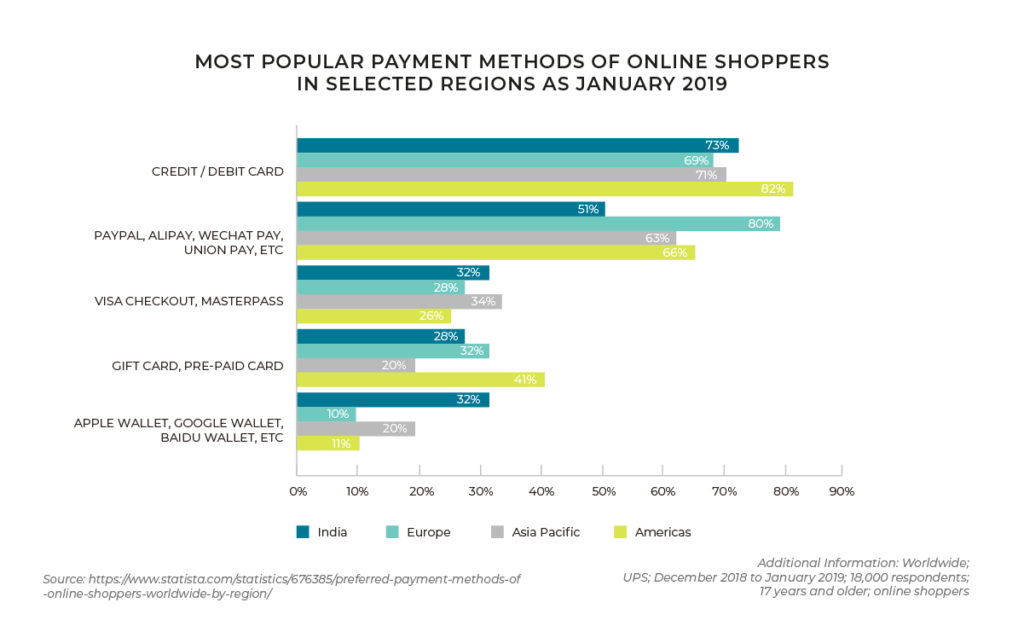

69% of European online shoppers selected credit card among their preferred online payment options. 45% of shoppers said they used a Debit Card and 80% used PayPal. Cash on Delivery is a little different from the other payment methods in that it is considerably more popular in Eastern European countries. 36% of online shoppers in Eastern Europe prefer to use this payment method, with only 4% of Western Europeans selecting Cash on Delivery.

Internet and Device Usage

Internet penetration in Europe is currently at 89%. Smartphone penetration is 77% and is projected to grow to 83% by 2025.

Marketing

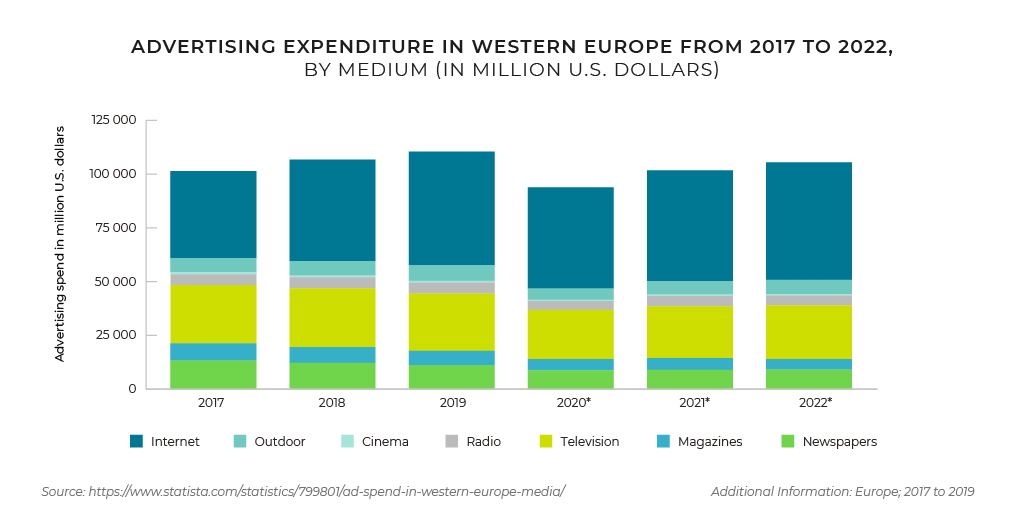

Online advertising in Europe has grown steeply in recent years to reach just under 40 billion USD in 2015. TV accounts for the second biggest marketing spend at just over 35 billion USD, with Print dropping to third place in recent years with a market spend under 30 billion USD.

Social Media

65% of Europeans in 2018 use Social Media, showing impressive growth from just 53% in 2011. Popular networks across the region vary from country to country, but those which are popular across Europe include Facebook, GooglePlus, Twitter, Instagram and LinkedIn.

To find out more about European ecommerce, check out our ecommerce insights into the individual markets: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Ireland, Italy, Latvia, Lithuania, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom.

For more market insights, check out the ESW series of blogs covering a range of emerging ecommerce markets.

*Insights derived from ESW data, Statista, WorldBank, OECD and other industry sources.