As COVID-19 continues to impact the world at large, cross-border ecommerce brands are moving into a ‘new normal’ in how they do business both now as well as looking to the future. Response to the crisis has been varied with some retailers able to pivot their businesses to support health care efforts in their countries, by repurposing factories to create PPE or hand sanitizers, and others cancelling supplier orders immediately and indefinitely.

For cross-border ecommerce brands navigating the crisis and wondering what things will look like when things get back to ‘normal’, there are ways to anticipate how things might be. Analyzing shoppers’ behavior during the crisis – especially once it settled down after the initial panic – and monitoring which technologies are improving various aspects of the business, from shopper experience to supply chain, will help to predict what business post-pandemic will look like.

Ecommerce seeing growth during pandemic

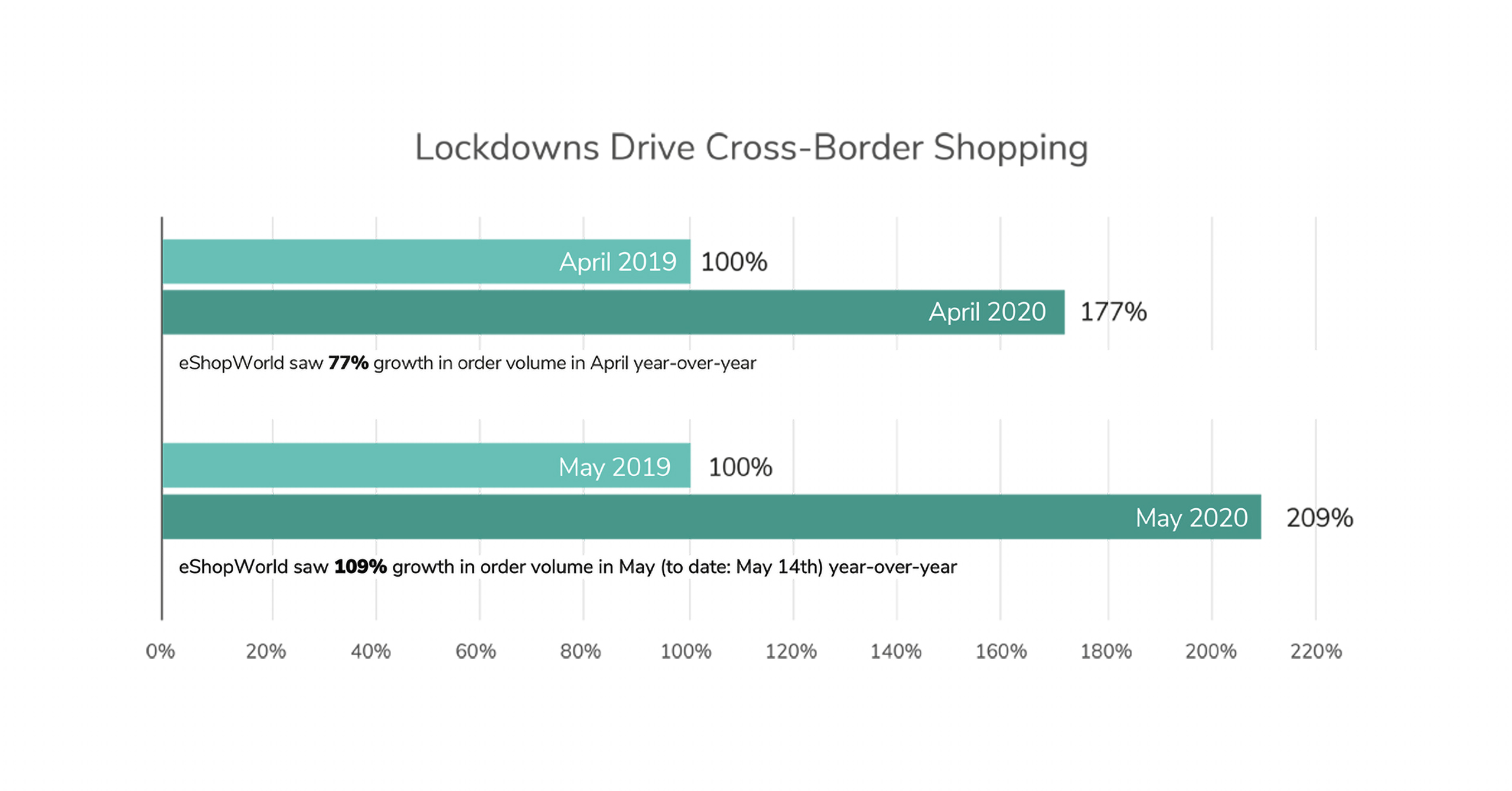

Cross-border ecommerce has seen strong growth globally with eShopWorld seeing 109% YOY during the month of May alone which suggests that even during these difficult times, brands that are geographically diversified are in a stronger position.

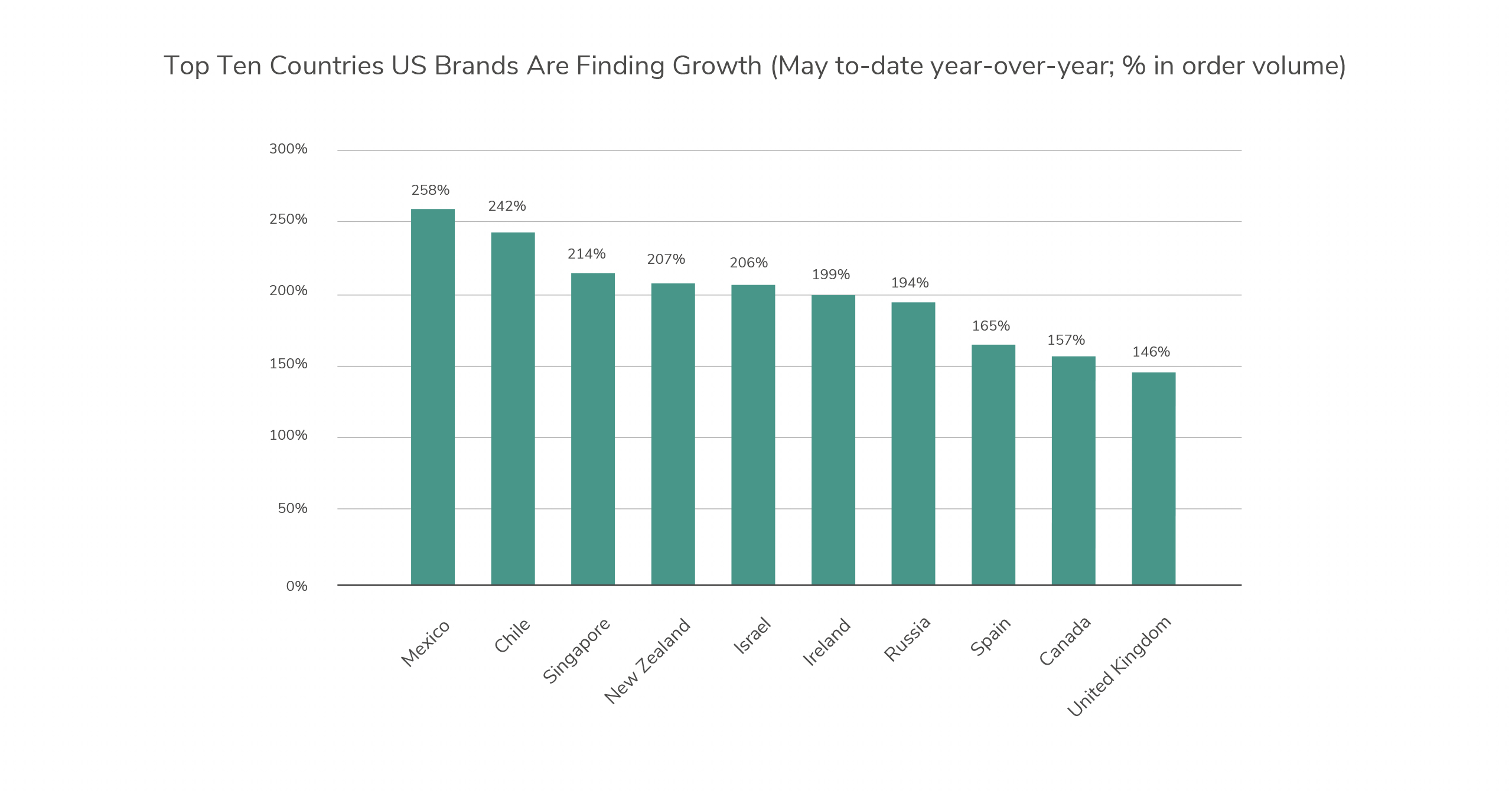

The countries showing the highest growth for US brands through the eShopWorld checkout in April are Israel (178% increase in order volume), Ireland (173%), New Zealand (168%) and Canada with 152% increase in order volume, however, in May the countries that are showing the highest growth for US brands are Mexico (258% in order volume), Chile (242%), Singapore (214%) and New Zealand (207%).

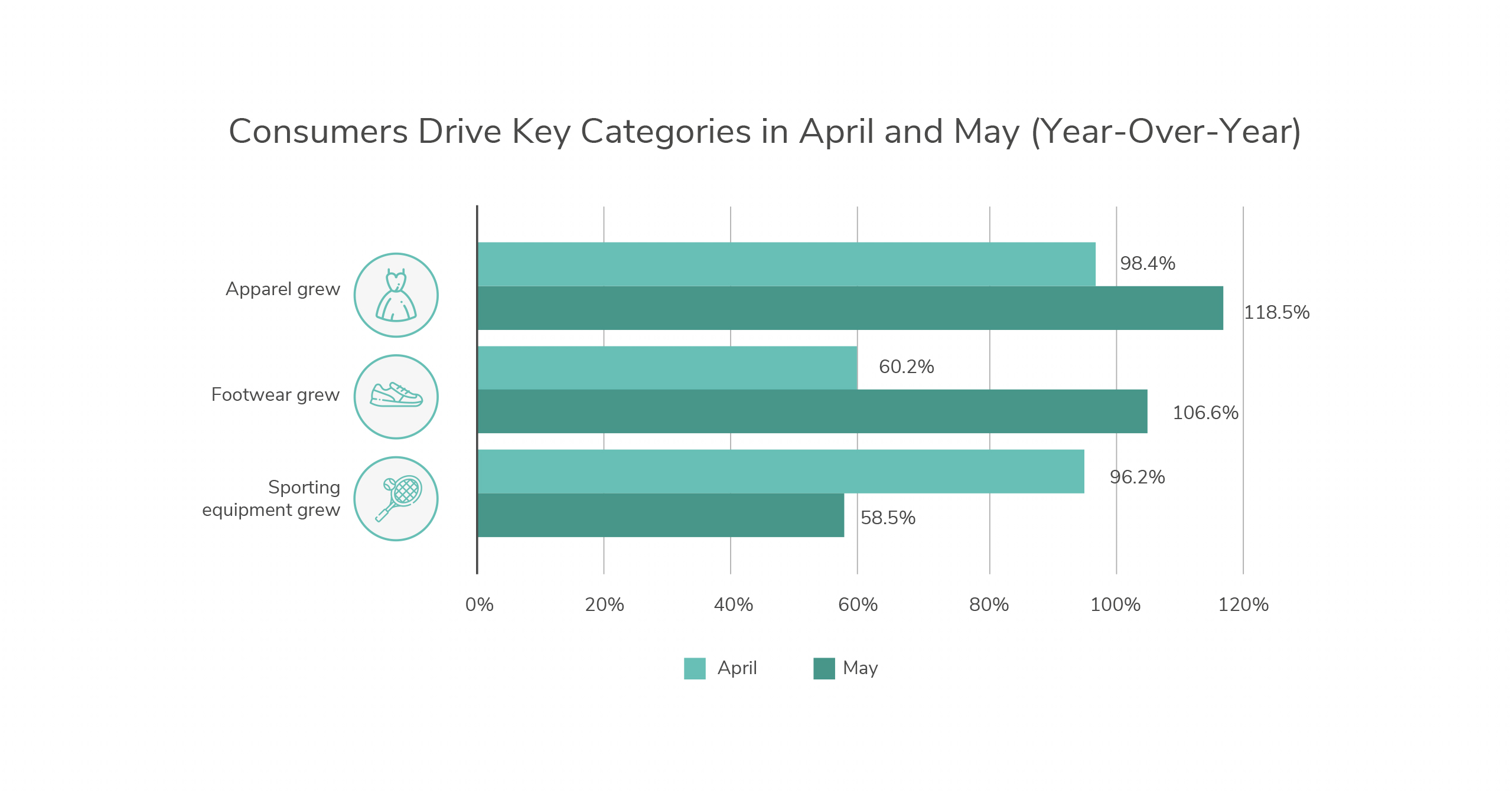

The categories that are achieving the highest growth year on year for May are Apparel (118.5% growth in order volume), footwear (106.2%) and sporting equipment (58.5%).

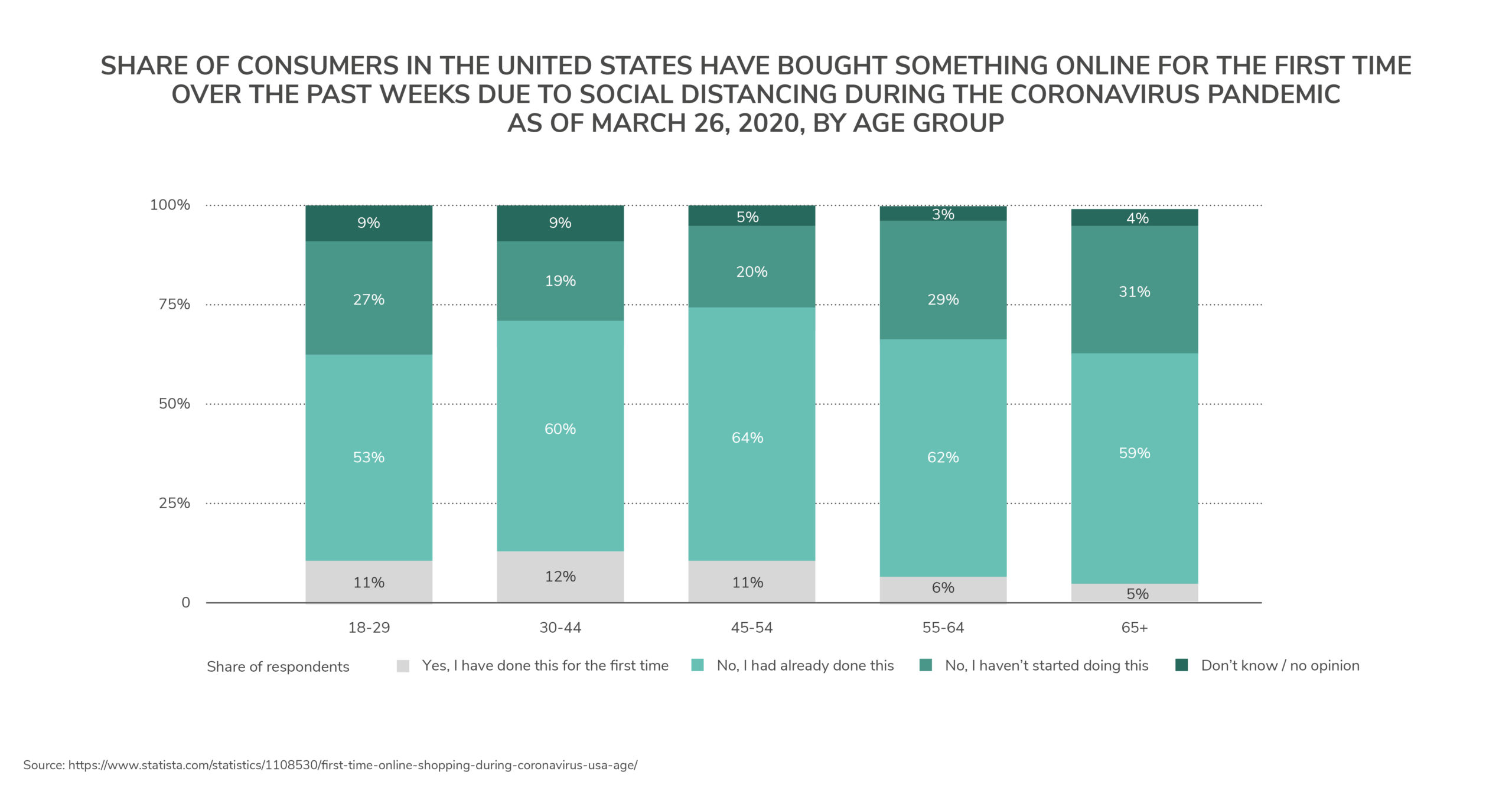

This data indicates that shoppers from all over the world are starting to shop or increasingly shopping online, meaning that ecommerce retailers have an opportunity to access customers that may never have shopped online before. By acquiring them in this time, there is an opportunity to keep them when things go back to ‘normal’ by providing an excellent shopper experience and persuading them of the benefits of shopping online.

What will ecommerce look like after the crisis? Sign up for our latest webinar ‘Retail is dead, long live Retail! The strategies, tactics, channels and markets that will define success in the Post Covid world’ to find out.

Changing consumer behavior

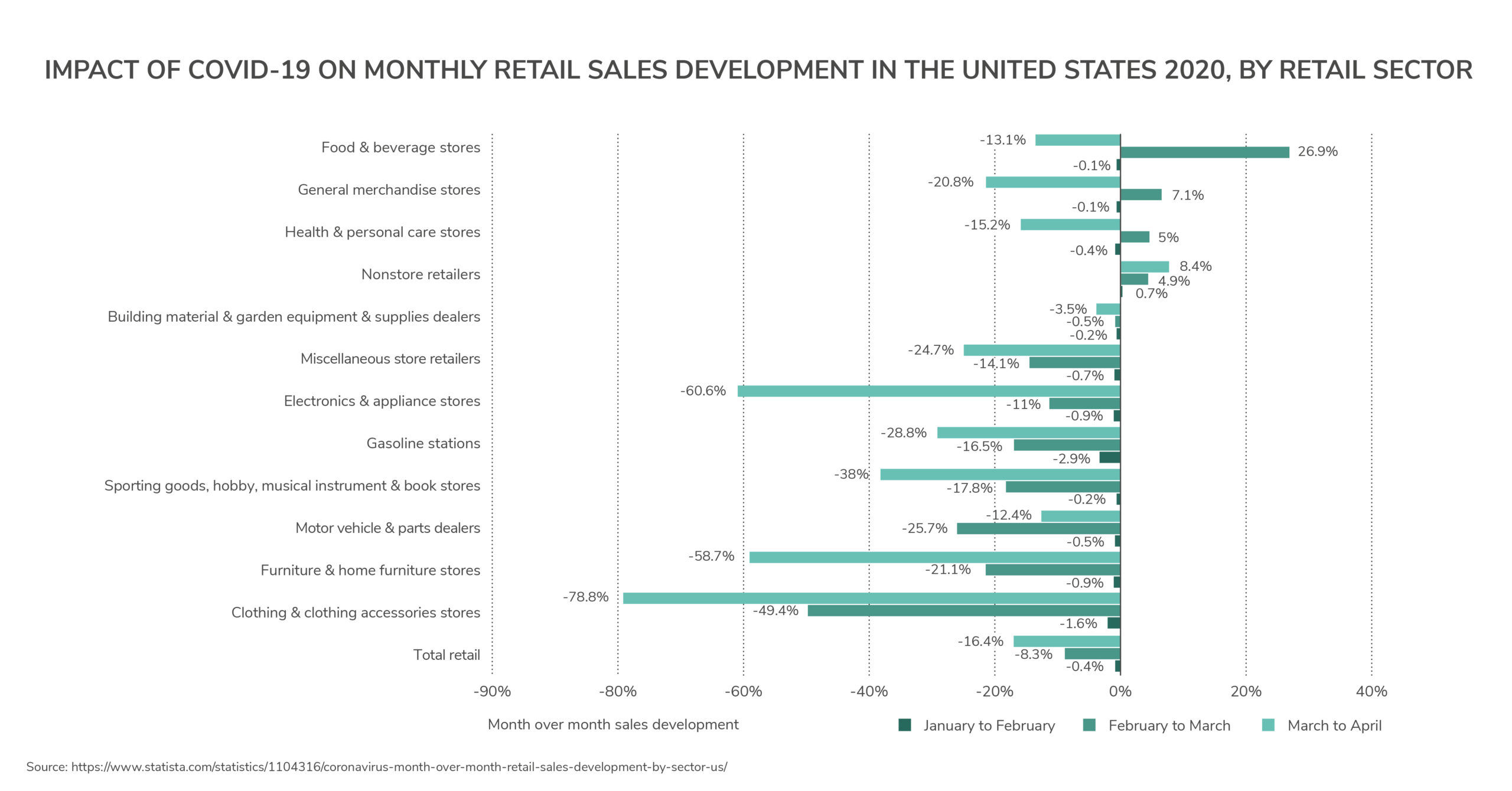

After a dramatic drop off in shopping both in brick and mortar stores and online in the first weeks of COVID-19, consumers have begun spending again even while still in lockdown. Certain sectors, such as electrical and health and beauty, saw dramatic increases in online spending, with growth at over 140% YOY compared to last year, according to IMRG data. There has also been an increase in shoppers who did not traditionally shop online and retailers may find that these shoppers will be more likely to still shop online even after things go back to normal if they have a good shopping experience.

Looking to the future for ecommerce retail

The impact of Covid-19 globally cannot be understated with a recent Statista report saying, “As of now, the forecasts regarding the economic consequences of the COVID-19 pandemic can only be seen as estimates, as the true economic impact is yet to be seen. The state of the global economy post-COVID-19 depends on how the governments contain the coronavirus and prevent an economic downward spiral.”

While no one can predict the future, ecommerce retailers can look at how shoppers behaved during the crisis and extrapolate from there to gain some sense of how things might be moving forward. Analyzing shopper data, how they browse, if and when they abandon carts, what returns are made and why, will give ecommerce retailers a wealth of data that they can use to tailor the shopping experience for their customers.

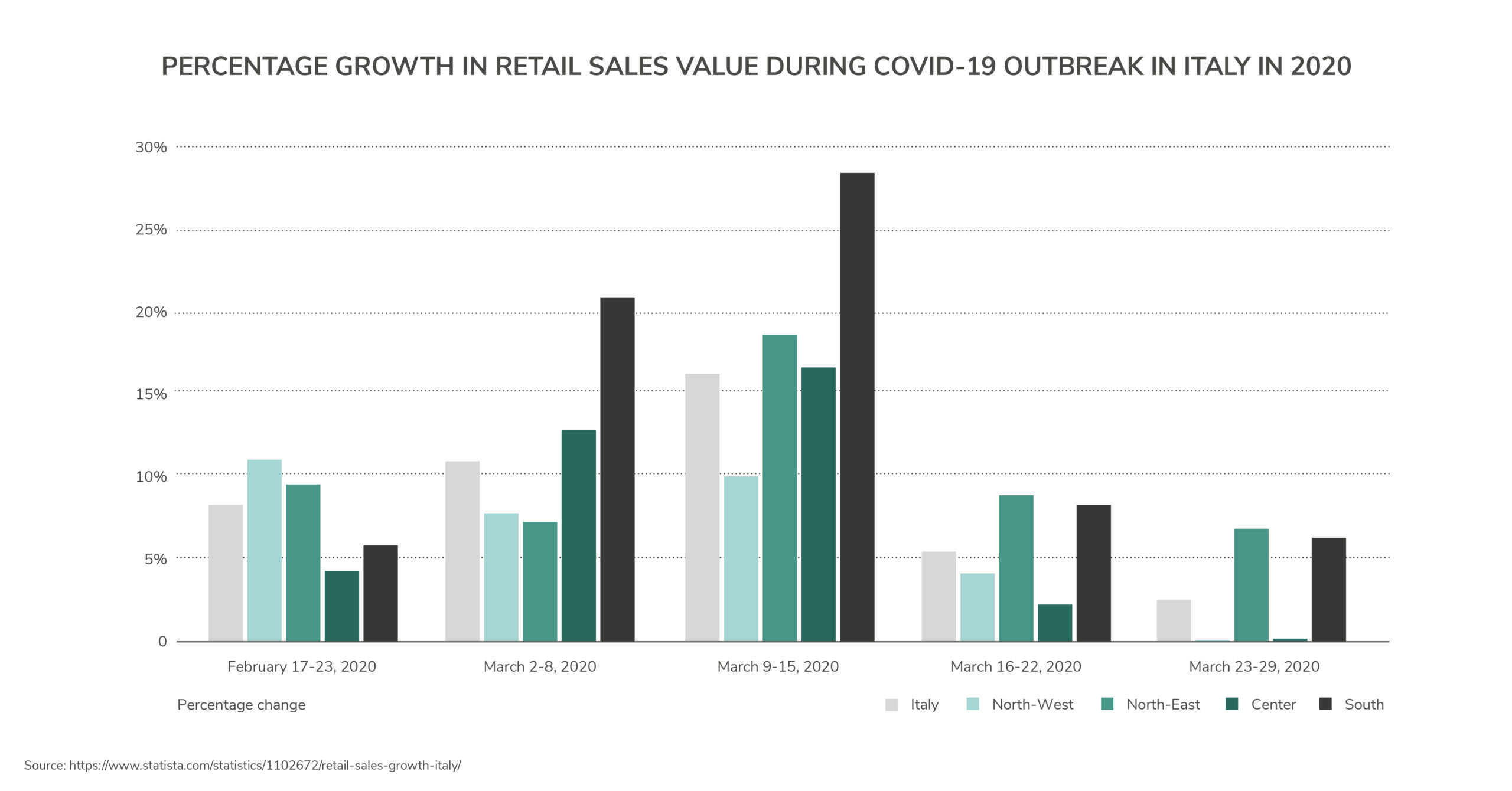

Seeing how shoppers in other countries that have lifted lockdown restrictions have behaved is another way for retailers to attempt to predict how shoppers in their regions will behave. Whether that’s implementing more options for shoppers around delivery or returns, or payment methods, or aligning the offline and online experience and initiating an omnichannel experience, retailers will no doubt find themselves in a period of experimentation and iteration for some time moving forward.

Technology is playing its part in supporting retail during this time and there is a high probability that not only will this technology be developed faster in response – from using AR lenses to let customers ‘try on’ or sample items virtually, to improvements in tracking and inventory management technology to help retailers to better manage their business – but it is also likely to be continued to be used post-pandemic, and retailers who implement such measures sooner rather than later may find themselves in an advantageous situation.

Conclusion

Ecommerce retailers navigating these difficult times will find themselves with a lot of questions about how to operate once the pandemic has ended, particularly if new or additional health and safety measures are implemented at any point of the supply chain.

However, they will find that the same tenets of what makes a successful ecommerce business won’t have changed much if at all. From providing excellent shopper experience, to removing friction at checkout, and providing options that best suit the shopper, the new normal is an opportunity for ecommerce retailers to take the learnings that helped them move through Covid-19 and use them to excel.

Trying to make sense of the current retail climate? Join us as our panel of experts from Deloitte, The How Consulting, and eShopWorld discuss how brands can survive, and even thrive during Covid-19 in Retail is dead. Long live Retail webinar on the 27th and 28th May. Sign up here.