Executive Summary

The COVID-19 pandemic, which took hold of the global consciousness a year ago, has shaped and revealed many things about the world of retail and commerce. With lockdowns came new consumer attitudes and behaviors. Last year, more people around the globe made online purchases for the first time. Others got more comfortable with the kinds of purchases they could make, the places they could make them, and how they could pay for and receive those purchases. Retailers and brands, many of whom faced the threat of bankruptcy or permanent closure, were forced to find ways to address both new and existing customers. They pivoted their focus from physical stores to the web and adapted to newly formed habits and expectations.

Through it all, digital transformation has accelerated, and cross-border ecommerce has been thrust to the forefront of any global retail strategy aimed at thriving in the post-COVID-19 economy. As brands and retailers have moved to eliminate friction from the online shopping experience to make it faster and more convenient, many people are increasingly embracing the idea of international ecommerce.

To better understand these online shoppers, eShopWorld (ESW) recently conducted the Global Voices 2021: Cross-Border Insights survey of 22,000 consumers in 11 countries. The study, which found that 68% of shoppers made ecommerce purchases outside of their home country in 2020, looked at cross-border buying habits and expectations of these consumers, and analyzed them across their demographic and generational makeup. By examining various cohorts, brands can gain insight into where cross-border strategies are succeeding and where there may be untapped opportunities to foster customer relationships for business growth.

Talking About Generations

When looking at cross-border adoption and behaviors, some clear distinctions can be observed across generational lines. As their name might suggest, digital natives are the most comfortable shopping sites outside of their home countries. This group comprises consumers 25-34 years-old, spanning two generations: younger Millennials and older Gen Zers. In their savviness, they not only show a propensity for adopting new behaviors compared to older generations; they also possess more buying power than their younger counterparts.

Shoppers ages 25-34 were the most likely to have made 11 or more cross-border commerce purchases in the past year (33%), compared to 35-44 (32%) and those ages 18-24 (29%). Of those purchases, categories including clothing (30%), toys (19%), and health & beauty (19%) were the most popular. Collectively, Gen Zers and Millennials bought cross-border in all categories, including cosmetics, fragrance, luxury, and skincare, at a rate three times that of Boomers.

Among the digital natives, the US ranked as one of the most-shopped countries overall, with 55% of respondents saying they made cross-border purchases from US-based brands and sites.

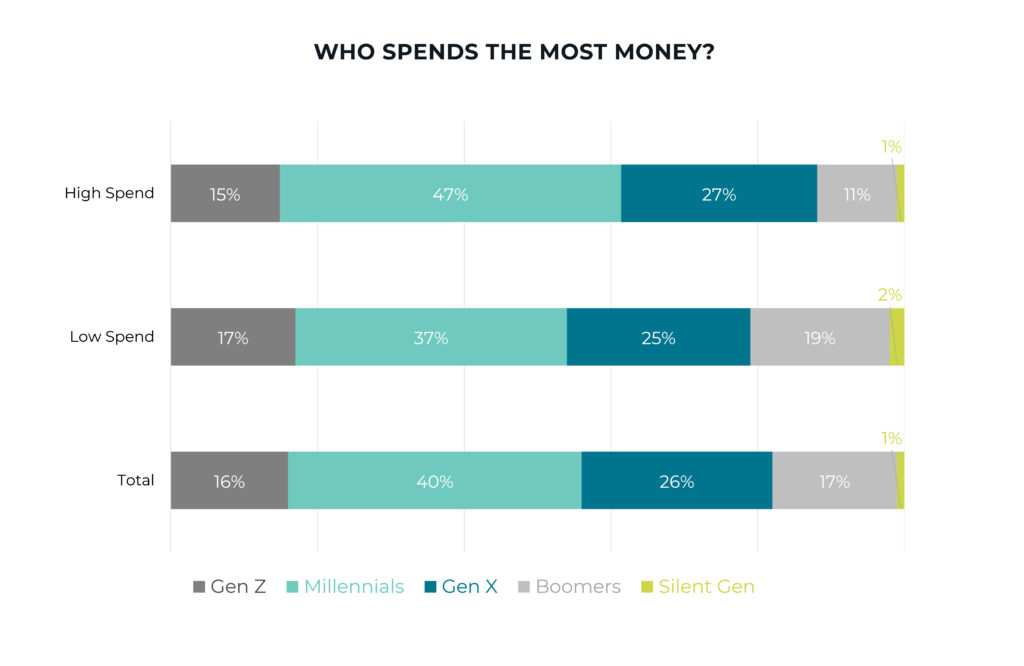

Millennials make up most of the cross-border market overall and have the distinction of being the highest spenders, with 47% having spent more than $500 on cross-border ecommerce purchases in the past year, followed by 27% of Gen Xers and 15% of Gen Zers.

Gen Z, however, is establishing itself as a force. This cohort is quite comfortable spending money and already possesses spending power of $44 billion per year in the US alone.[1] The Global Voices study found they are most likely to buy directly from brands instead of marketplaces or a combination of the two. Nearly 30% of Gen Zers who shopped cross-border shopped directly from brands, versus 23% of Millennials and 23% of Gen Xers. This presents a significant opportunity for brands looking to capitalize on the growing Gen Z consumer base, which already makes up about 25% of the cross-border market in Chile, Mexico, and Turkey.

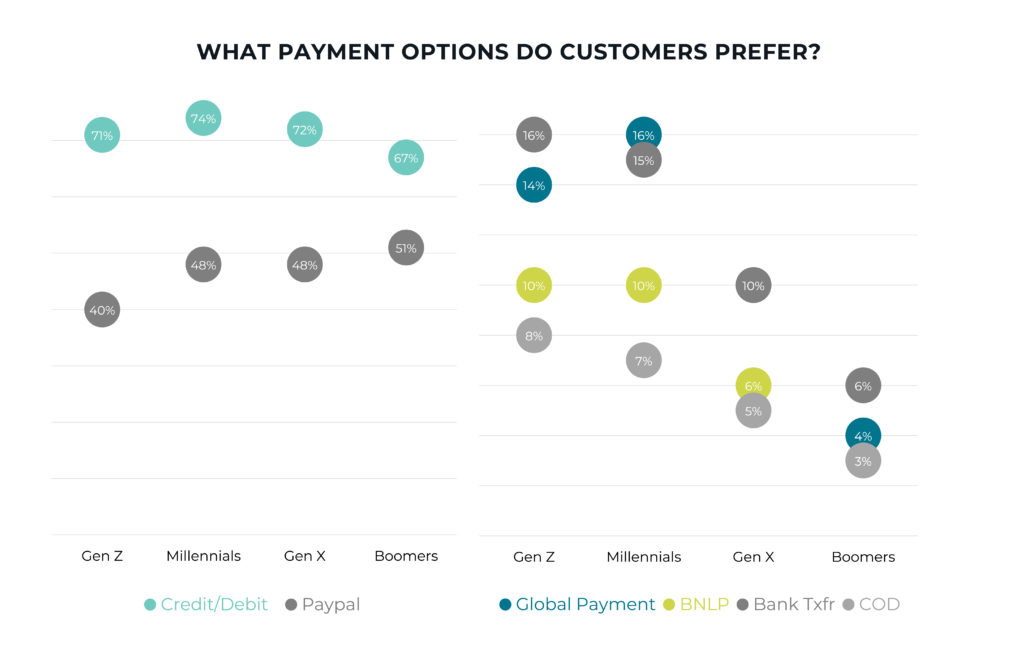

It’s not just what they buy, but how that distinguishes younger shoppers. While Boomers and Gen Xers are most comfortable with credit card and PayPal payments, younger shoppers are increasingly gravitating toward global payment systems and Buy Now, Pay Later options. This signals the emerging importance for retailers to offer a range of payment options. That said, concerns around shipping costs and times are cited as the most significant barriers to purchase across all age groups.

The Boomer Boom

On the other end of the generational spectrum are the Baby Boomers, who between the ages of 57-75, are engaging in international ecommerce more than ever before. Boomers still maintain the most significant overall buying power in the US at $548.1 billion per year.[2] Unlike younger generations, up to and including Gen X (ages 41-56) to varying degrees, Boomers seek a more traditional cross-border online shopping experience and prefer fundamental best practices like the use of local language and currency and clear refund policies.

Forty-three percent said they prefer websites to present information in their local language (versus 31% of shoppers 40 and under), 39% expect prices in their local currency, and 29% prefer a clearly stated refund policy when shopping cross-border. They are also most comfortable paying by credit or debit card, with 65% using credit cards, compared to only 3% who have used Buy Now, Pay Later options.

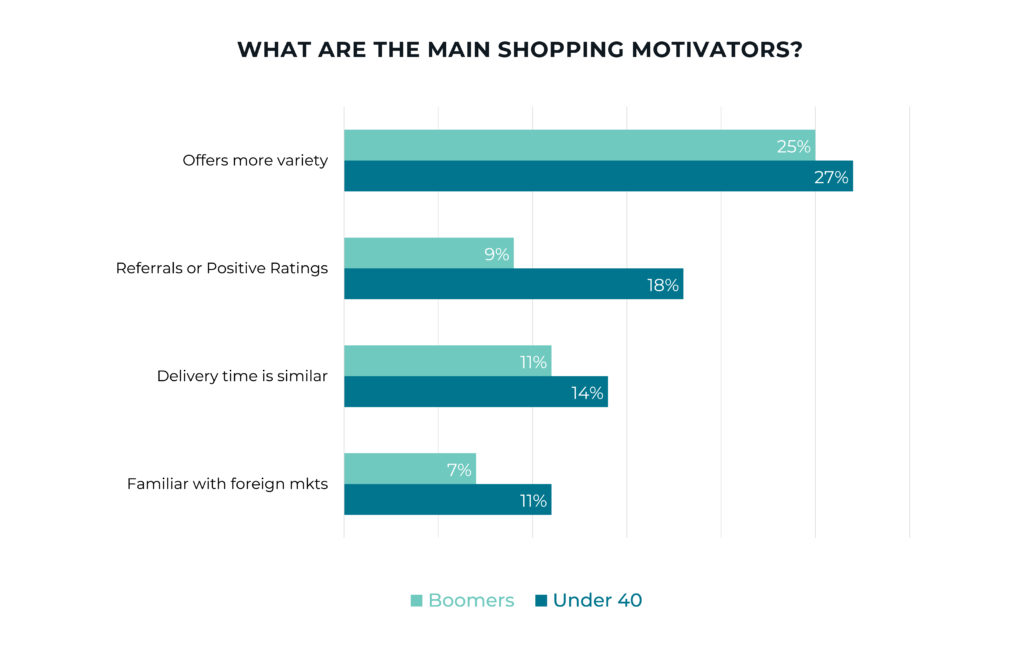

When it comes to motivators and closing a sale, Boomers prioritize lower costs over their satisfaction with a previous online experience. 42% cited cost as a primary factor compared to just 32% of those in the younger cohorts. They seek out sites with more variety but are half as likely as younger shoppers to be swayed by referrals or positive reviews (9% versus 18%).

Like other cohorts, clothing is the most popular category, with 72% purchasing clothes from an international site in the previous six months. More than half the Boomers also made health & beauty and skincare product purchases internationally but lagged younger consumers in other categories, preferring to make those purchases in their home country.

The Cross-Border Power Shoppers

When it comes to cross-border ecommerce, consumers who exhibit comfort with online shopping, the propensity to spend more money, and affinity for specific brands can be a magic combination. Meet the new power shoppers, a cohort of consumers who spend over $500 per year on cross-border purchases. Unlike other high-spenders, power shoppers are potentially more brand loyal and valuable, as they tend to buy more directly with retailers and brands rather than marketplaces.

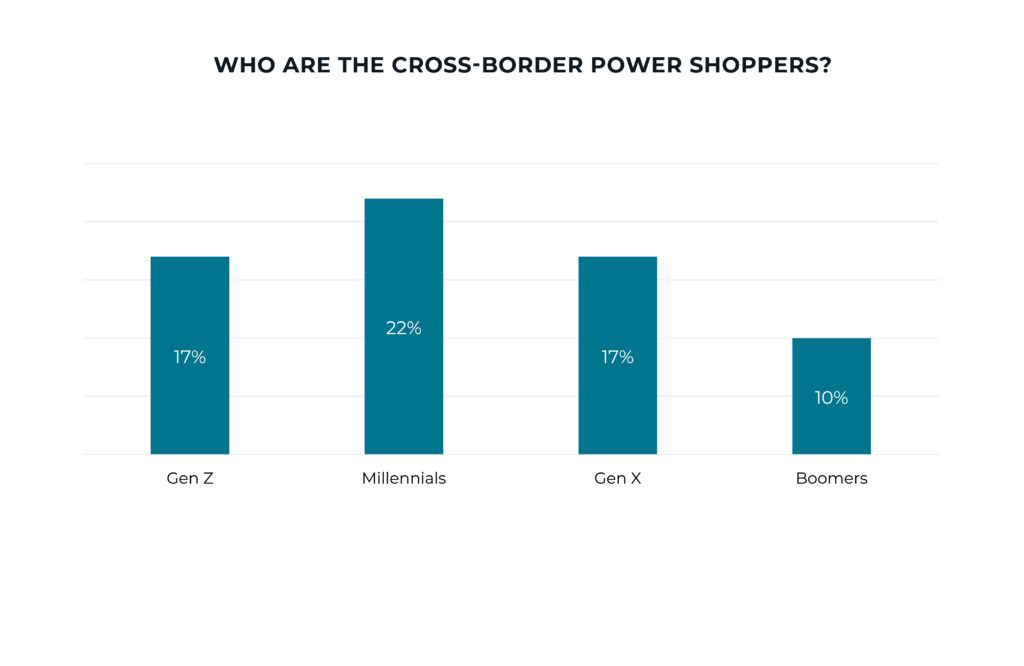

Underscoring their digital native-level of comfort with buying online, Millennials represent 40% of the overall cross-border market and 47% of high spenders. When we look more closely at the power shoppers, 22% of Millennials exhibit that magic combination, compared to 17% each for Gen X and Gen Z, and just 10% of Boomers.

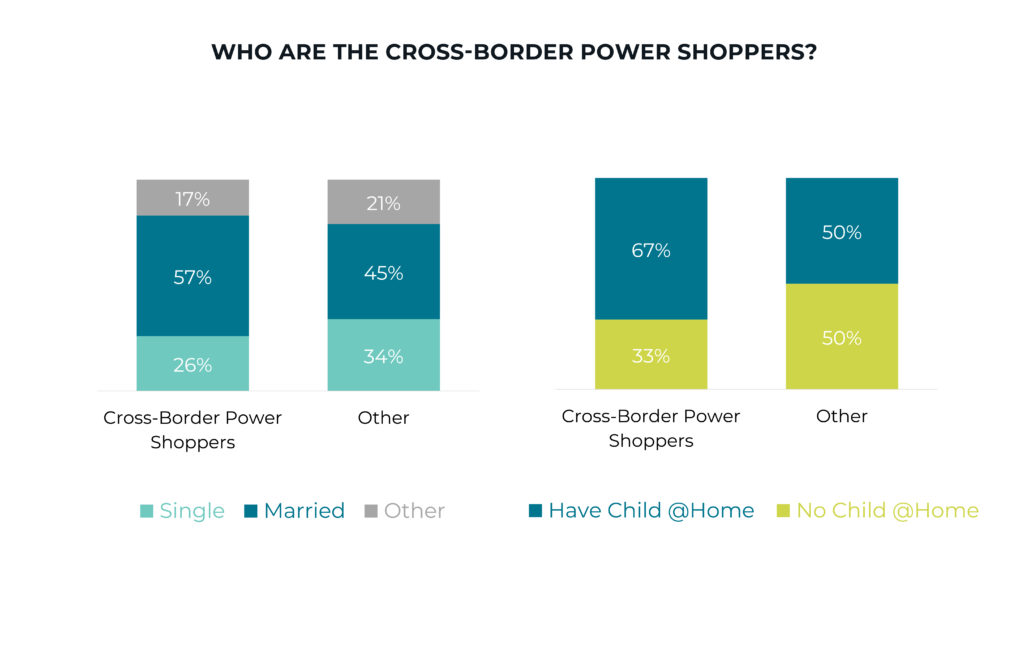

When we pull back and look at power shoppers collectively, they are more often married with families compared to the overall market.

The family lifestyle may account for higher spending across key verticals. Survey respondents who qualify as cross-border power shoppers buy twice the number of products across a range of categories:

- Clothing – 39% v. 25%

- Health & Beauty – 29% v. 15%

- Cosmetics – 26% v. 12%

- Luxury Goods – 26% v. 12%

- Fragrance – 25% v. 12%

- Skin Care – 26% v. 11%

They are also far more likely to purchase directly from brands, department stores, specific retailers, and luxury retailer sites.

Overwhelmingly, cross-border power shoppers prefer to use credit or debit cards for purchases, similar to overall consumers. However, they are twice as likely to use flexible or alternative payment methods. Twenty-three percent use Global Wallets, such as Paypal, Apple Pay, etc., compared to just 12% of general consumers, 22% use bank transfer (vs. 12%), 12% use Buy Now, Pay Later (vs. 8%) and 12% use COD (vs. 6%).

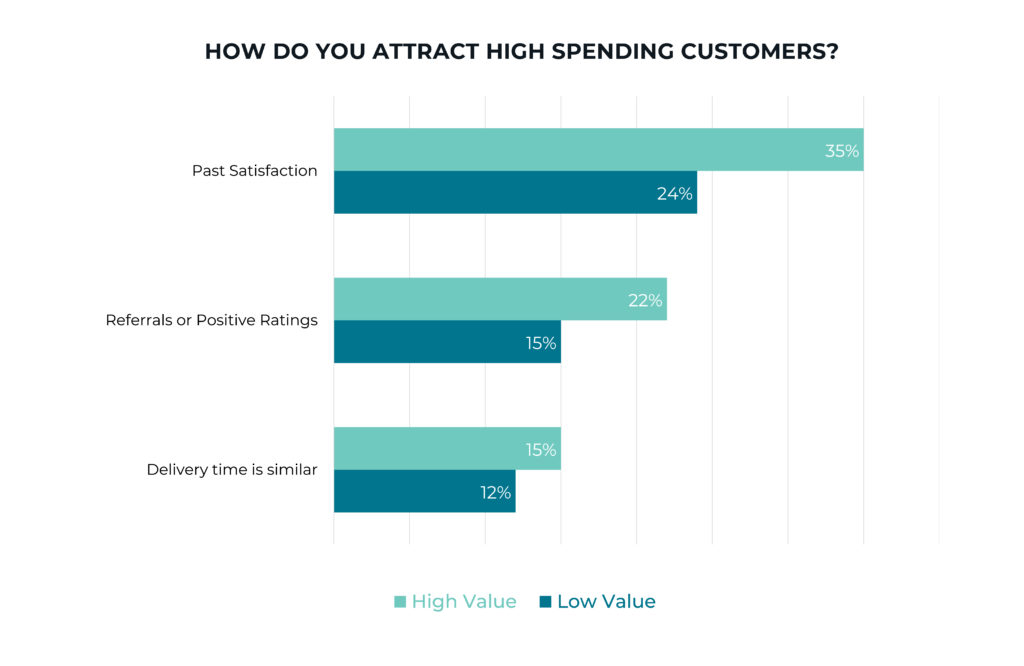

While money is always a consideration, power shoppers are no more motivated by cost than general consumers when considering cross-border purchases. However, they are more likely to look to other countries for wider variety or more unique products they can’t find locally. They are also far more likely to become loyal customers based on their overall satisfaction with the buying experience.

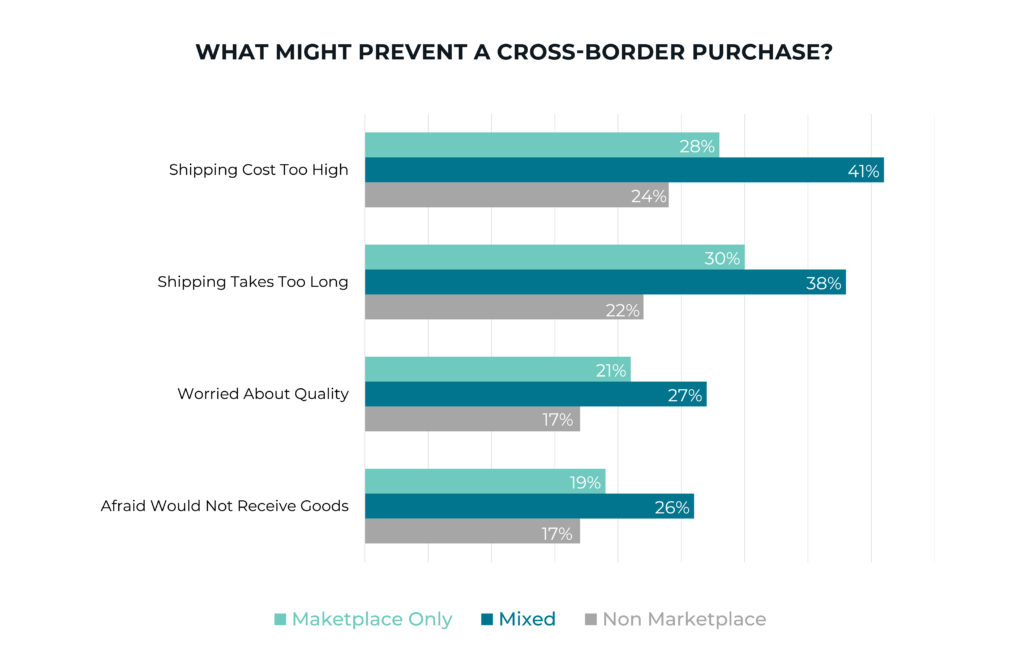

While they are as cautious about shipping costs as the average consumer, power shoppers are more sophisticated. When it comes to purchasing decisions, 22% factor in unfavorable exchange rates (vs. 15%) and customer service concerns like return policies (22% vs. 17%) and tracking options (17% vs. 12%).

They more often cite positive reviews, flexible delivery options, clear refund policies, brand recognition, and familiar payment methods as factors when deciding to buy online. When buying cross-border, localization also matters. In addition to viewing a website in their language, they expect prices to appear in their local currency and import charges stated upfront to avoid surprises.

Still, power shoppers view shipping costs and shipping times as the primary reasons not to complete a purchase.

Cross-border Hotspots Around the World

Two thirds of shoppers surveyed around the world made ecommerce purchases outside of their home country in 2020, leading many cross-border brands and retailers to be curious about which markets are generating the most attention. According to the Global Voices survey, 59% of consumers shopped a brand or marketplace based in China. US brands and retailers attracted 51% of cross-border shoppers. Rounding out the top three, UK-based sites sold to 20% of international customers.

The high percentages of customers coming to these sites show a particular affinity for American and British brands, and a preference for Chinese marketplaces for certain product types, but also underscore the importance of availability, variety, and the overall convenience of the buying journey.

Of the countries spending the most annually on cross-border purchases, Russia, Mexico, and Turkey top the list. These emerging markets offer significant opportunity for cross-border retailers who are able to serve the demand. By offering a localized shopping experience that provides the same level of service and convenience customers expect when shopping locally, brands can win customers and open new avenues for growth.

Buying British Post-Brexit

The multi-phased withdrawal of the United Kingdom from the European Union, finalized on January 31, 2020, raised many concerns for global retailers and brands. New import taxes, border controls, and processes around the movement of goods into and out of the country led to initial disruptions. Many speculated that increased costs and delivery delays might jeopardize the UK’s standing as a cross-border ecommerce powerhouse. Fortunately, however, it appears that European fervor for British brands remains intact.

According to the Global Voices 2021 report, which includes a survey of more than 4,000 German and French shoppers, 64% believe that products from the UK will cost more and 57% are uncertain about the length of delivery. However, nearly half expressed commitment to purchasing from a UK-based retailer – including 42% of French and 41% of German respondents – if it is the only one offering the product they want. This comes as more than a third (36% French, 37% German) say they are already regular shoppers of a UK brand, and will continue to shop cross-border in the UK, in toleration of any disruption.

Following the UK’s newly signed Free Trade Agreement with the EU, UK and EU retailers will still need to navigate the complexities of selling intra-jurisdiction, particularly as more than half of respondents expressed additional concern about their ability to return products due to delays in delivery and return times. The cross-border opportunities for UK and EU retailers remain, as long as brands are committed to providing a clear, seamless, and frictionless shopping experience.

Cross-border Motivators and What they Mean for Retailers

The ability to shop safely and conveniently across borders is beneficial to consumers and brands alike. Understanding these consumers – particularly those considered high value, regardless of demographics – is key to unlocking cross-border business growth possibilities.

But the factors going into a purchasing decision are becoming increasingly complex. With such rapidly changing market conditions – spurred by a global pandemic that upended that industry and caused lasting change – predicting consumer behaviors is nearly impossible.

To develop a winning cross-border strategy, it’s essential to consider who these consumers are, their motivations, and their disincentives.

While there are many differences across geographic borders and generations, there are several key points that emerged about high-value cross-border consumers through this study:

- The most valuable shoppers look to shop across borders when they are seeking more variety, products that are not available locally, or cost-savings

- Their loyalty is won through past satisfaction, positive ratings and referrals, and predictable delivery

- Having a website in the consumer’s language and currency will lead to more cross-border purchases.

Key takeaways from Global Voices 2021: Cross-Border Shopper Insights

Embrace the Millennials, but look out for Gen Z: While Boomers and Gen X are still flexing significant spending power, Millennials and Gen Z represent the highest value segments for most retailers and brands when it comes to cross-border ecommerce, particularly those in the US. Smart brands will prioritize Millennials’ engagement and keep a close watch on Gen Z as they establish more buying power and clout in the global market.

Watch the emerging ecommerce markets: Cross-border power shoppers are found in every region but present a unique opportunity in Turkey, Mexico and Russia, and Singapore.

Sell Globally, Act “Locally”: Power shoppers expect a wholly localized cross-border shopping experience, with appropriate languages, local payment methods, currencies, and items that can’t be found on other sites. To keep customers coming back, provide a positive shopping experience that conveys:

- Estimated delivery dates

- No surprise charges

- Easy local returns/return to store

- Clear refund policies

- Reviews

When targeting Gen Z, remember they prefer to shop directly from brands and place a high premium on past experience, so focus on providing a branded experience that delivers consistent satisfaction. To maximize conversion amongst high-value Millennial and Gen Z shoppers, give them various local payment options, including Buy Now, Pay Later, and offer free or low-cost shipping.

Variety is the spice of cross-border: Product availability and variety are as crucial as costs for high-value shoppers.

Big spenders spend more time with brands: High spenders are more loyal. They tend to shop more frequently on brand websites and with more confidence than on marketplace sites. Catering a direct-to-consumer experience that exceeds expectations is the way to attract and convert them.

About the Survey

ESW’s latest consumer survey was fielded from more than 22,000 consumers in 11 countries (Australia, Canada, Chile, France, Germany, Mexico, Russia, Singapore, Turkey, the UK, and the US), who were surveyed online in December 2020. Gen Zers are defined as consumers ages 18–24, millennials as ages 25–40, Gen Xers as ages 41–56, baby boomers as ages 57–75, and the Silent generation as ages 76–92.

Explore how eShopWorld can help you grow your business with cross-border ecommerce strategy and solutions. Reach us at https://esw.com/contact/sales/

[1] “Consumer Shopping Trends and Statistics by the Generation: Gen Z, Millennials, Gen X, Boomers and the Silents” (V12, July 10, 2019)

[2] “A Guide to Cross-Generational Marketing” (Epsilon, July 19, 2019)