Cross-border ecommerce brands could be affecting their international growth in these five ways.

5 Ways Ecommerce Brands could Affect their International Growth:

- Being consumed by domestic markets

- Sacrificing experience for volume

- Taking a ‘one size fits all’ approach to checkout

- Cannibalizing payments

- Turning away business

1. Being consumed by domestic markets

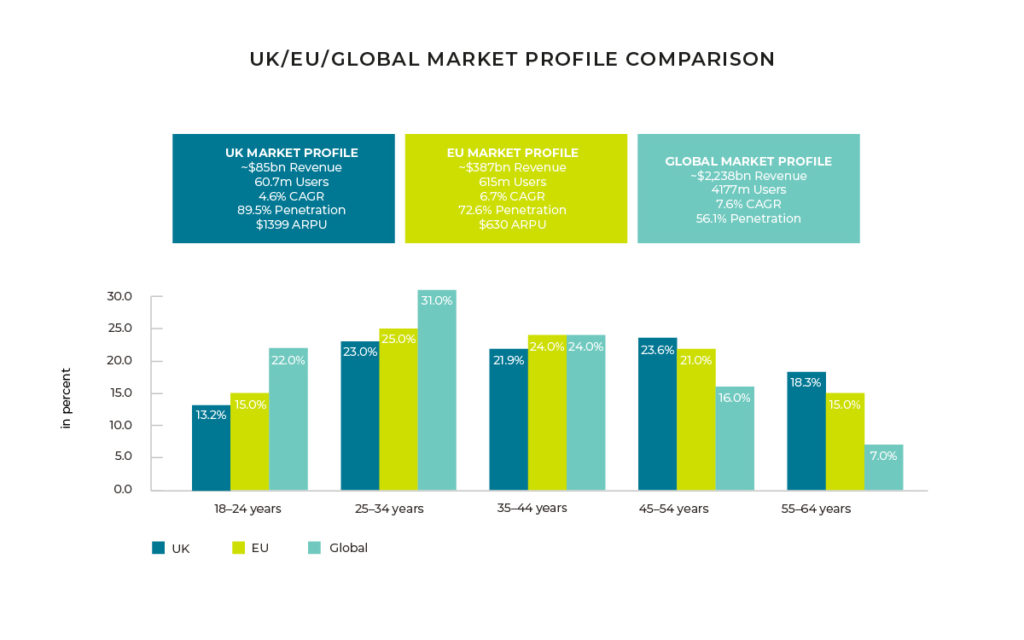

Retailers tend to do most of their business in their domestic market, with almost 95% of business coming from their home territory. With those kinds of numbers, it’s easy to do the minimum necessary to service international markets – like turning on international shipping, for example. Unfortunately, this is not a future-proof strategy, and it results in stagnant growth. Looking at the UK, we can see there are 60.7 million users with an ecommerce penetration rate of 89.5% – in many ways, this is great, it means that there is a large portion of the population accustomed to shopping online.

However, it also means that there are limited growth opportunities. CAGR is expected to be 4.6% over the next five years, which is significantly less than other markets. Add to that the fact that the largest group of users is 45-54 years old, and that more than 41% of all users are over the age of 45, and we see a less healthy picture of what’s to come. Compared to the EU market, which (when UK figures are excluded) amounts to revenues of approximately $300 billion and has a penetration of only 72.6%, we can see much stronger opportunities for growth and for ecommerce retailers to reach new online shoppers. Looking at the global picture, across the same criteria, we can see revenues of $2.2 trillion, and penetration of only 56.1%. Retailers that are strategically focusing on key international markets, where they can compete, are going to be better placed to drive sustainable growth into the future.

2. Sacrificing experience for volume

There can be a temptation, especially as a smaller ecommerce brand, to use a marketplace (where goods are hosted by a third party) to sell goods. While they can have their benefits, including the retailer not needing to have their own ecommerce capabilities, generally the brand will be sacrificing shopper experience and not gaining much in return. Putting goods on a marketplace means the retailer has no control over the shopper experience, is competing against other retailers in the same space, and potentially, depending on the marketplace, on the marketplace’s own-brand goods which will get preferential placement during search.

Nike and Birkenstock are two high-profile examples of brands that, having piloted working with marketplaces, are now pulling back and refocusing on the Direct to Consumer model, where they can control every aspect of the shopper’s engagement with the brand. More importantly, when the brand owns the shopper experience, they will also own all the associated data, which can be used to make informed decisions to improve shopper experience and therefore conversion rates, (and acquisition and retention rates).

3. Taking a ‘one size fits all’ approach to checkout

Cart abandonment is a key challenge for the ecommerce journey, and checkout is often where the abandonment happens – for several reasons, chief among which is a ‘non-familiar’ checkout flow. Using a ‘one size fits all’ checkout, rather than a bespoke checkout for each market, negatively impacts conversion rates and the retailer’s ability to grow. There are many parts of the checkout that need to be ‘localized’. For example, addresses in different countries have different structures. Some have three lines – others have six. Some countries have zip codes (US), while others have postcodes (UK). In some markets, the country should come before the zipcode – in others, it doesn’t. All of these are important enablers that can affect the quality of the delivery experience. Going further, some countries require ID collection – which can be incorporated at checkout – to facilitate customs clearance. Some have taxes that change from state to state (US) or province to province (Canada). Simply put, a “one size fits all” checkout will not suffice when selling into international markets and will hamper the retailers’ growth initiatives.

4. Cannibalizing payments

While it is important to offer a choice of payment methods to shoppers, offering too many could lead to unnecessary cannibalization. The decision to add a payment method should always be taken with a view to how much incremental penetration and sales it will give in each market. Non-card payment methods are typically more expensive for the retailer, so offering a plethora of non-card payments in a country where card penetration is extremely high, is likely to simply increase the cost of conversion, without a corresponding increase in conversion or revenue. Additionally, not all payment methods can offer the same customer experience to the shopper. Refunds are handled differently by all payment companies – do the methods you want to offer to the shopper allow you to give full refunds (without any cost to you?). These are important considerations to be assessed in each market.

5. Turning away business

One of the more frustrating things as an ecommerce retailer is to know that you have successfully guided the shopper through your conversion funnel and completed the order, only to find out that the acquiring bank will not honor a card payment. This usually arises when a global acquirer does not recognize a local card scheme, so is unwilling to take on any risk (there is usually none!) The payment is not honored, the order invalidated and a frustrated shopper (with money in their account) will go elsewhere to fulfill their need. Working with a domestic acquirer can dramatically increase payment acceptance rates. For example, when ESW started using local acquirers in Turkey, acceptance rates increased from 54% to 93% – overnight. This is an area of optimization that offers some of the best returns for international retailers.

Conclusion

Operating in new markets can be an easy decision for ecommerce retailers to make, although not one that can be implemented without forethought and strategy. There are many areas of optimisation that need to be considered beyond deciding which markets to enter – from whether to translate the website to checkout localisation, payments, pricing, delivery and understanding shopper behavior in different regions. Working with an expert can flatten the learning curve for the brand, and get them trading – with ease and speed.

ESW operates in over 200 markets helping the world’s best brands move into new regions seamlessly. To find out more about operating an international ecommerce retail business, contact our sales team or read our blog here.