The State of Luxury Ecommerce and Global DTC at the Mid-Year

Throughout the pandemic, shopping attitudes have shifted, especially among luxury shoppers. In 2020, the luxury market took a heavy hit as brands and retailers scrambled to accelerate their digital strategies and account for lockdowns and other precautionary measures that impacted physical locations. Fortunately, luxury has since rebounded, with 18% of consumers making cross-border luxury purchases, a 50% increase that marks its place as the fastest-growing category so far this year.

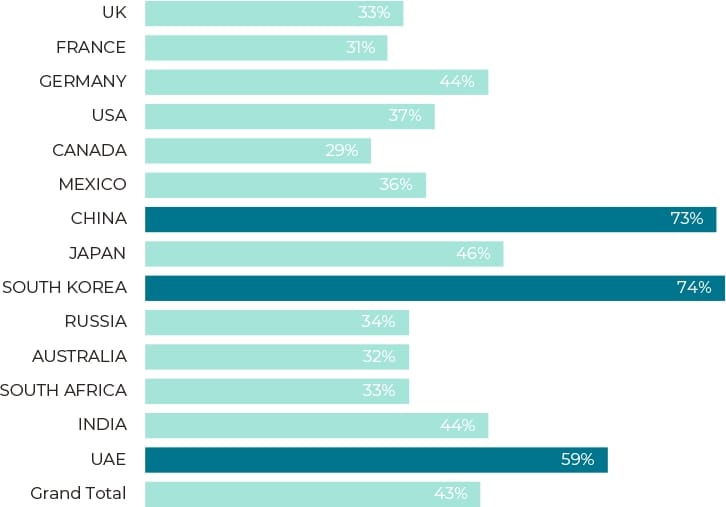

In a new survey, “Global Voices: Pre-Peak Pulse 2021,” 43% of respondents self-identified as luxury shoppers.

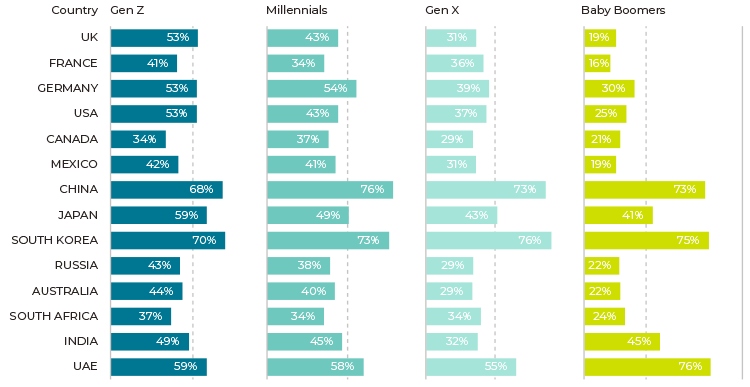

Shoppers in Asian countries and the United Arab Emirates were more likely to shop for luxury items than those in Europe, North America, and South Africa, regardless of age.

demand for luxury goods (By country)

For instance, more than 70% of Millennials, GenX, and Baby Boomers in China and South Korea shop luxury, compared to less than 45% of shoppers in the Americas and most of Europe. When it comes to cross-border purchasing, demand for luxury goods is strongest in four key markets: China (39%), UAE (33%), South Korea (28%), and India (21%).

New Attitudes & Post-Pandemic Plans

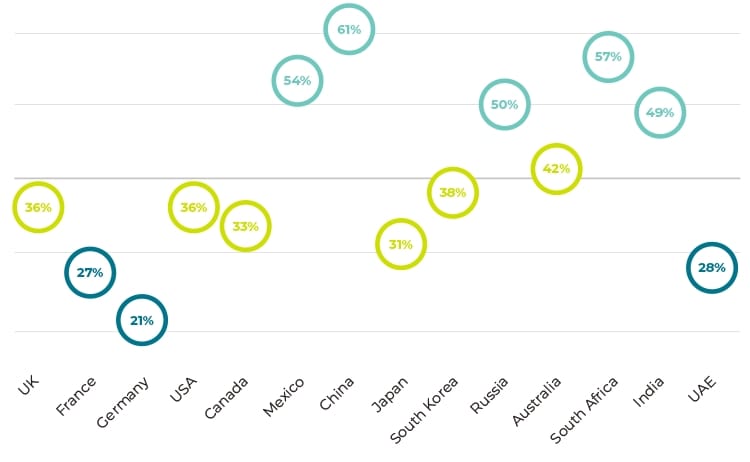

While a significant number of luxury shoppers (42%) still prefer to shop in-store, where they can touch and try on products, even more shoppers (43%) say they are happy to forego the in-store luxury experience for online convenience. Just as many (42%) will make those purchases from brand websites outside their home country.

about 4 in 10 luxury shoppers are comfortable purchasing luxury items online

That sentiment can be seen in a growing number of markets around the world. More than half of shoppers in Mexico (54%), China (61%), Russia (50%), and South Africa (57%) said they are comfortable buying luxury products online, likely due to the lack of availability and variety of such goods locally.

Despite the high price, i am happy to purchase luxury items online (top 2 box)

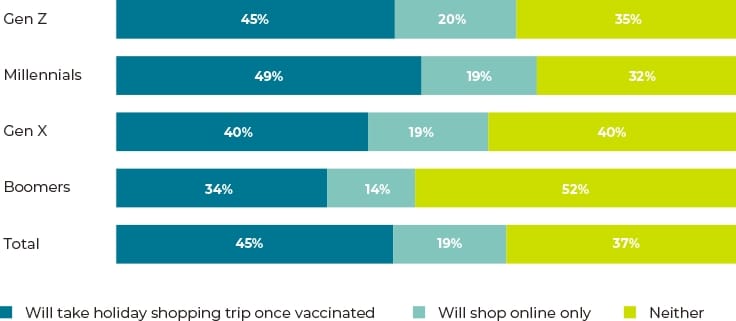

Of course, that doesn’t mean they’ve given up on brick-and-mortar. Luxury consumers are more eager than other shoppers to get back to their in-store experiences. While many consumers, in general, have adopted new behaviours that will see them buying online more frequently even after the pandemic passes, an increasing number of luxury shoppers are making plans for post-pandemic shopping trips. Once vaccinated and travel restrictions ease, a greater percentage of survey respondents across every age group said they’ll take a holiday shopping trip, compared with those who traveled to shop pre-pandemic. Meanwhile, just 20% or less said they will shop online only.

Post pandemic plan

International Shopping Holidays

One place that may not be high on the list for travel or online shopping is the UK. The recent removal of tax-free shopping and other policies is undoubtedly set to have an impact on both travel and purchase decisions. Approximately four in ten luxury shoppers claim that the removal of tax-free shopping will impact their purchase decisions from the UK. 43% state that it removes a competitive advantage for the luxury sector, 46% claim that they will spend less money with UK brands, and 46% say they will make fewer visits.

Have you ever taken an Int’L Trip focused on shopping?

What’s In Store for In-Store: The growing importance of Omnichannel

The in-person shopping experience has long been a draw for luxury shoppers, thanks mainly to the personalised attention and exclusivity afforded by high-end brands.

Approximately half of luxury consumers prefer to purchase in-store due to the overall experience, with 52% stating brand experience, store design, and exceptional service make such a purchase special.

Between 40 and 50% of luxury shoppers prefer purchasing in store due to overall experience

A significant portion of these shoppers (38%) are also doubtful about the ability of brands to replicate the high level of service or the luxury brand experience that physical stores can offer.

Just because they don’t believe it doesn’t mean it can’t be done. This is where a Unified Commerce and Omnichannel strategy will be essential. This approach places all consumer touchpoints on equal footing to create a more holistic shopping experience that meets consumers where they are.

With an omnichannel strategy, brands can:

Better understand their audience through customer data, and use it to plan for more targeted future events

Invest in online infrastructure like Click & Collect, in-store returns, and appointment-based shopping that elevates the personalised nature of the experience while addressing ongoing personalised concerns about hygiene and safety

Embrace Clienteling 2.0 and create more personalised white glove experiences both online and in-store

Merge digital and physical worlds to create more innovative retails experiences with seamless service consumers expect from luxury brands

The challenge is set for luxury brands that wish to remain competitive in a post-pandemic world.

Great Expectations for Online Luxury

When it comes to luxury consumers who are comfortable purchasing online, the expectations are still relatively high.

77% of survey respondents said they expect exceptional personalised customer service when purchasing luxury products online, and 75% said that brands and retailers could be doing more to improve the premium levels of customer service for such purchases. Nearly 70% said they are more likely to buy luxury goods online if the online experience mirrors the level of service received in-store.

expectations of luxury consumers

What’s Next for Luxury

The luxury market is expected to continue to grow through the end of the year and beyond. It’s the savviest of brands that will continue to thrive, even as uncertainties of the pandemic loom worldwide. Brands that continue to adapt and embrace those omnichannel strategies will bridge the perceived divide between online and in-store and win.

ESW recommends brands offer a high-touch online customer experience that includes tracked, personalised delivery, free returns, premium courier delivery services, and luxury packaging the meets the exacting standards of online luxury shoppers. They should also seek to replicate the white-glove in-store service online by offering immersive experiences, such as private shopping via video or live chat, exclusive brand content, and high-end website design.