The Changing State of Luxury

The pandemic crisis has dealt the luxury sector a crushing blow.

Experiential luxury is facing a decrease of between 40 to 60%, whereas the personal luxury segment is predicted to drop between 25 to 45% compared to 2019.

The crisis impacted even financially solid true luxury consumers.

While digital is a channel that many luxury houses have been slow to embrace, store closures and health and safety measures around reopening have impacted the luxury trade. The hard luxury vertical has been especially affected, as the store experience is a long-held ritual of jewelry and timepiece shopping. These uncharted waters and uncertain times call for a delicate balance between agile pragmatism and bold decisions. To have a strong position in the future, luxury brands will require strategic clarity, a deeper understanding of how consumers are shopping, laser-focus on where to invest and when, and a broader transformation that incorporates technology, people, and purpose.

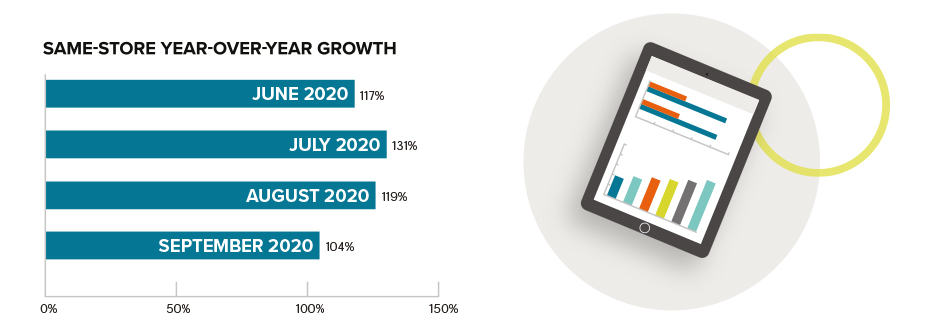

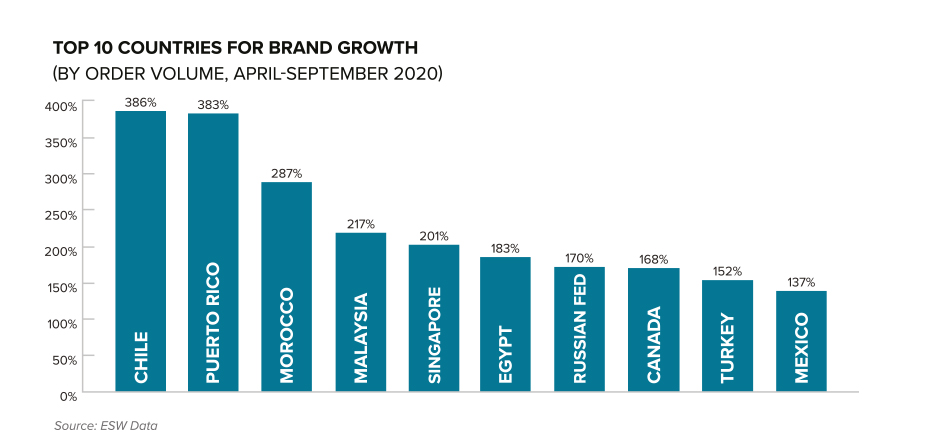

Cross-Border Explosion

International online sales of luxury goods increased by 170% year-on-year (YOY) in August and September 2020.

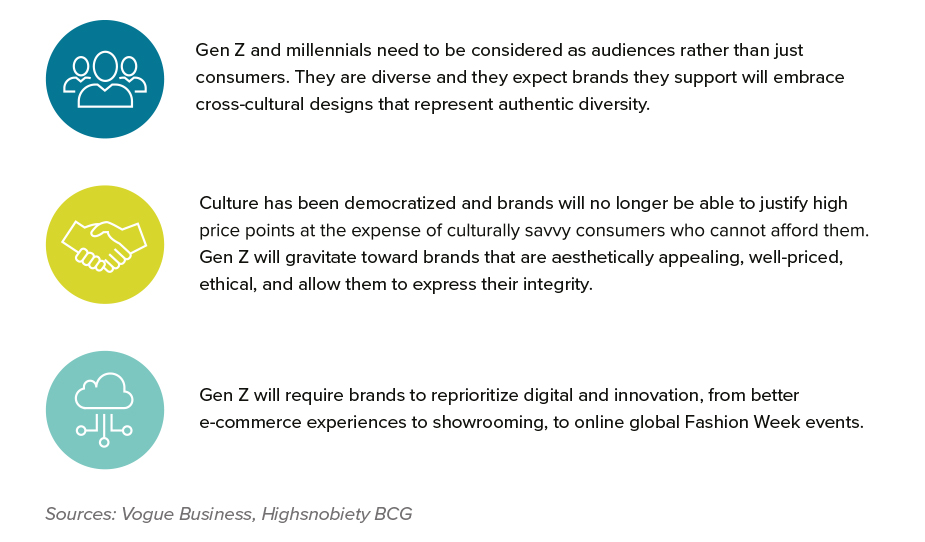

Spotlight: How Gen Z Will Shape Luxury

Gen Z currently accounts for 30% of luxury spending, and by 2030, they will likely dethrone millennials as the most important luxury consumers.

LIFE IN DIGITAL

Gen Zers grew up as digital natives. They are the first generation to experience a lifestyle that is about social currency, social scores, and social recognition. This creates pressure and the desire to “escape,” which ties in well with much of luxury’s appeal.

EXPERIENCE AS DIFFERENTIATOR

Authentic, branded experiences are more important than anything else. Gen Z expects quality, but they’re also fickle and expect that something better will be along soon, especially where technology is concerned. Experiences will be a competitive advantage for luxury brands.

LUXURY BRANDS NEED TO BE AWARE THAT:

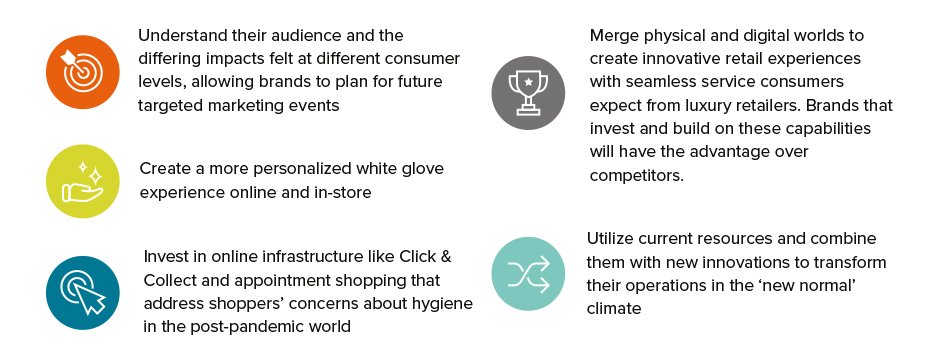

How Luxury Can Win: Unified Commerce and Omnichannel

Retail will no longer be about focusing on single channels such as physical retail, e-commerce or pop-up stores. Instead, the industry will likely shift towards adopting more holistic strategies that acknowledge consumer interactions across entire retail ecosystems: Unified Commerce is where all consumer touchpoints hold equal weight in creating bigger and better commerce.

In essence, the brand’s website will be the flagship store. The challenge is to ensure consumers are getting the same level of luxury service they have come to experience in brick-and-mortars.

AN OMNICHANNEL APPROACH ALLOWS BRANDS TO:

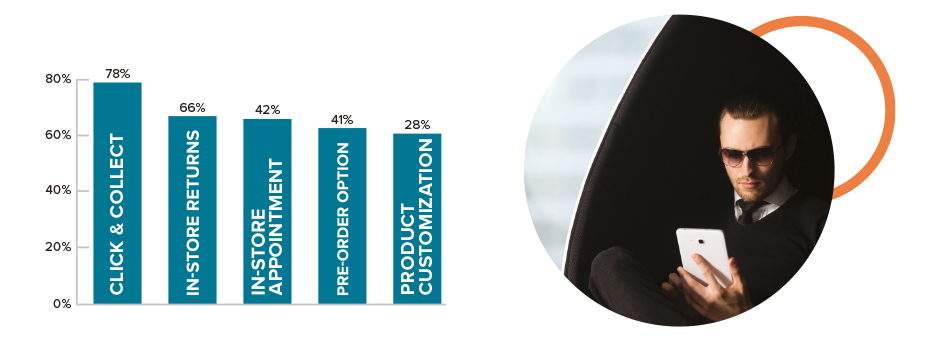

PROPORTION OF LUXURY BRANDS WITH FEATURE ADVERTISED

Luxury brands that have invested in online infrastructure like Click & Collect and appointment shopping may be well placed to retool or build out these features to address shoppers’ concerns about hygiene:

INVESTMENT IN YOUR GLOBAL D2C MODEL IS MORE CRITICAL THAN EVER

What Do Luxury Brands Do Now?

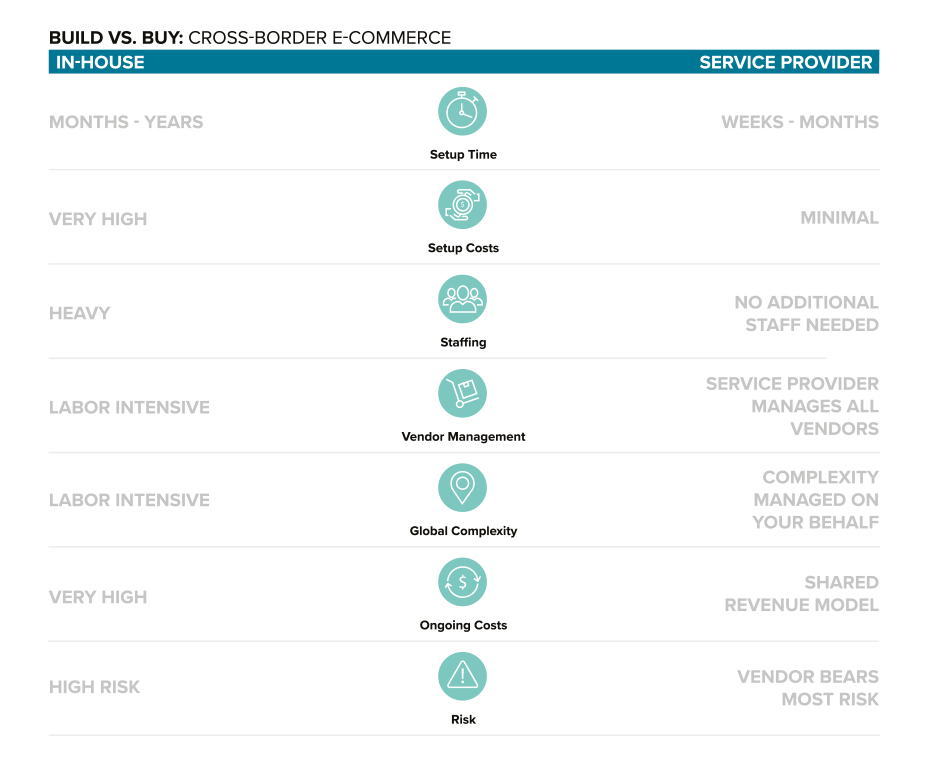

So now you’ve decided to expand your global footprint – do you do it in-house or engage a vendor?

How We Do It

ESW is the leading cross-border technology and services partner chosen by the world’s best-loved apparel, beauty, footwear, and luxury brands to power their international expansion.

Want to talk about global expansion? Contact us at growmybrand@eshopworld.com or visit eshopworld.com.