Insights into the growth of UK ecommerce profiling payment methods, target audiences, marketing, social media, economy and logistics.

Economy

The UK is ranked in the top 30 richest countries in the world, according to the World Bank. Home to 64.4 million people with a total GDP of US$2.89 trillion. GDP per capita is currently US$49,326 and expected to reach US$58,601 by 2026.

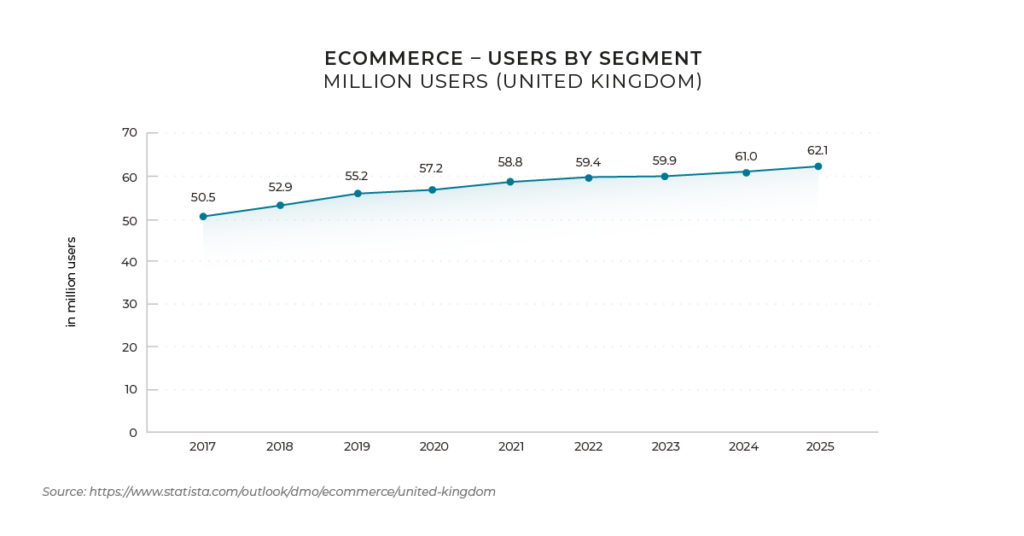

Digital User Insights

There are currently 58 million ecommerce users in the UK, with growth projected that will see an additional 4 million users shopping online by 2025. The average user spends US$1,768 online, a figure that will reach US$1,918 by 2025.

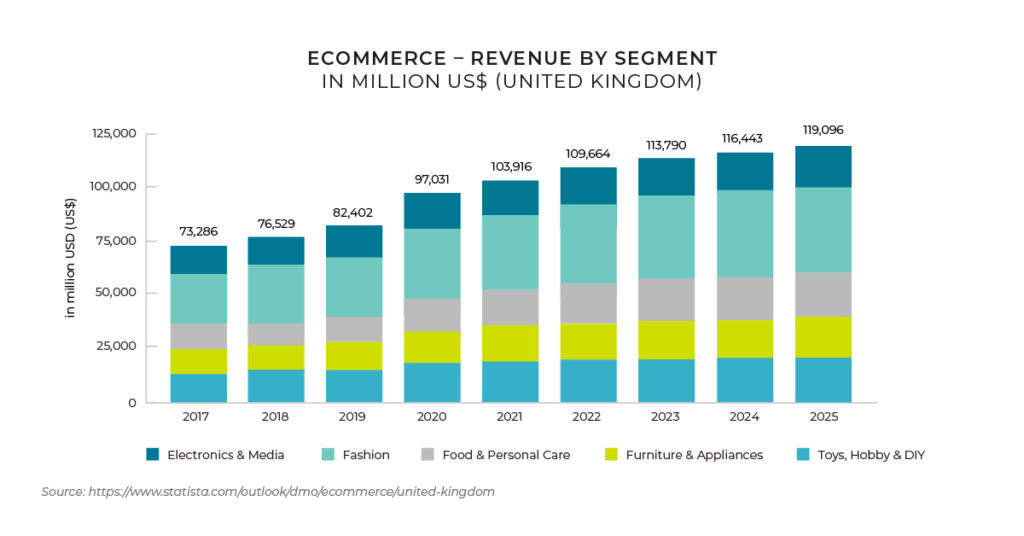

Product Categories

Total ecommerce revenue across all product categories is US$103 billion, and is expected to reach US$119 billion by 2025. Fashion is currently the leading product category accounting for US$34 billion market share. Toys, Hobby and DIY is the second product category generating US$18.1 billion.

By 2025, Fashion is to remain the leading product category. Valued at US$39 billion, with Toys, Hobby and DIY which will reach US$21 billion.

Logistics

The UK is ranked 9th in the World Bank Logistics ranking, and has consistently ranked in the top 10 countries for logistics since 2007. The majority of the UK’s population lives in urban areas with this figure increasing on a year on year basis. Current urbanization is 84% according to the World Bank.

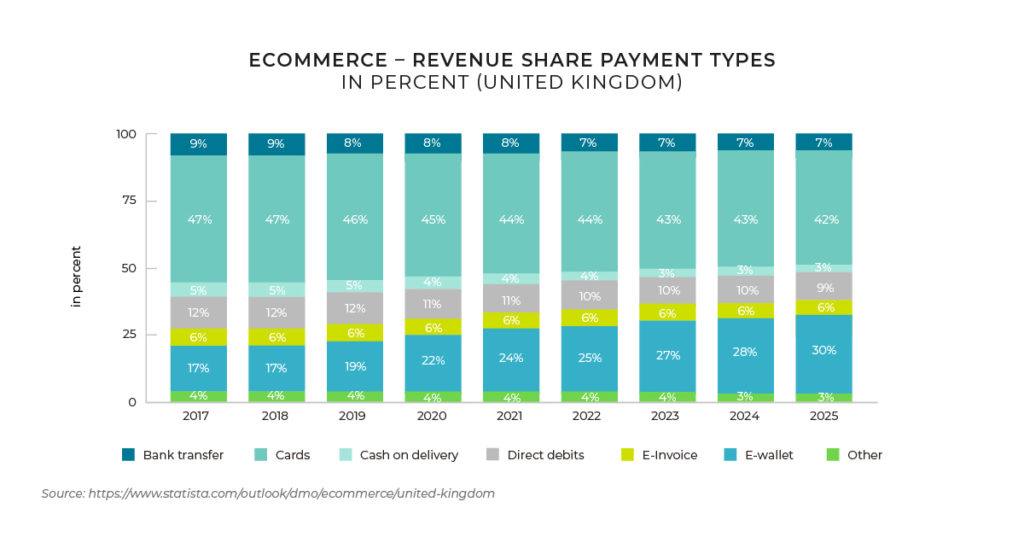

Preferred Online Payments

The bulk of online payments in the UK are made via credit/debit card, with this payment method accounting for 44% of payments. Other alternate payment types include: bank transfers, gift cards, prepaid cards and e-wallets.

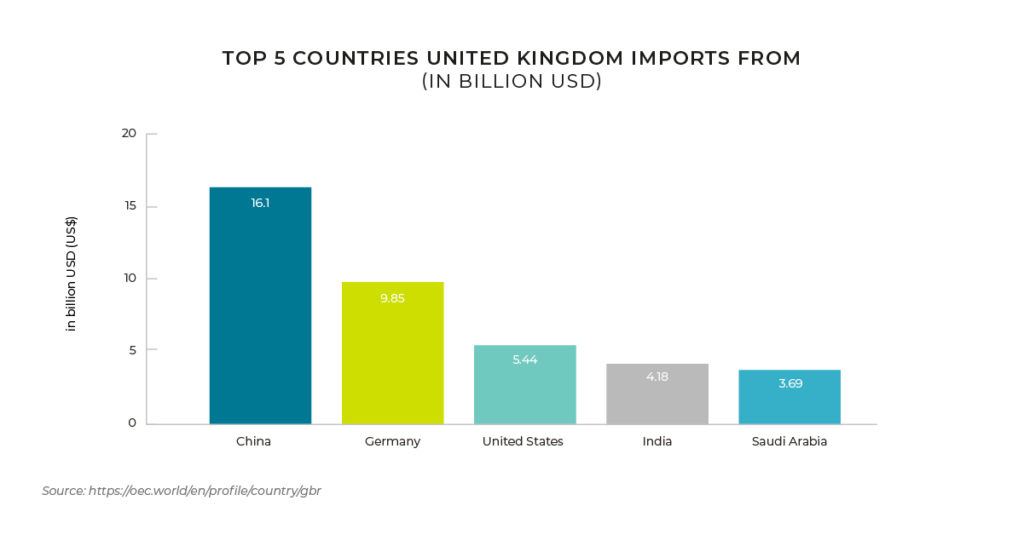

Where does the UK buy from?

The UK imports from Germany (US$86 billion), China (US$63.6 billion), United States (US$51 billion), Netherlands (US$48.5 billion), and France (US$38.2 billion).

Internet and Device Usage

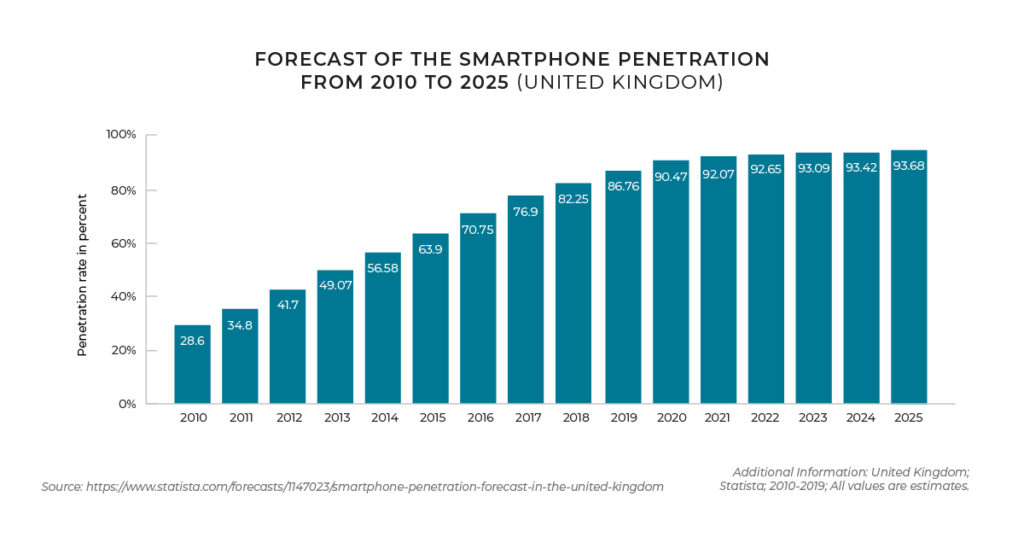

Internet penetration in the UK is currently at 96%, and should reach 97% by 2025. Smartphone penetration is 92% and is projected to grow to 93% by 2025.

Marketing

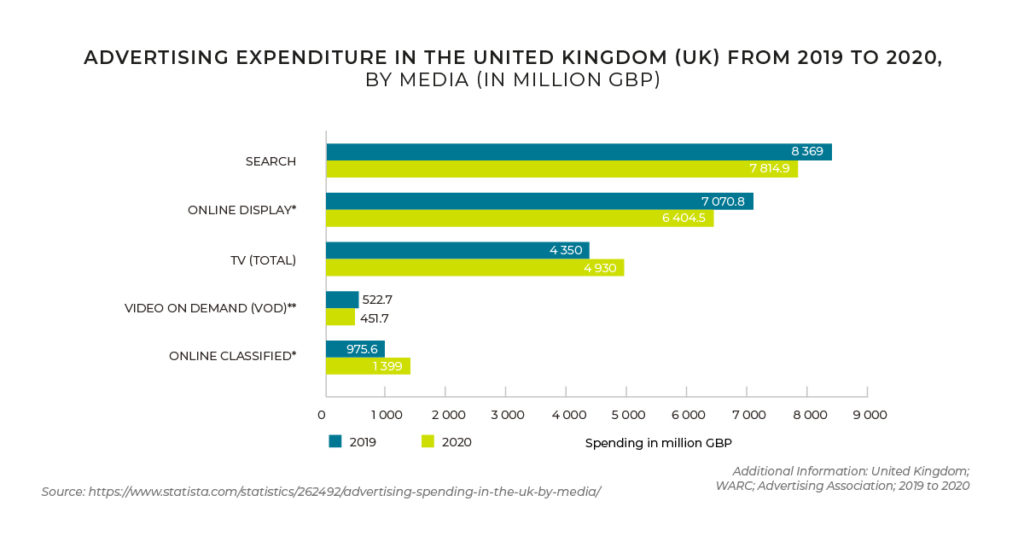

Marketing spend in the UK has moved to search and online, although they have decreased slightly from 2019 to 2020 with television advertising coming in third place, where spend has increased from 2019 to 2020.

Social Media

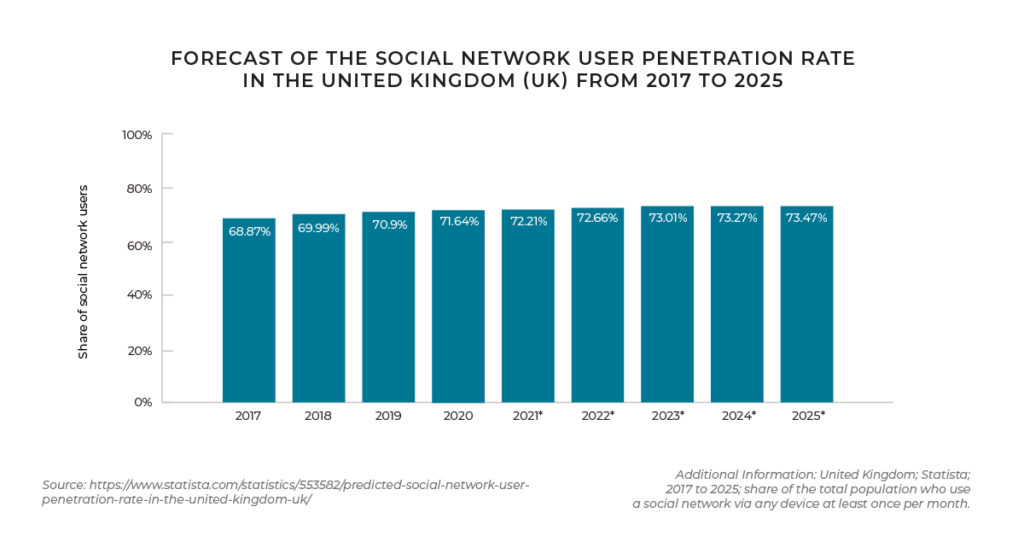

The UK’s Social Media penetration hasn’t increased significnatly in the last few years and is at 72% currently, expected to reach. Users are most likely to log onto Facebook, Twitter or Youtube on a regular basis. 60% of the UK use Facebook on a daily basis, with Twitter and Youtube accounting for a smaller, but significant share of users. Other popular networks include Instagram, as well as messaging apps such as WhatsApp and Snapchat.

For more market insights, check out the ESW series of blogs covering a range of emerging ecommerce markets.

*Insights derived from ESW data, Statista, WorldBank, OECD and other industry sources.