EXECUTIVE SUMMARY

COVID-19 has impacted the world in an unprecedented manner, affecting everything from health and wellbeing to the economy of every country around the globe.

It is clear that there will be significant changes to how societies and cultures operate, not to mention how new business models and practices emerge. In the retail space, there is a need to implement solutions to preempt being impacted by a similar event in the same way again, effecting physical and digital measures to allow brands and retailers to continue trading, while protecting and serving shoppers, staff and all other stakeholders.

The purpose of this report is to analyze the effect COVID-19 has had on global retail generally, and ecommerce specifically, and look to the future after the pandemic to see what innovations and changes will lead us to the ‘new normal’.

Topics covered include:

- Global effect of COVID-19 on business

- How consumer behaviour is changing during the crisis

- Brands’ response to the crisis

- What’s next for ecommerce after COVID-19

Brands and retailers that have prioritised digital transformation and embraced ecommerce – particularly those that have focused on diversifying digitally across geographies – are in a unique position to weather this specific storm and to leverage opportunities that will help them emerge from these difficult times stronger than ever. In this report we examine how brands and retailers can address these challenges, helping them decide which approaches are likely to have the most impact, which will remain and which are time-specific, and which can lead to improved performance, brand loyalty and conversion optimization. We hope you enjoy the insights contained herein, and they help you consider your approach in these challenging times. Should you ever wish to discuss your global ecommerce strategy, we’re here to help – just reach out.

INTRODUCTION

COVID-19 has rapidly affected the world in myriad and unforeseen ways, with a knock-on effect on the economy, retail and ecommerce. Considering this dramatic situation, people and businesses around the world have had to review how to live and do business under such dramatic conditions as lock down and worldwide illness.

The effect of COVID-19 on a global scale cannot be understated, with the worst recession since the Great Depression in the 1930s predicted globally.

Globally, unemployment has risen dramatically as physical locations and businesses are ordered to shut down to prevent the spread of the disease. The OECD23 predicts that containment measures could cause countries’ GDP to fall between 20% and 30% in the second quarter of the year.

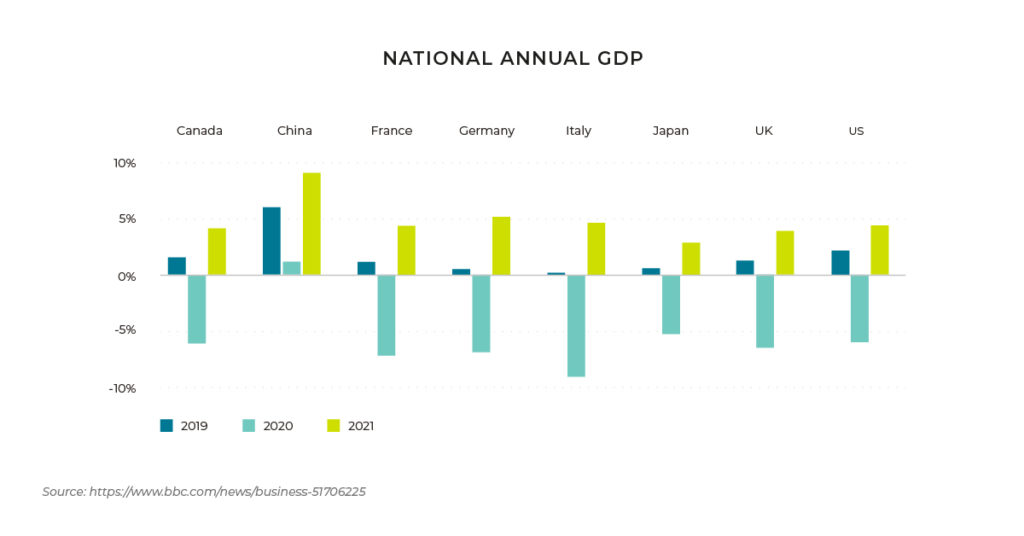

Many advanced economies are expected to enter recession this year National annual GDP

Source: https://www.bbc.com/news/business-51706225

While this is a grim prediction, there is speculation that the recession could be short and sharp with a strong recovery once restrictions are lifted, businesses can operate again, and people can return to work. While this remains to be seen it provides (at the time of writing) a glimmer of hope in a particularly concerning time.

Ecommerce has seen mixed results in the crisis with some sectors, particularly grocery, struggling to keep up with demand, while others are struggling to stay afloat as consumers stop shopping for at least the short term.

However, even some weeks into the crisis, consumer habits have changed and changed again with a sharp increase in shopping for health and beauty, electrical items and garden supplies occurring in the first week of April1.

While no one can predict the future of ecommerce or the world generally after the crisis ends, it’s clear that measures taken to accommodate or mitigate the effects of COVID-19 on retailers and consumers are likely to continue to have a place in the world post-crisis.

GLOBAL EFFECT OF COVID-19 ON BUSINESS

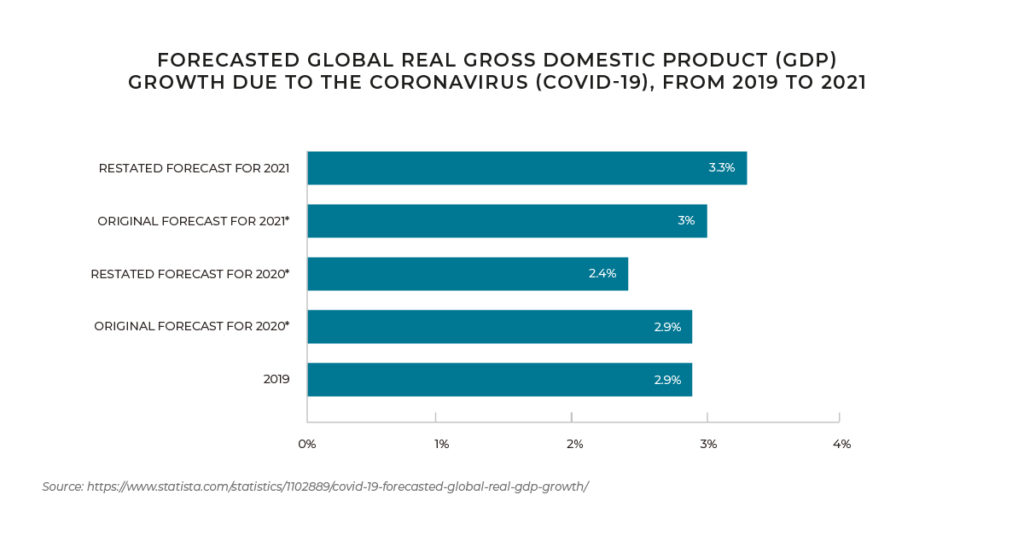

Forecasted global real Gross Domestic Product (GDP) growth due to the Coronavirus (COVID-19), from 2019 to 2021

Source: https://www.statista.com/statistics/1102889/covid-19-forecasted-global-real-gdp-growth/

It would undoubtedly be fair to say that almost every form of business in the world has been hit by COVID-19 in some way, to a greater or lesser extent – whether positively or negatively. With global GDP forecast to decrease by 0.5% in 2020, following 2.9% growth in 201922, no country will emerge from the pandemic untouched.

Whether it is a brick and mortar store that had to close physically, or a business that had to pivot to accommodate all staff working from home, the effects and implications have been unavoidable.

Retail businesses that relied on foot traffic have been particularly hard hit as shutdowns led to a drastic reduction in revenue. Businesses that already had a functioning ecommerce channel, or were able to set one up quickly, have been able to mitigate their losses somewhat, but even ecommerce hasn’t been immune to the effects of COVID-19.

While some ecommerce sectors are struggling to keep up with increased demand, many others are seeing a sharp decline in sales, as uncertainty around the length of time the pandemic will last abounds. The implications for jobs and increased global unemployment means that shopping for fashion and apparel are lower on many peoples’ priorities than they might have been previously.

Some of the issues that ecommerce (and other) businesses have had to face include supply chain issues – where goods weren’t being produced any more, or staff couldn’t work in warehouses to fulfill orders – or, as with brick and mortar businesses, a general reduction in revenue as consumers reduced shopping in a time of crisis.

EMBRACING ECOMMERCE IN A TIME OF CRISIS

What COVID-19 has done is show businesses how they need to be prepared to respond and pivot in an unprecedented situation. One major result of this pandemic is brick and mortar businesses realizing, if they hadn’t before, the importance of having an ecommerce channel. This realization is predicted to lead to stores embracing an omnichannel approach that can help mitigate against future disruptions to trade in this way.

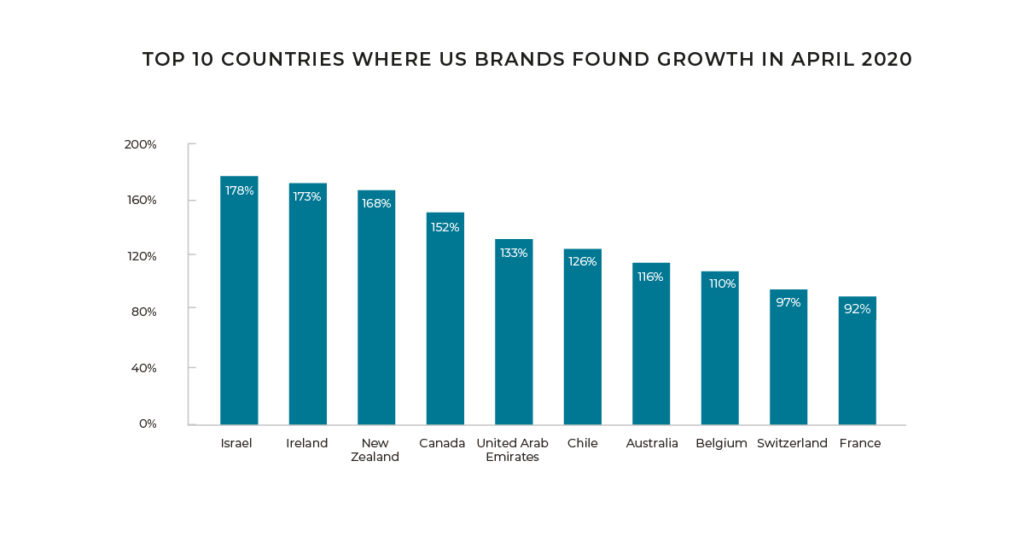

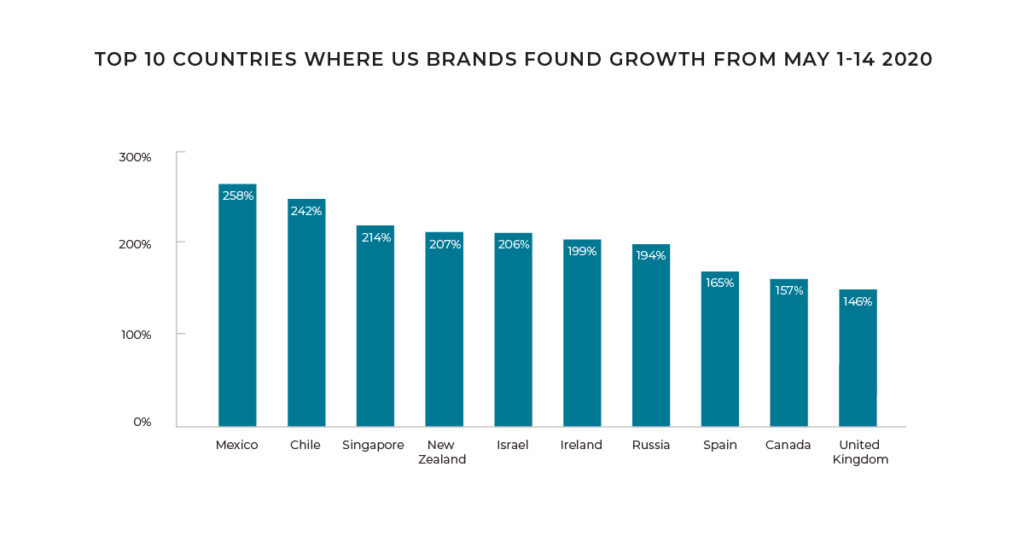

Cross-border ecommerce has grown globally with ESW seeing 109% YOY during the first half of the month of May alone which suggests that even during these difficult times, brands that are geographically diversified

are in a stronger position.

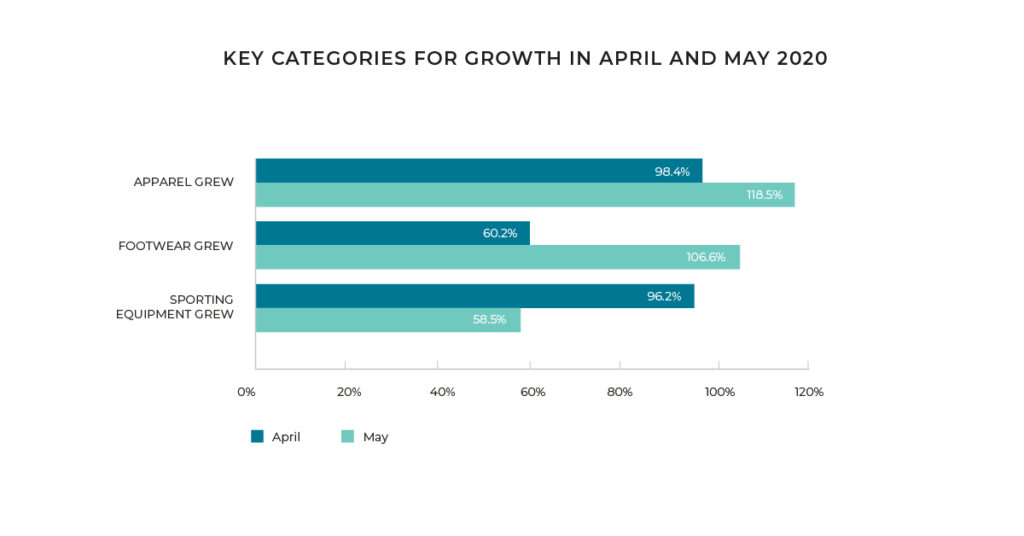

Key Categories for Growth in April and May

This data indicate that shoppers from all over the world are starting to shop or increasingly shopping online, meaning that ecommerce retailers have an opportunity to access customers that may never have shopped online before. By acquiring them in this time, there is an opportunity to keep them when things go back to ‘normal’ by providing an excellent shopper experience and persuading them of the benefits of shopping online.

HOW CONSUMER BEHAVIOUR IS CHANGING DURING THE CRISIS

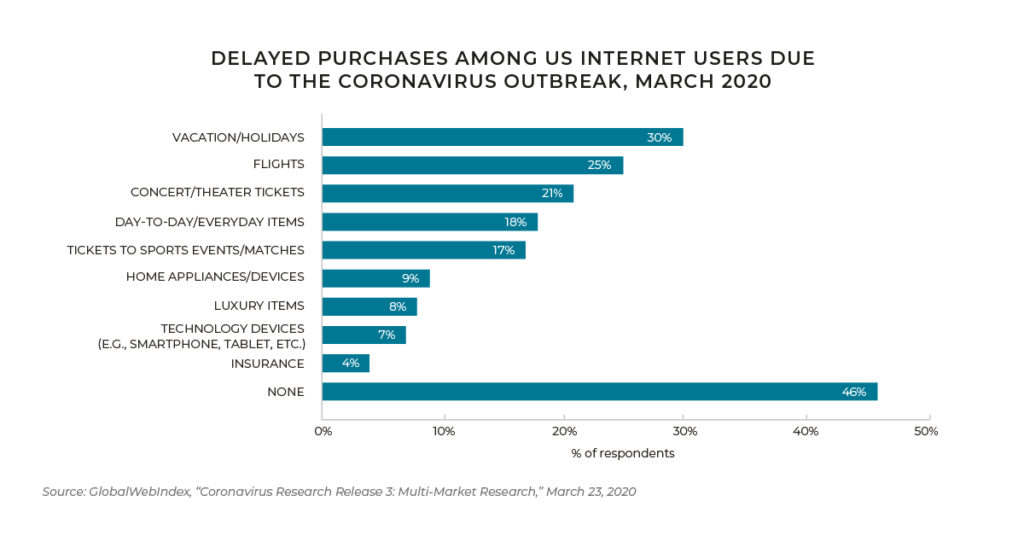

Consumer behaviour has changed dramatically since the start of the crisis due to either a personal concern regarding insecure future finances, or to not being physically able to shop due to the shutdown.

Source: GlobalWebIndex, “Coronavirus Research Release 3: Multi-Market Research,” March 23, 2020

One of the reasons consumers have paused purchasing is a natural concern regarding finances in light of the shutdowns occurring worldwide, with uncertainty over current or future employment creating an abundance of caution. Additionally, consumers have had concerns about contracting the virus via packaging or delivery, however, the World Health Organization has addressed this concern, saying on their website:

“The likelihood of an infected person contaminating commercial goods is low and the risk of catching the virus that causes COVID-19 from a package that has been moved, travelled, and exposed to different conditions and temperatures is also low.”

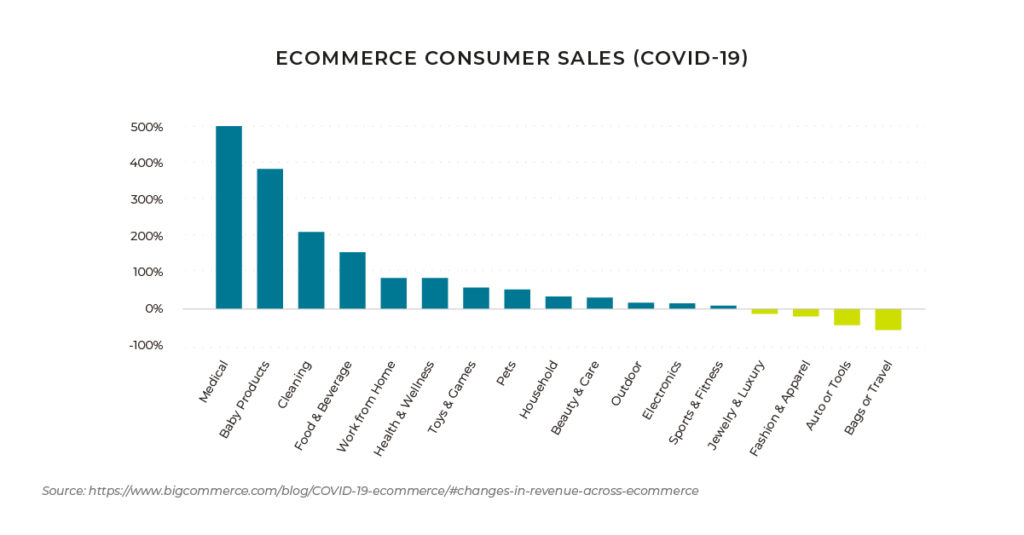

Source: https://www.bigcommerce.com/blog/COVID-19-ecommerce/#changes-in-revenue-across-ecommerce

Another way that consumer behaviour changed in the recent past is bulk or panic buying of daily supplies, although this has calmed down in recent weeks as consumers are reassured that supply chains are functioning, and food shortages are not a concern at this time.

Unsurprisingly, consumers generally paused purchasing during the pandemic, although some sectors did see an increase in sales a few weeks into the pandemic. While apparel and footwear took a hit, according to recent IMRG

data, beauty, electricals, and gardening sectors increased dramatically in the first week of April 2020 compared to April 2019 – in some cases up to 180% more year on year.1

Brands trading with ESW are also observing these trends, with those that are geographically diversified responding best to the restrictions and impact of COVID-19, showing that brands that serve multiple global markets are better-placed to weather unexpected storms.

GENDER DIFFERENCE IN CONSUMER RESPONSE

There has been a marked difference in how different genders respond to the restrictions and this may affect how retailers market to consumers moving forward.

According to a recent Forbes study2, while more women (71%) than men (60%) were “worried about Coronavirus” almost half the men (47%) said it impacted their purchase decisions, while only 41% of women said it changed how they shopped. Men (24%) were more likely to shop online and avoid shopping in-store than women (18%). They also preferred to use options that limited in-store interaction such as buy online pick up in-store (BOPIS), kerbside pickup and subscription services.

Additionally, both men and women (34% and 35% respectively) reported cutting back on spending due to Coronavirus concerns.

GENERATIONAL DIFFERENCES

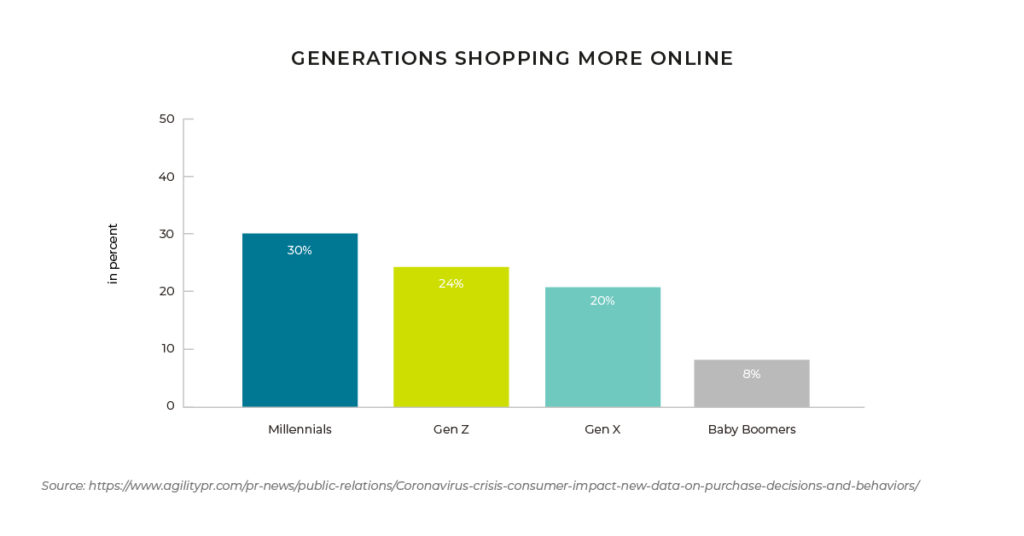

The generation responding mostly strongly to the crisis is Millennials, according to data released by First Insight3, with their behaviour changing more dramatically than any other – cutting back on spending, stocking up on groceries, staying indoors and minimising the use of public transport.

Gen X and Boomers have said that they are less concerned and are letting the pandemic affect their shopping habits less – only 24% of Boomers and 34% of Gen X said current events were impacting what items they purchase.3

Millennials (30%) are shopping more frequently online (compared to 24% of Gen Z, 20% of Gen X and 8% of Baby Boomers).

Source: https://www.agilitypr.com/pr-news/public-relations/Coronavirus-crisis-consumer-impact-new-data-on-purchase- decisions-and-behaviors/

BRANDS’ RESPONSE TO THE CRISIS

There has been a marked difference in how brands have responded to the crisis. Some pivoted to accommodate either supply chain or production issues to minimize the effect on consumers, increased their ecommerce offerings, or even responded to governments calls to help the pandemic by making protective gear or supplies such as hand sanitizer and donating these to the effort.

NIKE AND LULULEMON

At the end of March, both LuluLemon and Nike4 reported favorable earnings (19% in North America for LuluLemon and 7% total revenue growth for Nike) despite the crisis. According to a Coresight Research report, “At the end of March 2020, athletic apparel companies Nike and Lululemon reported favorable earnings amidst the Coronavirus outbreak. On March 24th, Nike reported that 3Q20 saw 7% revenue growth. On March 26th, Lululemon reported its 4Q20 earnings results which included growth by region: North America was up 19%, international was up 25% and China was up 70%.”

Both may benefit from being slightly less reliant on trends than high fashion brands, so stock won’t go out of date in the same way that high fashion brands’ will.

Both brands stayed engaged with their consumers by leveraging social media and apps and providing free exercise classes and encourage at home workouts, and in China alone Nike reported 30% digital ecommerce growth.

ESW has seen its clients, after some early March impact, recover quickly and subsequently perform better than they had pre-COVID-19 – by as much as 150% YoY.

PVH

PVH, the company that owns Calvin Klein and Tommy Hilfiger is considering “holding” some of its spring and summer inventory for some time – possibly until next season – in order to sell at full price or close to full price, instead of selling off stock at steep discounts5.

Due to stores closing and depressed apparel sales online, PVH is working with department stores and other retail partners to “push inventory commitments out at least an additional four to five weeks” said CEO Emanuel Chirico.

Embracing ecommerce during this time, PVH brands are amplifying their online marketing, having previously seen a 20% increase in digital business in 2019, with digital being worth 12% of total revenue in 2019, up from 10% in 2018.

GAP

Clothing retailer Gap has asked its suppliers to cancel summer orders and stop producing for fall in response to COVID-19 – except for items to be sold on its online platform.6 This approach, which other retailers are also taking, could have a knock on effect on production if factories face a drop in demand threatening jobs and ultimately the supply chain.

H&M

H&M have cancelled vendor orders and is only accepting shipments of products that have been made already.6

LUXURY BRANDS’ RESPONSE TO THE CRISIS AND PREDICTIONS FOR THE FUTURE

Luxury has and will continue to be hard hit by the crisis, as apparel and footwear sales will be seen as a non-essential purchase and most likely take a swift dip. For this reason, there is potential for the effects of COVID-19 to be longer lasting on the sector.

Several luxury brands have responded to the pandemic by supporting efforts needed to battle it, including LMVH, which has repurposed perfume factories to make hand sanitizer for donation to French hospitals.7

Some brands are viewing the crisis – once it’s over – as an opportunity to review the industry and its processes as a whole, with Giorgio Armani writing an open letter to WWD8 saying,

“The current emergency… shows that a careful and intelligent slowdown is the only way out, a road that will finally bring value back to our work and that will make final customers perceive its true importance and value.

The decline of the fashion system as we know it began when the luxury segment adopted the operating methods of fast fashion, mimicking the latter’s endless delivery cycle in the hope of selling more, yet forgetting that luxury takes time, to be achieved and to be appreciated.”

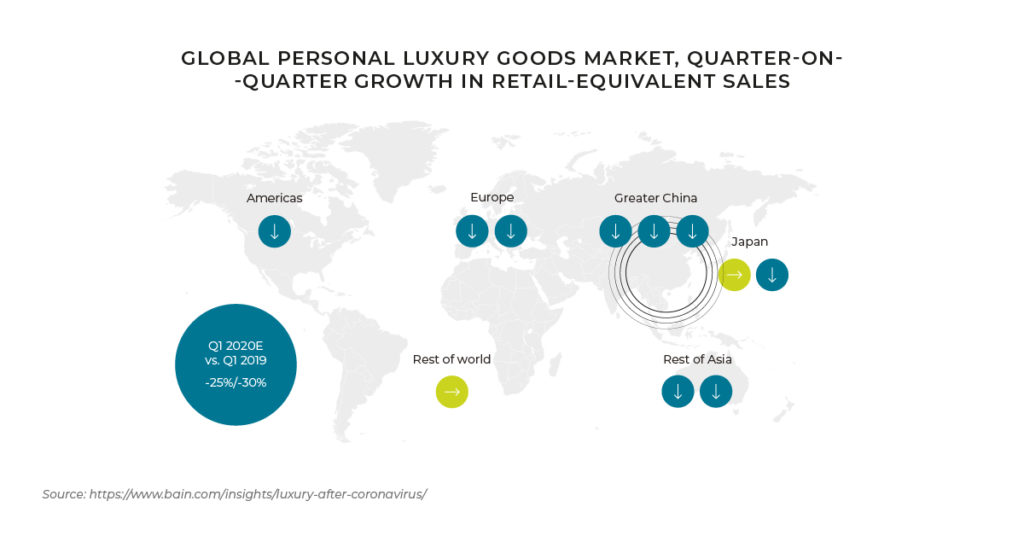

Source: https://www.bain.com/insights/luxury-after-coronavirus/

“Luxury cannot and must not be fast. It makes no sense for one of my jackets or suits to live in the shop for three weeks before becoming obsolete, replaced by new goods that are not too different.”

He continued, “This crisis is an opportunity to slow down and realign everything; to define a more meaningful landscape. I have been working with my teams for three weeks so that, after the lockdown, the summer collections will remain in the boutiques at least until the beginning of September, as it is natural. And so we will do from now on.

This crisis is also an opportunity to restore value to authenticity: Enough with fashion as pure communication, enough with cruise shows around the world to present mild ideas and entertain with grandiose shows that today seem a bit inappropriate, and even a tad vulgar — enormous but ultimately meaningless wastes of money. Special events should happen for special occasions, not as a routine.”

“The moment we are going through is turbulent, but it also offers us the unique opportunity to fix what is wrong, to regain a more human dimension. It’s nice to see that in this sense we are all united.”

Other luxury brands such as The Elder Statesman have embraced ecommerce and particularly social media in an effort to weather the pandemic. The brand is also avoiding discounting where possible with founder Greg Chait saying, “Nothing’s off the table,” he said. “But we’re not going to do anything that hurts our brand.”8

Les Petits Joueurs, an Italian producer of luxury bags and shoes, is launching a full virtual showroom with Augmented Reality (AR) options to try on every product and have more online interaction as a result of this, even in the last few days.20

FASHION SHOWS IN A TIME OF CRISIS

An essential of luxury retail is the fashion show, where brands can maintain relations with consumers and trade partners. Having seen almost all shows shut down or delayed for the foreseeable future, luxury retailers will need to innovate in order not to find themselves in the same position if a similar crisis ever occurs again. Some brands pivoted quickly to accommodate any shutdowns, live streaming shows or holding them behind closed doors. This may be an innovation that will be brought into the future, making the shows more accessible for those outside the fashion world, and potentially broadening the scope of reach – a potential upside driven by the disruption of the status quo by the current situation.

HOW DO TRAVEL LOCK DOWNS AFFECT THE LUXURY SECTOR?

Travel is an important part of the luxury sector, with 20-30% of industry revenues generated by shoppers making purchases outside their home country.

Chinese consumers represent 35% of the global personal luxury goods market21 and love to purchase their luxury items from the country of origin, both due to benefiting from lower prices abroad (often in Europe) but also because buying in the home country gives a sense of authenticity and excitement, without the risk of counterfeit.

With travel restrictions in place at the time of writing, and no sign of when they might be lifted, this revenue stream

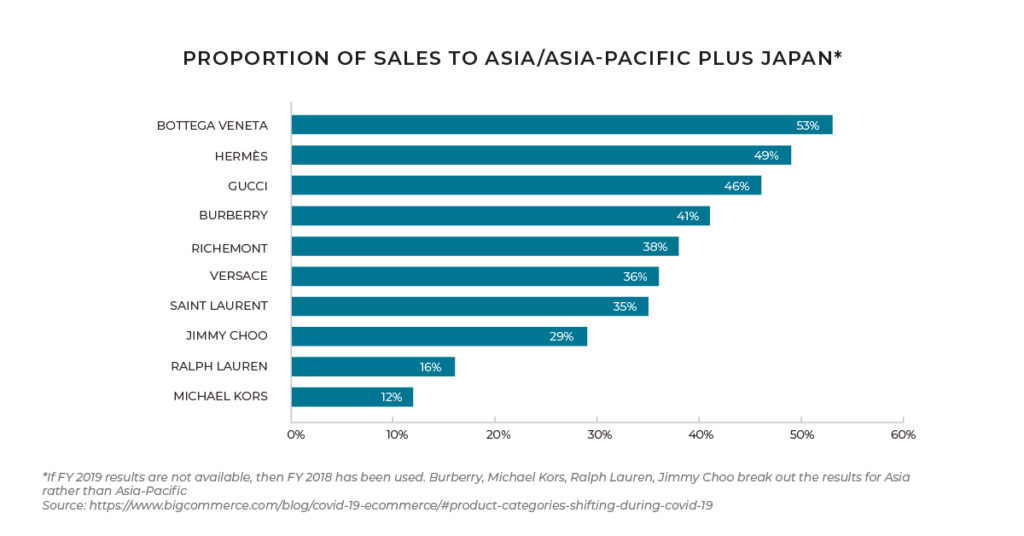

has been greatly affected. Vogue Business15 estimates a loss of up to $10 billion for the luxury sector in 2020 due to COVID-19. This is in part because luxury relies heavily on the Asian market’s purchasing power, which has been affected since January.13

Brands will need to rethink how to approach and sell to their shopper in order to come out of the pandemic in a strong position. Some suggestions include omnichannel, tailored experiences and engaging more personally with customers across multiple cities.9

*If FY 2019 results are not available, then FY 2018 has been used. Burberry, Michael Kors, Ralph Lauren, Jimmy Choo break out the results for Asia rather than Asia-Pacific

Source: https://www.bigcommerce.com/blog/covid-19-ecommerce/#product-categories-shifting-during-covid-19

WHAT’S NEXT FOR ECOMMERCE AFTER COVID-19?

While no one can predict the future, attempts are being made to imagine what disruptive measures and innovations, originated during the crisis, will be adopted long term. Certainly, brands are realizing the value of having a strong ecommerce channel to utilize if physical stores have to shut unexpectedly, but as previously outlined, ecommerce was not unaffected by the crisis and every business will have to assess how they were able to respond and what measures they can put in place – or did put in place – to help.

According to a report by Deloitte on the impact of COVID-19 on business and its recovery after the pandemic, “In the short term… the consumer sector, which contributes the most to economic growth, will be the one that hurts the most. In the first half of this year, catering, retail, and travel services will all experience tremendous cash flow pressure due to declining sales and high fixed costs, and the shortfall in cyclical consumption will not be made up after the epidemic.”12

Once the pandemic ends, will things get back to “normal”? Or will the lessons learned, and innovations developed during this time change the face of ecommerce for good? Here are some areas where its possible changes made during the pandemic to improve or pivot will be maintained and developed moving forward.

INVENTORY

Managing inventory – especially in an omnichannel situation – is a complex task at the best of times, but with stores shut down and some delivery options (collect in store for example) not available for customers, or new inventory put on hold because suppliers couldn’t fulfill orders, retailers needed to find new ways to leverage their existing stock and minimize the disruption to shoppers.

“US retailers have witnessed supply chain disruptions, including order shifts and delays,” Coresight CEO Deborah Weinswig wrote in a recent report. “Although the arrival of the Coronavirus in the US has triggered consumers to stockpile food and cleaning products, thus boosting sales for a few food and drug retailers, we expect overall retail sales to be negatively impacted in the next quarter as the outbreak worsens – lowering or slowing inventory turnover for many retailers.”17

One way some retailers managed this was to utilize existing stock in store to fulfill orders – even if they were online. Managing this requires clear communication between warehouses, stores and sales channels, and if retailers didn’t have the technology ready to leverage this, they could be missing out on a key channel for sales, or run the risk of having to pause selling online altogether. Retailers post-pandemic will need to review their inventory management and see if it can be better aligned to allow pivoting stock fulfillment from warehouse to store as necessary.

Managing stock in this way is a fundamental aspect of omnichannel which retailers can adopt post-crisis in order to optimize inventory utilization and align the online and offline shopper experience to the highest possible level.

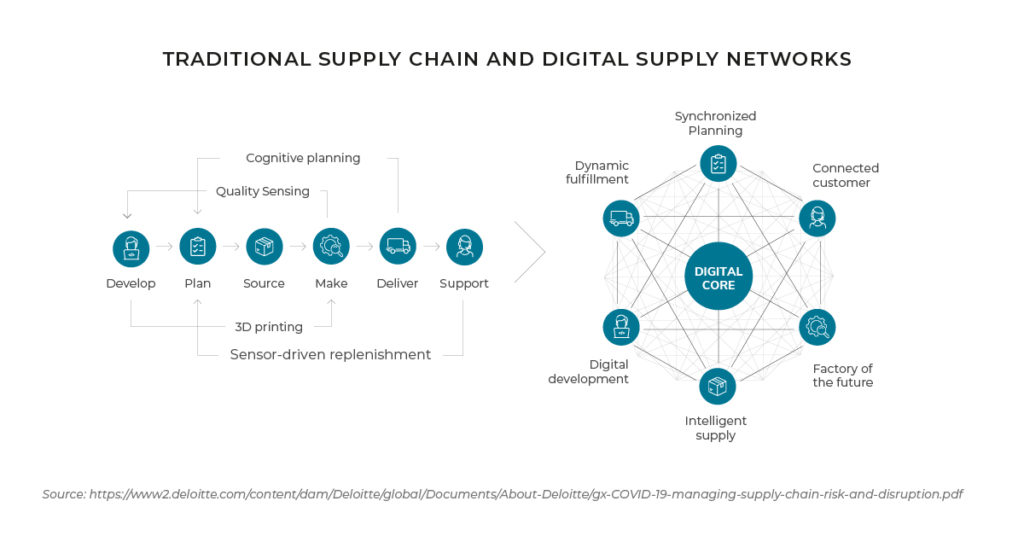

SUPPLY CHAIN

Ecommerce businesses are reliant on a robust supply chain, and the crisis has shown this to be susceptible to massive change in a short period of time. Whether retailers are waiting on supplies to be shipped from overseas to fulfill orders, or simply haven’t had access to their own warehouses to send out orders to shoppers, the pandemic has shown how fragile the supply chain can be.

The crisis could force companies and even entire industries to rethink and transform their global supply chain.

In order to mitigate and minimize the effect of supply chain issues, retailers have used technology to support their efforts and it is likely that this fast-tracked technology will continue to be utilized post-COVID-19. Advances in information and communications technology, IoT, 5G, 3D printing and robotics are all enabling a new evolution of the supply chain which will be better place to mitigate against “black swan” events such as a pandemic, or other unexpected events that could impact a business.

According to a PwC survey of CFOs, 39% are considering changes in their supply chains as of April 8. Amity Millhiser, PwC vice chair and chief clients officer said, “I think that reflects the fact that… as companies look to China and manufacturing coming back online, they have more confidence than they did the last time around in the near term strength of the China supply chain.”

She also pointed out that the trend toward supply chain optimization has left many organizations heavily dependent on few suppliers or supplying countries, which has become a source of risk as the virus moves around the world. 17

Source: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-COVID-19-managing- supply-chain-risk-and-disruption.pdf

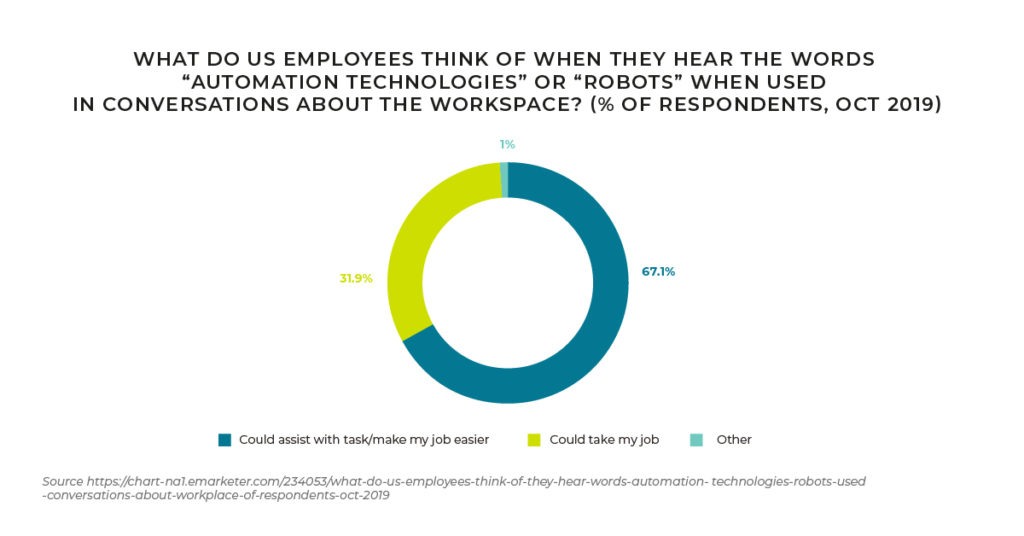

ROBOTS

Robots are already in use in some warehouses to help with fulfilment, but during the crisis robots’ input was taken to a new level, particularly in the healthcare space.

“In China, robots are helping patients navigate hospital departments, check temperatures, transport medical samples, dispense hand sanitizer, spray disinfectant residentially and commercially and clean hospitals. Healthcare robots are also seeing increased use worldwide and becoming more involved in-patient care. For example, at Providence Regional Medical Center in Everett, Washington, doctors used a robot to successfully treat a COVID-19 patient by sitting outside his window and using the robot’s camera, microphone and stethoscope to monitor his vital signs. The hospital staff, which used the robot to minimize their exposure, communicated with the patient using a large screen.”10

These technologies and abilities have been predicted to move into other sectors, particularly the food industry, and there is no doubt that as the technology gets more advanced robots will enter the workforce in all industries to improve multiple areas. Retailers should keep an eye on the developments in these technologies to see what could be applied to their business in order to streamline the system.

Source https://chart-na1.emarketer.com/234053/what-do-us-employees-think-of-they-hear-words-automation- technologies-robots-used-conversations-about-workplace-of-respondents-oct-2019

DELIVERY DRONES

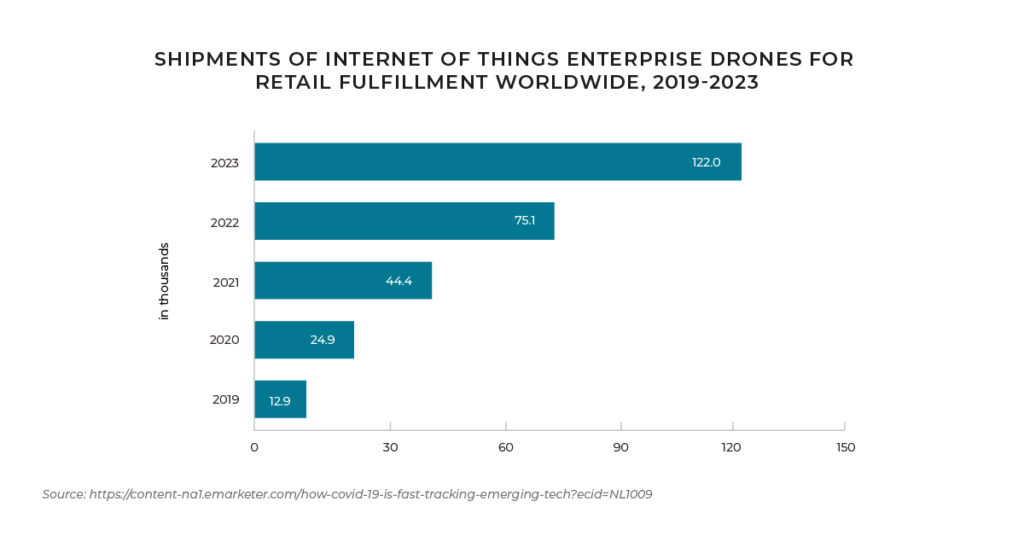

In China, delivery drones were already in use in some cities before COVID-19, however due to the shut down and the need for less human interaction, some companies have rolled out delivery drones to transport medical supplies within hospitals, as well as delivering food, supplies and medicine to those isolated at home.

In the US, a growing number of companies are testing drones to help with last-mile delivery with Gartner anticipating 24,900 drones designed for this purpose will ship this year – although these are pre-COVID figures.11

Source: https://content-na1.emarketer.com/how-covid-19-is-fast-tracking-emerging-tech?ecid=NL1009

VIRTUAL REALITY

Virtual reality (VR) technology, usually utilized by games companies, but sometimes used by retailers for “virtual wardrobes” and allowing shoppers to see what goods look like in their own home virtually, may see an increase in popularity on the back of the crisis. As the technology is developed and improved to respond to demand in supporting health care, training, conferences, or collaborations10, it is likely that retailers could pivot these advancements into supports for their shoppers in order to create a better shopper experience.

DELIVERY OPTIONS

Ecommerce relies on efficient delivery and final mile carriers to fulfil the final touchpoint of the customer journey, and with ecommerce shopping increasing and multiple retailers and businesses using ecommerce channels where previously they may not have before, this has led to an increase in demand on services and delays to shipping.

Fedex executive vice president Brie Carere said this about the impact of ecommerce on the company,

“When I think back to the percentage of our business in 2001 that was ecommerce, it was negligible. Now in the US – and especially when we’re talking about the personal delivery element of logistics – about 90% of the growth in the parcel market is driven by ecommerce. And it’s driving growth in absolute terms as well. There will be about 100 million packages delivered per day by 2026.”19

Shoppers have been understanding of delays and this is due in large part to clear communications from retailers regarding extended delivery times. This adherence to communicating clearly in the future will prove beneficial to retailers, as it is clear that while no one wants a delay to their delivery, shoppers tend to reach out to customer service less if they have been contacted in advance of a delay and are kept in the loop.

Utilizing multiple methods of delivery will also help retailers – from Buy Online Pick Up in Store (BOPIS) to in-flight tracking where shoppers can change delivery details while the parcel is en-route – provide the shopper with ownership over their delivery and leads to a better shopper experience, which its known increases customer satisfaction, brand loyalty and repeat purchases.

RETURNS

In responding to the pandemic and shoppers’ inability to return goods to store, many retailers have increased their returns policy to allow shoppers more time to return goods. After the restrictions are lifted, retailers may find that this policy is worth continuing as it provides a better shopper experience for the customer – and it often works out better for the retailer too, due to the fact that shoppers will (if returning to store) often pick something up in store on their way to make a return – therefore buffering the cost of the initial return with a new purchase.

Continuing, Brie Carere of Fedex commented on the importance of returns, “The other segment where there will

be increased competition, something that still doesn’t get enough conversation, is returns. What retailers recognize – good retailers who understand conversion and checkout – is that retail policies and speed of returns really matter. There’s a huge portion of consumers who are not going to make their next purchase until their money is back on their credit card. Speed of returns matters almost as much as the outbound shipping.”19

Providing flexible returns will benefit both the retailer and shopper, and providing multiple ways to return – in store, by mail – will be appreciated by shoppers and again lead to higher shopper satisfaction, brand loyalty, and future conversions.

PAYMENT METHODS

Having the right payment methods can help conversions but having too many can lead to cannibalization. During the pandemic, alternative payment methods became popular with Buy Now Pay Later and Cash on Delivery showing an increase in usage.

ESW has found throughout the crisis period – from early March to date (mid-May 2020 at time of writing) – that payment methods and their utilization changed somewhat. Cash on Delivery became even more popular as a payment option particularly with apparel clients in South East Asia where activity increased by almost 200%.

Credit card payments saw a lull in the early days of the pandemic but have picked up again as of early April. Amex saw a drop from the start of the year with a lull period in March but has been growing week on week since April, showing approximately 40% increase in usage from April to May.

In Mexico, Oxxo – where shoppers buy online but pick up at a designated Oxxo store and pay for the goods there – transactions are down by approx. 40% – this is not surprising given that people have to leave their house in order to use the payment method in a time of quarantine, and there are currently lockdown restrictions in place across Mexico.

iDEAL, an online payment option in the Netherlands, where shoppers can make payment using direct online transfers from their bank accounts, saw a marked decrease in January of almost 60% but has been increasing steadily and is almost back to current levels as of May 2020.

CUSTOMER COMMUNICATIONS

Throughout the pandemic, brands have struggled with communicating with shoppers, trying to balance between not seeming to be minimizing or taking advantage of the situation, whilst still staying in contact with shoppers, and trying not to go out of business in unprecedented times.

Messaging regarding whether retailers’ physical locations were open or if they had paused online sales – or even started selling online – were necessary, especially in light of changing regulations from week to week and country to country.

Many retailers in different countries aligned themselves with charities, either giving discounts for frontline workers or directly contributing supplies such as hand sanitizer, scrubs or masks, and this too needed to be communicated, on site or via email.

What seems to have worked for retailers, and can be adopted after the crisis, is clear communications with customers. Providing detailed information that preempts questions is helpful, such as

having a comprehensive FAQ or pop up box on landing at website if more urgent or updated information needs to be communicated and emailing customers when necessary – but not overdoing it. Providing support to customers such as extended return dates or discounts for frontline staff has also seemed to have increased customer satisfaction and brand loyalty in troubled times.

During the crisis, it seemed that every single business in the world reached out to their email list to advise them of how they are responding to the crisis and it has no doubt helped receivers prune their subscriptions as they find out they’re still on the email list of a company they haven’t bought anything from or interacted with in years.

In this regard, retailers may find themselves starting life post- pandemic with decreased email lists – but this doesn’t have to be a negative. In fact, it can be quite beneficial to know that those who remain on the list are there because they want to be and are therefore a more engaged and receptive audience.

MARKETING

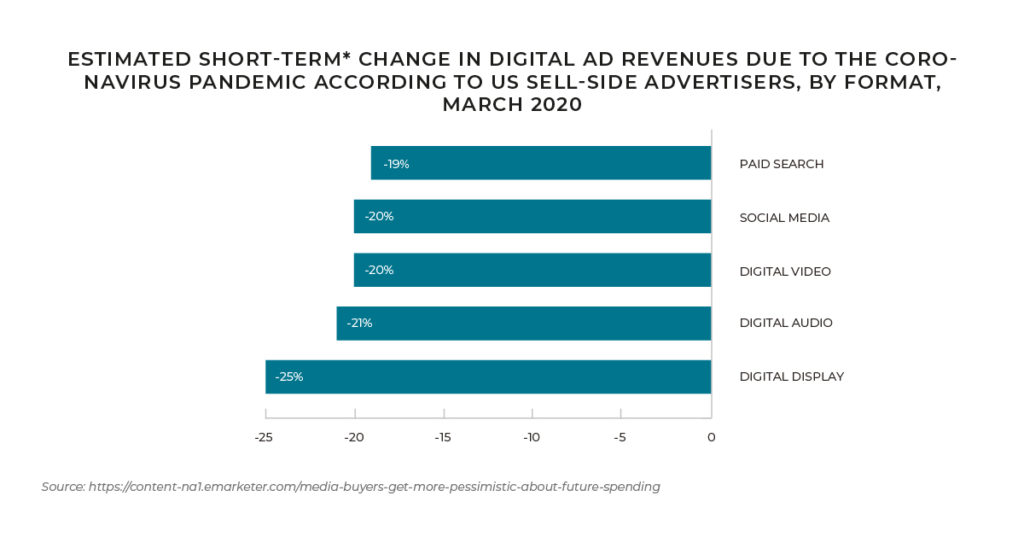

An immediate effect of Coronavirus was that advertising spend went down almost immediately as businesses grappled with how best to respond to the pandemic. According to eMarketer, the crisis is going to be worse for advertising and media than even the last recession in 2009 was. Ad spend has dropped by US$80 billion already15 and a study of marketing executives by IAB found that “70 percent have already ‘adjusted or paused their planned ad spend’ for the first half of the year. Another 16 percent are ‘still determining what actions to take.” Of those, 24 percent have pulled the entirety of their ad budgets. And among all respondents, about 75 percent expect the Coronavirus downturn to be worse than the 2008-09 recession.”15

eMarketer notes that, “What happens after [Coronavirus measures are lifted] depends on when ‘after’ is.

We hesitate to speculate about demand that is lost vs. pent up, for example, without having a better idea of how long the time period is [both indoors and with depressed income].”

While this seems dire in the short term, with crisis comes opportunity and rather than suspend all marketing, retailers are being given an opportunity to iterate and reiterate on campaigns – particularly digital efforts – in order to attract and convert new and existing shoppers. Given, as already discussed, that there is an upsurge in online shopping and demographics who previously didn’t shop online are finding themselves doing so by necessity, there is a massive opportunity for retailers to retain these customers post-pandemic by providing excellent shopping experience and winning over possibly previously sceptical shoppers.

Source: https://content-na1.emarketer.com/media-buyers-get-more-pessimistic-about-future-spending

CUSTOMER BEHAVIOUR

Will COVID-19 change customer behaviour forever? While behaviour has certainly changed in the short term as outlined previously, there will come a time in the future when the world will hopefully return to “normal” – whatever that new normal will be. Will the lessons that shoppers learned during the pandemic – to do more with less, to pause purchasing on non- essential items, and in fact possibly learn to live without non-essentials – stick, or will shoppers revert to “revenge shopping” where shoppers splurge on purchases as has been seen in China? Will shoppers continue to shop online, or rush back to stores once restrictions are lifted?

It’s already been seen that clothing – which had taken a hard dip in the early days of the pandemic – is having an uplift as of the first week of April, while sales of health and beauty, electricals and garden equipment rose rapidly in the latter end of March. However, it remains to be seen whether these are sustainable figures as electronics, as one example, don’t need to be replaced regularly, and so the sector may see the numbers flatten or drop again shortly.

For ecommerce retailers, the move to online by shoppers who previously wouldn’t have used online shopping at all or very much, such as an older demographic who wouldn’t have traditionally shopped online, is a positive one, and one that they can try to take advantage of and nurture moving forward. Strategy and insight director, IMRG, Andy Mulcahy, says he expects to see very concentrated growth in ecommerce: “As the stores are shut, the demand will almost certainly have to shift online. As people get used to this new reality, you might expect their shopping habits to extend past focusing so heavily on grocery and essentials, although we have to consider the economic environment.”14

While obviously nothing can really be predicted with any certainty at this stage, retailers can certainly take advantage of the learnings of this time if they have been collecting and analysing shopper data and apply it their business plans to capitalise on the changes to consumer behaviour that benefit them.

FINAL THOUGHTS

“If you wait for the mango fruits to fall, you’d be wasting your time while others are learning how to climb the tree”

Michael Bassey Johnson

There is no doubt that the world of retail will face a new paradigm once the current phase of the COVID pandemic has ceased. Those that embrace the new world will thrive, leveraging emerging behaviors, technologies, perceptions, demand and even regulations.

By recognizing the opportunity to gain efficiencies in supply chains and channels, adopt innovative technologies, and foster long-lasting direct relationships with consumers, some brands will come to the fore, and claim their position as the new leaders – while others that prefer to cling on to old practices are unlikely to flourish. Those that use the pandemic as a learning experience, and a chance to improve their value proposition to consumers across channels and geographies will emerge with even better offerings that create more value than previously imaginable – a truly world changing opportunity lies in front of those that are brave enough to act and take the steps to lead that digital retail revolution.

“Through each crisis in my life, with acceptance and hope, in a single defining moment, I finally gained the courage to do things differently.”

Sharon E. Rainey

SOURCES

- https://imrg.org/webinar-coronavirus-weekly-online-sales-update-9th-april/

- forbes.com/sites/gregpetro/2020/03/13/coronavirus-and-shopping-behavior-men-and-women-react- differently/#5a967164737a

- https://www.agilitypr.com/pr-news/public-relations/coronavirus-crisis-consumer-impact-new-data-on-purchase- decisions-and-behaviors/

- https://coresight.com/research/coronavirus-insights-learnings-from-nikes-and-lululemons-china-experiences/

- https://www.retaildive.com/news/pvh-may-pack-and-hold-inventory-until-next-spring/575446/

- https://coresight.com/research/gap-cancels-shipments-of-summer-orders-and-stops-fall-production/

- https://www.ft.com/content/e9c2bae4-6909-11ea-800d-da70cff6e4d3

- https://www.businessoffashion.com/articles/professional/how-5-very-different-brands-are-managing-e-commerce- right-now

- https://www.mckinsey.com/industries/retail/our-insights/a-perspective-for-the-luxury-goods-industry-during-and- after-coronavirus

- https://content-na1.emarketer.com/how-covid-19-is-fast-tracking-emerging-tech?ecid=NL1009

- https://www.gartner.com/en/documents/3975823

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-COVID-19-managing-supply- chain-risk-and-disruption.pdf

- https://www.bigcommerce.com/blog/covid-19-ecommerce/#product-categories-shifting-during-covid-19

- https://www.essentialretail.com/features/covid19-coronavirus-change/

- https://wwd.com/business-news/media/coronavirus-business-impact-advertising-media-recession-1203559395/

- https://www.voguebusiness.com/companies/coronavirus-luxury-brands-impact-sales-altagamma

- https://www.retaildive.com/news/covid-19-wreaks-havoc-on-inventories/575795/

- https://www.supplychaindive.com/news/coronavirus-pwc-supplier-scrutiny/575936/

- https://content-na1.emarketer.com/how-ecommerce-is-transforming-fedex-s-logistics-and-last-mile- delivery?ecid=NL1014

- https://divante.com/blog/what-ecommerce-managers-and-directors-should-know-in-the-time-of-coronavirus/

- https://www.bain.com/insights/luxury-after-coronavirus/

- https://www.statista.com/statistics/1102889/covid-19-forecasted-global-real-gdp-growth/

- https://aib.ie/content/dam/aib/fxcentre/docs/special-reports/Irish%20Economy%20Update%20-%20April%20 2020.pdf?_lrsc=18dfe85c-95c1-44a6-994d-a244b0e627e2&utm_source=Elevate&utm_medium=social&utm_ campaign=linkedin