BEAUTY ACROSS BORDERS

As the world adapts to ongoing unpredictability, there is widespread consensus that many consumers will continue to shop online. By 2023, ecommerce is expected to account for 48% of beauty sales in the United States.1

Consumer confidence in online commerce is growing and as travel restrictions remain, the number of shoppers looking outside their country for the right products will continue to accelerate.

According to ESW’s recent global shopper survey, the number of consumers buying beauty products from outside their domestic market increased across all age groups between December 2020 and July 2021. The skincare and fragrance categories increased by as much as 4%.

For beauty brands looking to capitalize on these trends, expanding into new regions is not always smooth sailing. There are a number of complexities that are unique to the beauty industry, and they can vary greatly between regions. Staying on top of these nuances and establishing processes to overcome logistical hurdles can be a time-consuming and expensive investment for brands and retailers. Working with an experienced DTC partner is the most efficient way to tap into the lucrative opportunities that await.

20% of Millennials and Gen Z are purchasing cosmetics, fragrance and skin care products from outside their own country.2

GLOBAL DTC COMPLEXITIES

Not knowing or having working solutions to global complexities poses risks at every stage of the shopper journey. Even if a customer converts, goods may be delayed at customs, damaged in transit or by the inspection team, or may never be delivered to the consumer. This risks reputational damage, poor shopper satisfaction, and loss of repeat purchase.

To ensure a seamless shopping experience, beauty brands and retailers must navigate each of these potential roadblocks and make sure they’re in compliance with the rules of each market they’re selling into.

DTC BEST PRACTICES

STAGE: BROWSING

When browsing beauty products online, shoppers expect to see products that are relevant to them and that are guaranteed to be available when they go to checkout. When setting up an online catalogue, it’s important for retailers to know what products they can and cannot make available to shoppers in each country they sell into.

KEY CONSIDERATIONS

- With potential customs delays common, consider the expiration dates of each product. Make sure it can get through customs without spoiling.

- Skin creams, sunscreens, and foundation shades are all closely tied with the demographic of the region and should influence what products are front and center of the online store in each country.

- Regulations and import restrictions around dangerous goods can vary greatly per region. Brands and retailers should know the alcohol and animal content of their products and adjust what is made available accordingly.

DANGEROUS GOODS

The shipping of dangerous goods is one of the main concerns when it comes to selling beauty and cosmetics products across borders. Even items that may not typically be considered dangerous could be banned or have import restrictions in certain countries.

Successfully navigating the challenges of dangerous goods means being aware of all country restrictions and adjusting selling practices to ensure compliance. Cosmetics may contain:

- Alcohol e.g. perfumes

- Other flammable liquids

- Heavy metals e.g. lead

- Dyes

- Aerosols e.g. hairspray

- Pressurized foams, sprays and creams

- Toxic chemicals

- Animal products e.g. fish or beef tallow

As well as the ingredients within a product, a country or carrier may enforce restrictions on quantity or volume. A common example is perfumes that can be shipped easily when below 100ml but will likely face delays or rejection at customs for anything larger.

STAGE: CHECKOUT

Ensuring conversion at checkout is about providing a quick and seamless experience for the consumer. Shoppers should be presented with options they are familiar with and not face surprise charges or changes to their basket. Having an efficient process for the below reduces the risk of cart abandonment.

PAYMENT OPTIONS

- Both Buy Now, Pay Later and express payment methods are continuing to grow in popularity, particularly with Millennials and Gen X shoppers.3

- These should be localized to each market.

DUTIES & TAX CALCULATION

- Some countries have high duties and taxes; you’ll want to take this into account when pricing products for each market.

- Present duties and tax upfront in an all-inclusive price at checkout for a smoother customs process and a better shopping experience.

ID COLLECTION

- In countries that require ID collection for delivery (e.g. Russia), it is best practice to collect ID at checkout so goods aren’t delayed on import.

QUANTITY LIMITS

- Make sure you’re enforcing this at the time of checkout rather than when goods are in motion.

STAGE: SHIPPING

When shipping beauty and cosmetics internationally, there are a number of best practices that ensure smooth and efficient delivery of products to the customer.

One of the main hurdles that can be complicated for retailers to manage is the fact that country-specific forms must be completed to declare the contents of each import. Possible declarations include:

- Any lead content being shipped into Australia.

- Shipping into South Korea requires a certificate of non-BSE (Bovine spongiform encephalopathy) for any animal products to prove there was no chance of contamination with Mad Cow Disease.

- Malaysia is one of several countries that require sellers to work with a Cosmetics Notification Holder, or an agent or registered person who is designated to receive shipments containing cosmetics.

STAGE: RETURNS

Today’s consumers are ever more demanding when it comes to the ability to return their purchases. In the beauty world, returns are more complicated due to health and safety concerns but should be managed by the following two practices:

CONSIDER IT DONE WITH ESW

Navigating global complexities can be cumbersome for brands and retailers, but it is essential to fully capitalize on the DTC opportunity. ESW powers DTC commerce for the world’s best beauty brands, ensuring an optimized experience at every stage of the shopper journey, in every market.

ESW handles everything from customer acquisition to checkout, to logistics and delivery, customer service, and returns. For beauty brands, this means:

- Customers see products and promotions relevant to their region.

- Checkout is localized to each market.

- All appropriate customs declaration forms are complete, guaranteeing compliance and successful delivery to the customer.

- Brands are kept aware of any regulatory changes that would affect tax rate/payments.

- Any returned dangerous goods are destroyed in-country and ESW will certify that on behalf of the retailer, helping to navigate local restrictions.

With ESW, accessing new markets and growing globally is as frictionless as possible. Rather than investing time and resources into learning regulations for each country, building workarounds and risking customer satisfaction, brands can focus on delivering the best possible experience in all markets.

BEAUTY TRENDS IMPACTING ECOMMERCE

1. OMNICHANNEL

Consumer behavior trends that accelerated as a result of COVID are becoming an increasingly integral part of the ecommerce landscape.

Seventy-one percent of shoppers in ESW’s recent survey said that, post-pandemic, they would continue to purchase via a mix of digital and physical channels.4 This highlights the importance of omnichannel capabilities in retailers’ international commerce strategies as many countries begin to ease COVID-19 restrictions.

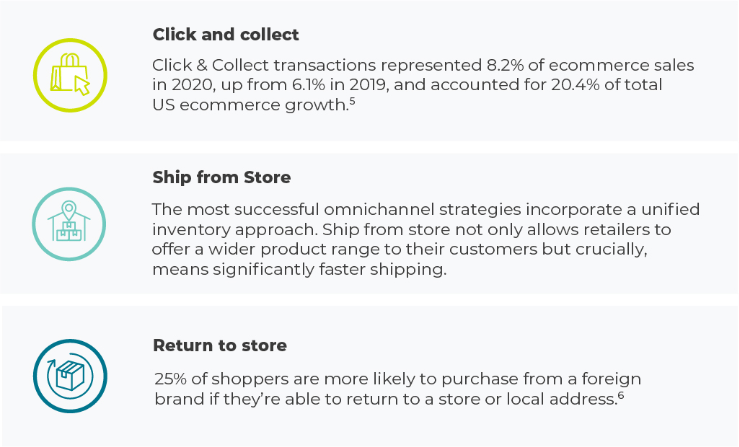

Shoppers have come to expect these three essential omnichannel capabilities:

2. AUGMENTED REALITY

Augmented Reality (AR) is fast becoming a critical sales tool in the beauty industry, leading to increased conversion rates and reduced returns.

ESW clients have seen significant success using AR to allow their customers to test their products before purchasing.

Enabling at home try-on technologies such as foundation testing is beneficial for both the shopper and the brand. It offers the chance for retailers to engage the customer even in markets where they don’t have an on-the-ground footprint. The data collected by such technologies can also help brands with remarketing strategies and inventory anagement.

Cosmetics leaders utilizing technologies such as ModiFace have seen conversion rates double since implementation.7

3. SOCIAL COMMERCE

Around 87% of ecommerce consumers said that social media plays an important role in helping them make a shopping decision.8 According to ESW’s July 2021 survey, 47% of shoppers made a purchase via a social media channel, with Gen Z (55%) and Millennials leading the way.

Social media not only enables brands to target and engage consumers online, but also allows customers to make a purchase without leaving the platform.

These trends are particularly prevalent in the beauty industry; as shoppers are unable to consult with retail or beauty specialists face-to-face, they are seeking expertise from brands, influencers and their fellow consumers.

Beauty products currently make up the second-largest product category for engagement across Instagram, Twitter and Facebook.9

4. DIRECT-TO-CONSUMER

As it stands, more than half of US internet users have purchased from DTC personal care and beauty brands in the past. Almost 54% said they will likely try new products from DTC’s in the beauty industry going forward.10

However, online vs. offline beauty shopping is spurred by different motivations. The beauty buyers who valued quality most were far more likely to shop directly at a beauty brand site (64%), while big-box stores won shoppers on price (28%).11

Brands who capitalize on the DTC trend will have greater flexibility, visibility and drive higher customer lifetime values.

Sources:

- Statista

- ESW Global Voices Pre-Peak Pulse Survey

- Statista

- ESW Global Voices Pre-Peak Pulse Survey

- eMarketer

- ESW Global Voices Survey

- Business of Fashion

- Social Media Today

- Common Thread Collective

- eMarketer

- eMarketer