It has been impossible to avoid hearing about Brexit and its potential impacts for both the UK and all countries within the European Economic Area (EEA). In particular, the implications for ecommerce retailers could be significant – both for those in and looking to trade with the UK. While much is still unknown as no agreement has been put in place yet, there have been indications in the press from senior UK politicians about what the country would like to achieve in terms of trade deals with the EU.

ESW’s Customs and Compliance Specialist, Jean Louis Laubret shares his insight into the potential effects of Brexit on ecommerce retailers.

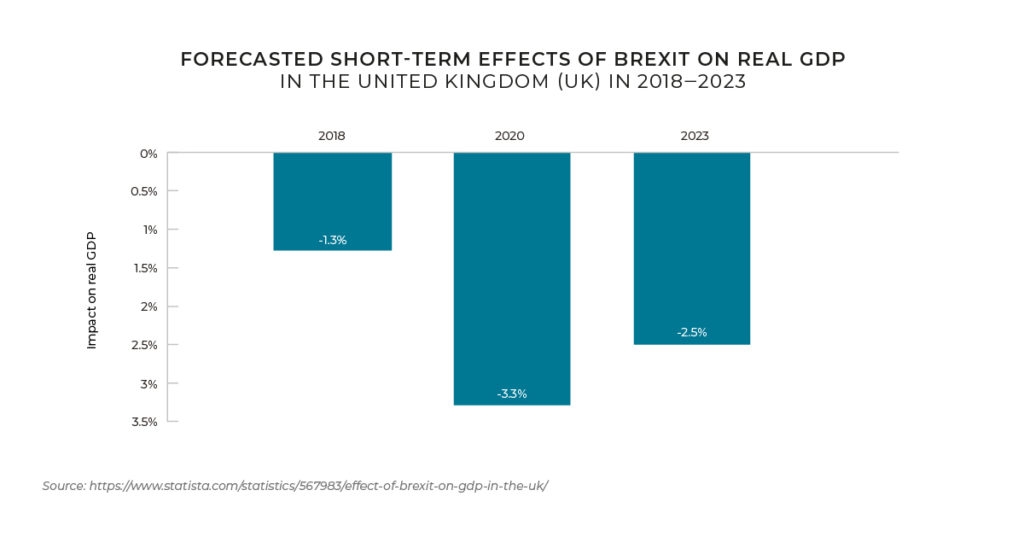

Brexit and its effect on UK GDP

Predictions show that the potential effects on the UK’s GDP will see a negative effect in all cases from positive prediction to negative.

While it is not possible to predict with any certainty how Brexit will affect ecommerce retailers until a deal is agreed, ESW has been preparing for potential scenarios to make sure that disruptions to our clients are minimized.

Here, we look at some of the possible trade deals for the UK and their potential impact on ecommerce retailers – both those looking to trade with the UK and UK retailers trading with the European Economic Area (EEA).

Canada trade deal

The UK has been suggesting that it wants a deal similar to the one that the EU has with Canada.

The EU’s trade deal with Canada is called the Comprehensive Economic and Trade Agreement (Ceta). It removes almost all tariffs on goods traded between the EU and Canada – tariffs remain on poultry, meat and eggs.

Border checks were not completely removed under Ceta, meaning there is a possibility that goods can be examined at ports to ensure they meet regulatory requirements and all paperwork is in order. Standards of quality and safety are agreed between the two regions, so safety and quality checks performed on products made in an EU country don’t need to be repeated in Canada and vice versa.

Other areas where the Canadian and EU rules align are in some copyright and patent areas and recognizing professional qualifications.

The EU’s stance on getting a ‘Canada-style’ trade agreement for the UK is that the deal took 5 years to agree and the UK wants to have it in place by June 2020, which the EU is declaring to be impossible. Similarly, the ‘Australian Deal’ which has been referenced by politicians and the media hasn’t even been signed into law yet – so technically there is no such deal in place between Australia and the EU.

Trade between the UK and the EU – what will change?

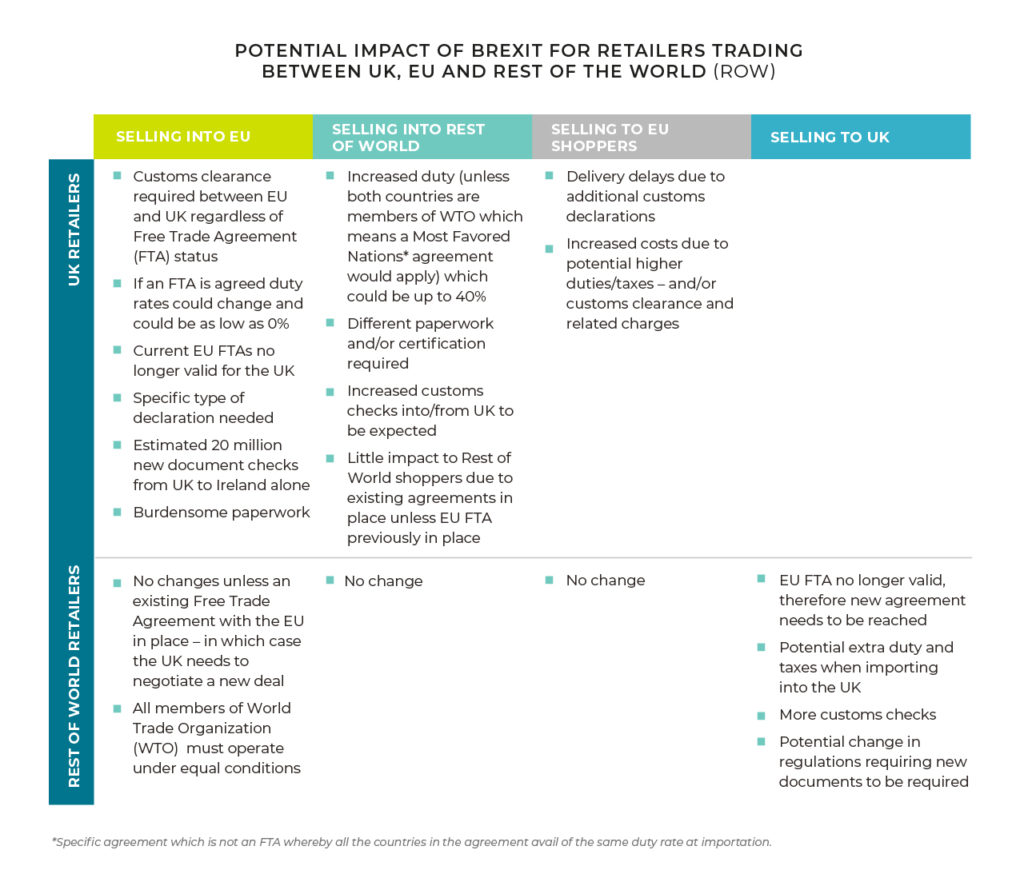

The biggest changes from Brexit will be between the EU and the UK. For other markets such as the US, Canada or Australia things will continue much as they always have as there were already customs, duties and taxes, inspections etc. between the UK and any market outside the EU that did/does not have a trade deal in place. Now, with the UK out of the EU it becomes a new market that both the EU and the UK must navigate.

The major area to consider for retailers, whether based in the UK or selling into the UK, is that there will be checks on goods coming from the UK into the EU and vice versa – where there wasn’t previously. This means that customs checks are going to substantially increase on both sides (into and from the UK), which will have the knock-on effect of delaying shipping into and out of the UK to or from the EU. The UK has decided that a full customs declaration will be necessary at the point of entry, which will create a bottleneck at all points of entry such as airports and ports going into both EU and UK.

If no Free Trade Agreement is reached between the UK and the EU, as members of the WTO, they would both be subject to specific tariffs that all WTO members agree to known as Most-Favored Nation tariffs. For countries that are not part of the WTO and wish to trade with the UK ‘Rest of World’ tariffs would be applied, which are individual to each country and the agreements reached.

Typically, minimum value thresholds apply to whether VAT or duty is payable upon an import, however what those thresholds are likely to be post-Brexit have not been determined. Currently, there is a €150 EU-wide duty threshold, however VAT thresholds are applied on a country by country basis. After January 2021, in the absence of an FTA the UK will need to set duties and taxes according to different product classifications.

Trade between the US and the UK

There is no existing FTA between the US and the EU, which means that there are already customs checks and paperwork requirements in place, whether in the UK or another EU country. This means that the general process should remain the same for US retailers selling into the UK, however there may be additional requirements from a declaration and clearance perspective. The UK must decide after their withdrawal what duty and tax regime they and their negotiating partners wish to implement. The only change maybe if the UK decides that they want to apply different regulations, duties or taxes than what the EU has the US, in which case there will be different paperwork which may be more onerous – but in absolute terms the process will be as before Brexit.

Northern Ireland

One area of Brexit that has long been discussed and is yet to be resolved is Northern Ireland and how it will sit between the EU and UK in terms of duties, taxes, and customs checks. As things are currently, Northern Ireland is part of the UK, however, from a customs perspective it will remain part of the EU customs territory. Clearly this can potentially lead to customs issues.

If a retailer ships goods from Britain into Northern Ireland, no duty is applicable, however if then the goods are shipped from Northern Ireland to Ireland, duty will have to be paid. Moving goods between Ireland, Northern Ireland and Britain could result in a lot of paperwork depending on how the process is finally defined.

Moving goods through the EU by road

Before Brexit, it was possible to move goods throughout the EU by road without customs checks, once goods were shipped in free circulation into the EU or originated in the EU. However, the withdrawal of Britain from the EU will lead to challenges for retailers wishing to ship by road if the goods have to go through the UK.

If a retailer wishes to ship goods from Belgium to Ireland by road, for example, they will likely need to go through Britain to do so. This requires a document called a T1 or T2, depending on the customs status of the goods being transported. A T1 is a certificate that allows for the moment of non-community goods. Non-community status means that the goods that are under customs supervision and don’t need to be cleared in the non-EU country the goods are passing through. T1 is for goods not in free circulation (not cleared) which are going from a point into the EU to another point into the EU.

A T2 is for community goods that are from or have been imported into the EU or for non-community goods that are in free circulation in the EU and are ready to be redistributed. However, if moving the goods through a non-EU or Common Transit country a T2 form is needed to declare the goods in the country of destination to allow the goods to transit through the non-EU country and reach its final destination without having to pay duty and tax either in the non-EU country or at the destination.

However, it is unlikely that retailers will want to ship through non-EU countries to deliver goods to a final destination in the EU due to the amount of paperwork that is likely to be required.

Certifications

A potential area for consideration for producers of goods is whether the UK will continue to accept certifications such as the CE Mark which is a certification marking that shows that a product meets the health, safety and environmental protection standards for products sold with the European Economic Area (EEA). If the UK decides not to recognize this standard and impose its own it could lead to problems selling goods into the UK in the short term as retailers will need to get their products re-certified. Equally, the EU will not permit goods to be sold in the EU without adherence to the CE standard.

If there are other certifications that the UK doesn’t accept it could affect trade not only between the EU and the UK but the UK and non-EU countries too.

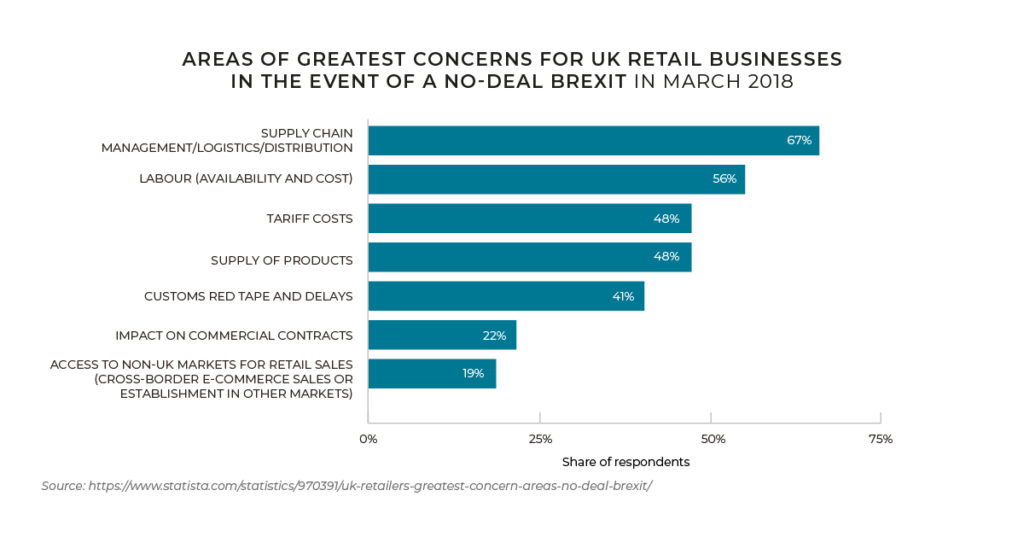

Logistics and Supply Chain

For ecommerce retailers looking to sell into the EU post-Brexit one area that may be causing concern is moving goods into Europe. London Heathrow (LHR) is currently one of the main hubs for entry into Europe, with goods continuing their onward journey by road. Post-Brexit, this could cause problems with paperwork and customs checks required for goods entering the UK before moving on to their final destination. For ESW clients, our use of multiple European hubs will allow EU destination packages to be re-routed without going through the UK at all. For UK orders, goods will continue to enter the UK directly.

All trade into and out of the UK will face some form of delayed processing time, as customs checks are implemented that weren’t previously required. It can’t be said with any degree of certainty at this time, how long these delays may be or what their impact will be on delivery times.

Conclusion

While there are a lot of unknowns surrounding Brexit, the greatest impact is likely to be felt by EU and UK retailers and shoppers. For countries like the US and Australia, there should be limited impact as they will continue to trade with the UK much like before – albeit with some potential changes to duties and taxes. However, there is a strong possibility of delays due to the bottleneck that will be created by newly imposed customs checks.

ESW believes the impact on our clients will be minimal due to our existing technology to calculate for duties and taxes and our existing European shipping hubs which will minimize any possible supply chain disruption. To find out more about how ESW can help you prepare for Brexit speak to our sales team here.