When it comes to what is driving cosmetics sales across the ecommerce sector, there are two very important factors: shopper preferences and social media.

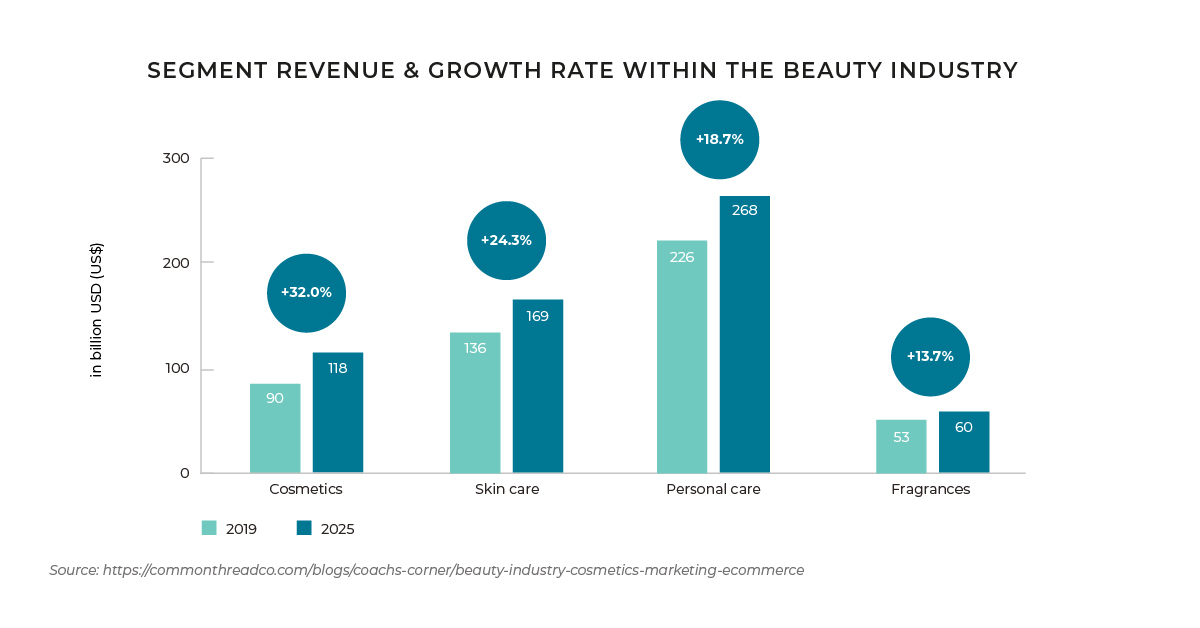

The cosmetics category, long resistant to ecommerce, has seen a shift in attitudes in recent years, largely due to the rise of social media. And like many other online categories, shoppers want to research products before purchase. Global revenue increased from US$483 billion to US$511 billion in 2021 and is expected to reach US$787 billion by 2027.

eMarketer reports that 45% of shoppers say they favored online research for beauty products. This search for online beauty information falls into two major categories:

eMarketer reports that 45% of shoppers say they favored online research for beauty products. This search for online beauty information falls into two major categories:

- Science-based information, such as color-matching, delivered through mobile apps, and

- Subjective views, communicated through social media and especially video.

The shopping habits of younger buyers are very different from those of baby boomers and Gen Xers, meaning conglomerates such as Estee Lauder need to change or be left behind.

Jane Lauder, president of Clinique and the granddaughter of Estée Lauder said:

“We are trying to stay in the game. And it is all evolving so quickly. Every day is different and everything is constantly changing. Shopping habits of younger generations are different [to my generation]. They do more research, they are armed with information, and they make decisions on their own versus looking for advice at the point of sale”

Shoppers between the ages of 18 and 34 now represent nearly 29% of the total beauty market, according to Karen Grant, a global beauty industry analyst at The NPD Group, a market research company.

It is a significant and fast-growing demographic that big brands are still trying to decipher, she said:

“One of the challenges is that there are so many voices today… In the past, the big brands commanded the voice. They could afford to be in the magazine so they had more visibility. Today, everyone can be online. So you don’t own the space anymore. You can’t command more attention by just being big”

An A.T. Kearney survey has also shown 67% of online beauty shoppers use four or more websites to find what they’re looking for. Additionally, 47% of respondents said they have shopped for more beauty products than last year, and 66% indicated that they prefer the online experience to the in-store experience.

These findings classified online beauty shoppers into three categories: Online Enthusiasts (55%), Information Seekers (36%) and Showroomers (9%).

Online Enthusiasts primarily browse and shop for their beauty and personal care needs online; Information Seekers research beauty and personal care products online, but generally prefer shopping in a store; and Showroomers prefer to browse in a store but shop online. When asked what they’re looking for online, 72% of the beauty and personal care shoppers surveyed said finding the best price was “very important”, as were free shipping and site security (68%), free returns (67%), special promotions (54%) and favorite products (50%).