India – The Next Ecommerce Opportunity for Cross-Border Brands

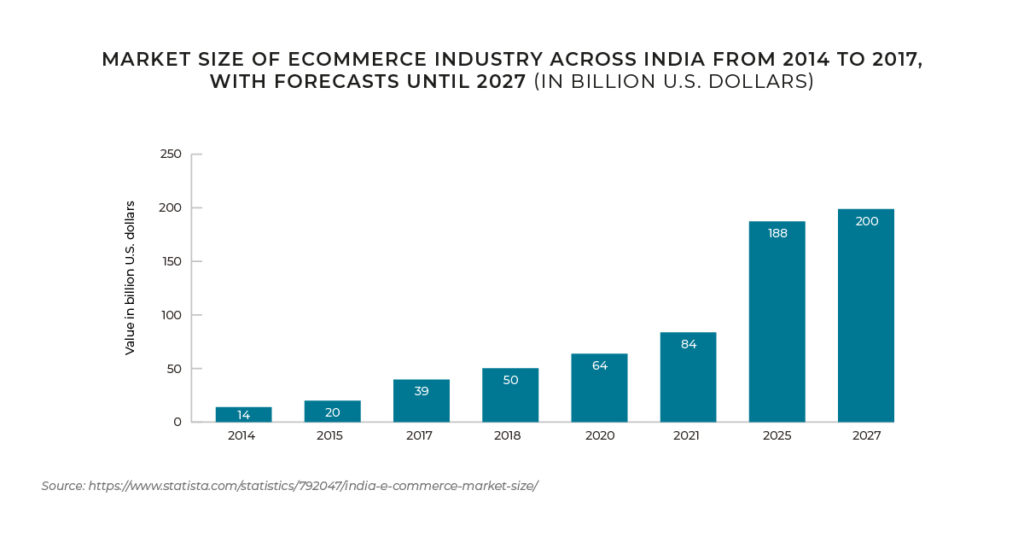

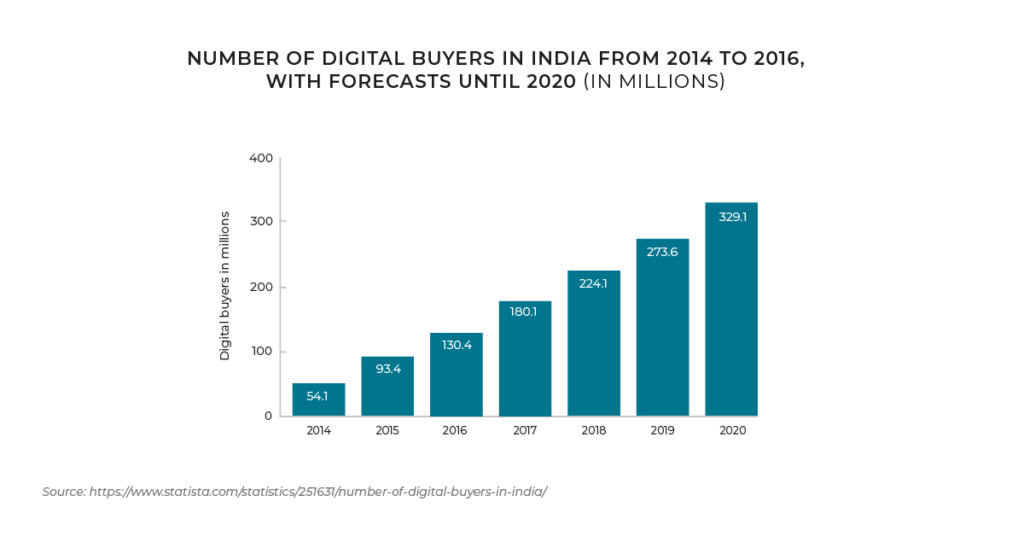

Ecommerce in India is a huge opportunity, expected to grow to US$200 billion by 2027. With the second-largest global population and increasing internet and smartphone penetration, there is great opportunity for cross-border ecommerce brands interested in expanding into the market. India ranks 44th in ecommerce penetration with 48% of the Indian population shopping online.

The average retail ecommerce revenue per user in India increased from US$48.3 in 2017 to US$73.81 in 2020 and is set to continue increasing to US$76.4 in 2024 as ecommerce becomes increasingly accessible to a wider population. The number of ecommerce users is expected to grow by 41% to 920 million users in India by 2023.

Cross-border ecommerce brands wishing to enter the market will face some challenges such as language translation, logistics and infrastructure, and localization for such a large and diverse nation. This guide to ecommerce in India aims to help brands gain insight into a complex market, and prepare them for success.

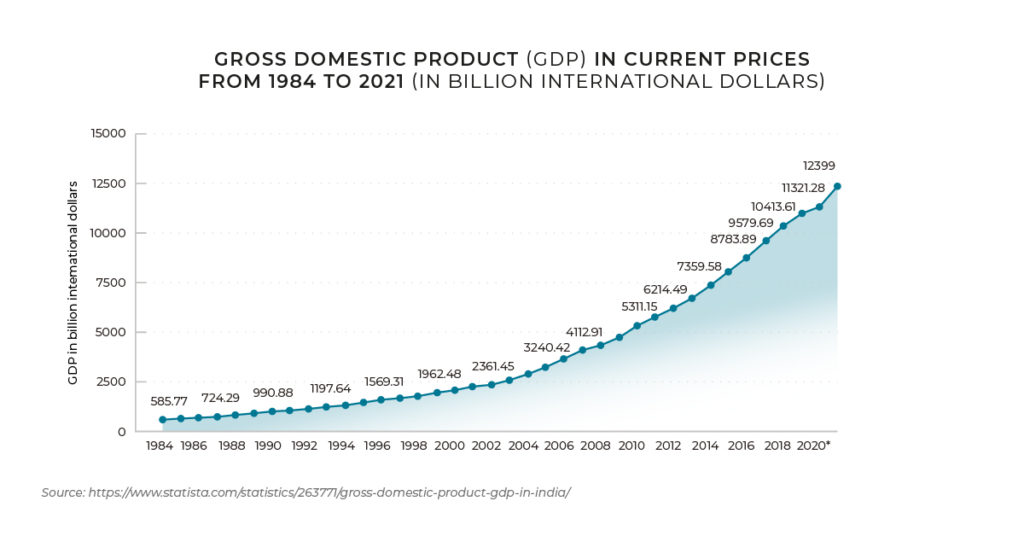

India’s Swift-Growing Economy

GROSS DOMESTIC PRODUCT (GDP) IN CURRENT PRICES FROM 1984 TO 2021 (IN BILLION INTERNATIONAL DOLLARS)

INDIA IS THE SEVENTH LARGEST COUNTRY IN THE WORLD, WITH THE SECOND-LARGEST POPULATION – CURRENTLY 1.3 BILLION AND GROWING.

The country is classed as ‘lower middle income’ and has a population growth of 1.1%, which is below the regional average.2 65% of the country live in rural areas, although there are more than 50 areas in India with a population of more than one million3. The country’s GDP (11.04 trillion US dollars in 20195) is the fifth largest in the world6 and is predicted to increase 7.6% pa from 2018 to 20232. Ecommerce is growing strongly and is expected to reach US$200 billion by 20254.

In 2018, almost half of India’s GDP was generated by the services sector which has been steadily increasing over the previous ten years. Services include IT, telecommunications, and software. IT accounted for 7.7% in 20206.

INTERNET ACCESS

With over 450 million internet users, and 59% of the country’s population expected to have internet access by 2021 through 2 billion connected devices, the country is anticipated to witness a dramatic digital transformation in the coming years.8

ECOMMERCE OPPORTUNITIES IN INDIA

The ecommerce market in India is strong and growing stronger with predictions that it will be worth approximately US$200 billion by 2027 – it currently stands at US$64 billion. Part of this increase has to do with strong government initiatives alongside reduced smartphone and data plan prices that make the internet more accessible to a wider population. Consumer behaviour has also evolved, with convenience driving increased levels of online shopping.7

MARKET SIZE OF ECOMMERCE INDUSTRY ACROSS INDIA FROM 2014 TO 2017, WITH FORECASTS UNTIL 2027 (IN BILLION U.S. DOLLARS)

With approximately 100 million online shoppers and over 450 million internet users7, there is a lot of scope for ecommerce retailers. Internet penetration is currently at 50%, which points to potential for more shoppers to come online in the future – making India a very attractive market to build an ecommerce presence in.

Electronic and Media are the strongest categories in India, followed by Fashion, Food, and Personal Care.2

“Ecommerce businesses now need to prepare for flexible ecosystems to let users move from entertainment to infotainment, eventually leading to online transactions. Further, several retailers are able to leverage traditional products and services with technology to make it appealing and convenient for consumers.”

ECommerce Retail Logistics In India, KPMG

Cross-border sales key to India’s ecommerce growth. Cross-border spending makes up the majority (74%) of total ecommerce sales in India with 37% of online shoppers purchasing cross-border in 20199.

GOVERNMENTAL-DIRECTED MOVE AWAY FROM CASH TO DIGITAL PAYMENTS

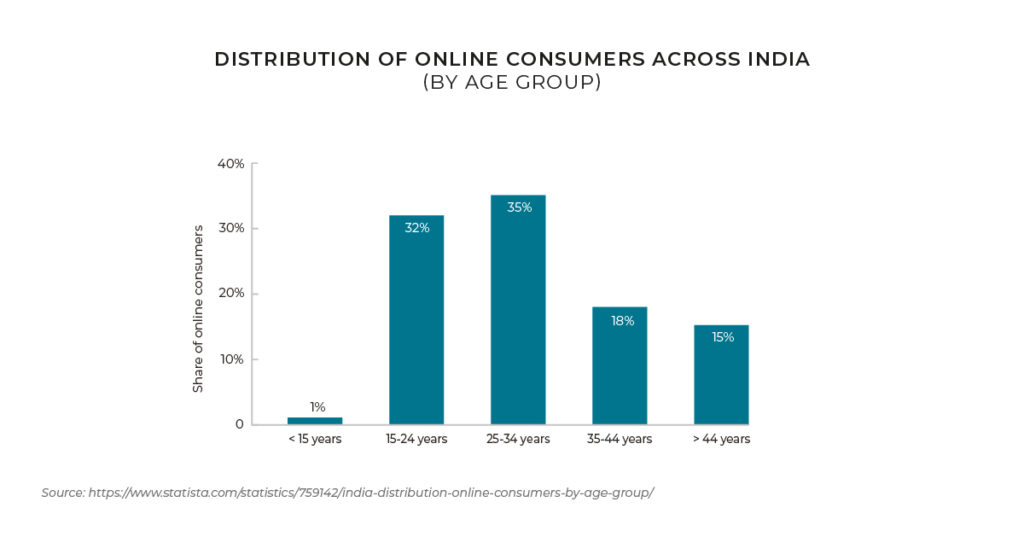

India has an advanced digital retail payments infrastructure contributing to the fast growth of digital retail payments. Younger consumers are also pushing digital retail payment methods forward with 68% under the age of 25 using Paytm for retail payments. Older generations still prefer to use cash on delivery and hesitate to pay digitally when shopping online.9

CROSS-BORDER E-COMMERCE BRANDS PLANNING TO SELL INTO INDIA, SHOULD FACILITATE BOTH YOUNGER GENERATIONS WITH AN EXCELLENT M-COMMERCE EXPERIENCE, AS WELL AS ACCOMMODATING ALTERNATIVE PAYMENT METHODS SUCH AS CASH ON DELIVERY TO ALSO CAPTURE THE OLDER GENERATION.

CORONAVIRUS EFFECT ON INDIAN ECOMMERCE

As with every other nation, COVID-19 has impacted India significantly, and prompted

a strong push toward ecommerce. With hygiene and safety a concern, as well as lockdowns impacting access to stores, many shoppers are moving toward buying online. Although ecommerce in the country took a hit initially, it has exceeded (as of June 2020) pre-COVID levels to reach US$36.5 billion11, an increase of approximately 20%.

INDIAN LANGUAGE INTERNET USERS

English is the primary language used on digital platforms in India, however there is a growing base of Indian language (which comprises a number of Indian languages such as Hindu, Urdu, Gujarti etc) users which has surpassed English language internet users at 234 million to 175 million as of 2016.8 This is predicted to rise to 199 million English language users and 536 million Indian language users by 2021.

M-COMMERCE

Mobile commerce (M-commerce) or buying on mobile devices, tablets or smartphones is becoming increasingly popular in India and touted to be a ‘game changer’7 for ecommerce.

CONSUMERS ARE BECOMING MORE COMFORTABLE PURCHASING SERVICES AND PRODUCTS THROUGH MOBILE APPS, MAKING M-COMMERCE A SIGNIFICANT OPPORTUNITY FOR RETAILERS AND BRANDS TO EXPLORE.

Demographics

AGE BREAKDOWN

India’s population growth rate is approximately in line with global averages with the largest age group between 15-64 years at 66.77% in 2018 and a median age of 28.4 years in 2020. The median age is expected to increase to 38.1 by 2050, showing a slowly aging population.

Shopper Behaviour

City size can affect shopper behaviour12 with 51% of shoppers in major metropolitan areas using purely online shopping channels, compared to only 20% in smaller cites (between 0.1 million and 1 million). The main drivers of online shopping are home delivery and cheaper prices.

ACCORDING TO A 2017 STUDY, 70% OF RESPONDENTS12 ARE STRONGLY INFLUENCED BY IDEAS AND INFORMATION THEY’VE ‘GLEANED THROUGH DIGITAL CHANNELS PRIOR TO PURCHASE’.

For some products and services, Indian shoppers research online and buy offline and vice versa, however only 5% of purchases are driven by an omnichannel strategy. Shopping behaviour changes depending on category and even subcategory.

IN THE APPAREL CATEGORY 32% OF SHOPPERS12 ARE WILLING TO BUY ACCESSORIES ONLINE SIGHT UNSEEN, BUT ONLY 22% WILL USE THE INTERNET TO BUY SHOES. THE OTHER 78% STILL GO TO A STORE TO SEE THE NEW STYLES AND TRY THEM ON.

Also in apparel, impulse buying is more prominent with more than half of online fashion purchases unplanned. Shoppers often browse for deals during their free time on their devices.

Social and digital media has changed the way Indian consumers shop, with Indian shoppers tending to research their purchases online initially. 39% of buyers use both online and offline research channels, and 42% visit a physical store prior to purchase, while 69% of shoppers start their purchase journey online, and more than half (51%) refer to product review and price comparison sites13.

Marketing to the Indian Shopper

With one of the fastest-growing younger population in the world, plus a push towards a cashless society ecommerce is a fast-growing sector of the market. Marketing to the Indian online shopper must take into account the generational differences in shopping behavior, and tailor the experience to the demographic that is pushing its growth.

THERE ARE A NUMBER OF WAYS TO MARKET TO THE INDIAN ONLINE SHOPPER, INCLUDING PERSONALIZATION, MAKING IT CONVENIENT TO SHOP ONLINE, AND EXCELLING AT CUSTOMER EXPERIENCE.

PERSONALIZATION

As online shopping becomes more prolific, personalization will be a key driver for shoppers and brand loyalty. Learning their shopping patterns and being able to make recommendations based on preferences will increase brand satisfaction and conversions.

CONVENIENCE

Convenience is a driver of online shopping and can influence whether shoppers purchase from a brand or not. Factors like short delivery, delivery slot options, flexible payment methods, choice of delivery and return methods, live assistance and swift query resolution can all create a seamless shopper experience that will encourage conversions.

CUSTOMER EXPERIENCE IS KEY TO RETAINING THE INDIAN SHOPPER

According to a recent report by Forrester, ‘The India Customer Experience Index, 2020 How Brands Build Loyalty With The Quality Of Their Experience’ providing excellent customer experience to the Indian consumer is a key differentiator for brands that are succeeding in India. Brands that were already consistent in this pre COVID-19, found that this ‘buys brands forgiveness for any missteps in handling the COVID-19 crisis.’

WHILE COVID-19 INITIALLY CAUSED CONSUMER SPENDING AND CONFIDENCE TO DROP SIGNIFICANTLY, BRANDS THAT OFFER BETTER EXPERIENCES WILL BENEFIT FROM CUSTOMER LOYALTY AND PENT-UP DEMAND.

Some ways cross-border ecommerce brands can increase customer experience for their shoppers include localizing the experience across all touchpoints, ensuring clear and consistent communications especially regarding delays or unexpected events such as the pandemic, and creating as frictionless an experience as possible throughout every step of the journey.

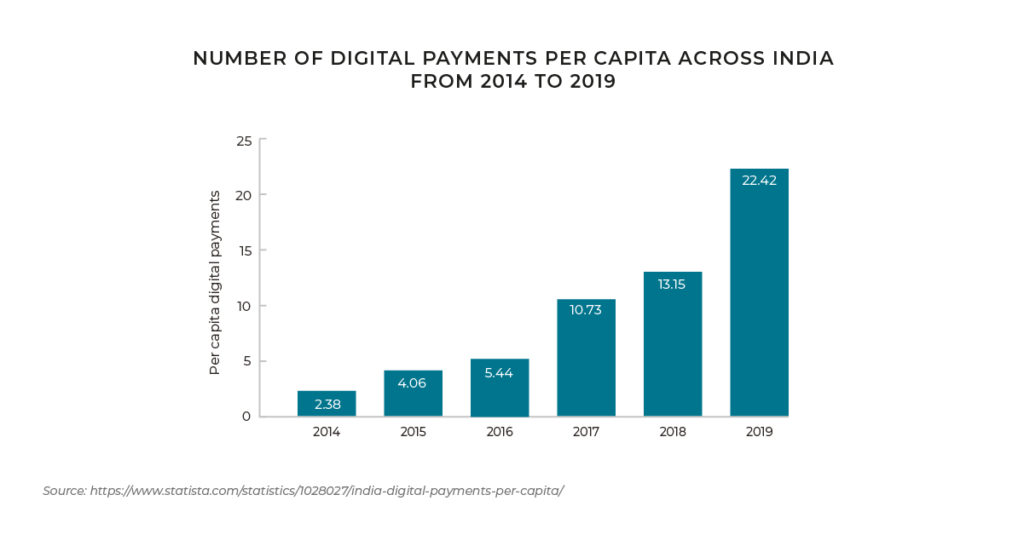

Digital Payment Revolution

IN INDIA, DIGITAL WALLETS ARE BECOMING INCREASINGLY POPULAR, WITH USAGE GROWING ALMOST TEN-FOLD FROM 2014 TO 2019.

In response, companies are making significant investment in digital payment offerings to capture this demand. According to a recent KPMG report14, more than 75% of Indian language internet users prefer mobile wallets such as eWallet and UPI15.

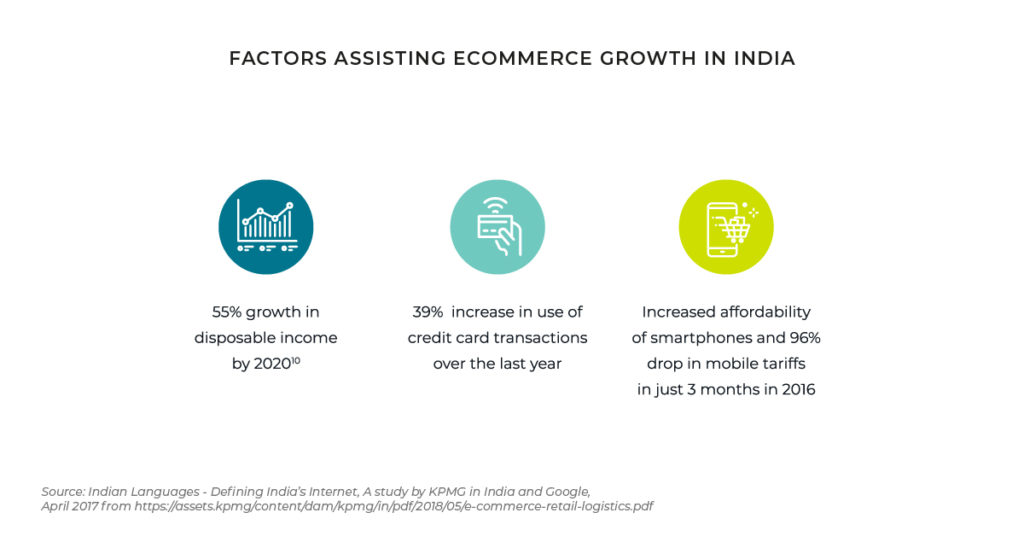

The Indian government has pushed digital initiatives which are expected to accelerate the reach and adoption of digital wallets. Further considerations fuelling the move toward digital wallets are an increase in disposable income (by 55%), increased use of credit cards (39%) due to a government-directed move away

from cash, and mobile tariffs dropping 96% for 530 million Indians, making online commerce more accessible.

Online bank transfers in India for ESW clients account for 27% of transactions with a payment success rate in excess of 90%. The most popular online payment methods16 in India are credit card (32%), e-wallet (26%) and bank transfer (18%), with cash on delivery at 17%.

DOMESTIC ACQUIRING

For ecommerce brands intending on selling into the market, working with a domestic acquirer can increase acceptance rates and help reduce fraud flags for customers leading to a better shopper experience.

SINCE ESW IMPLEMENTED DOMESTIC ACQUIRING, PAYMENT SUCCESS RATES HAVE INCREASED BY 11%17.

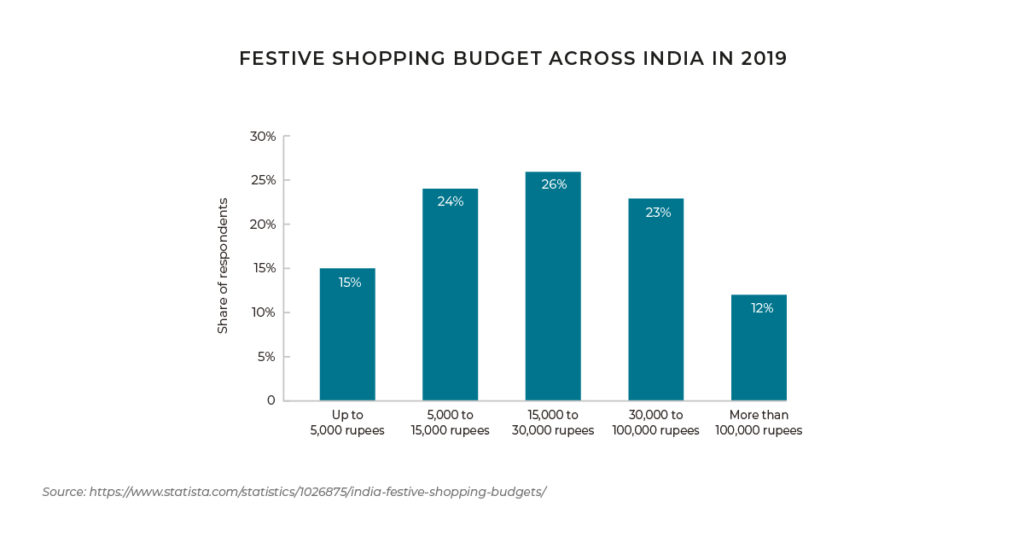

Major Indian Holidays to Plan Ecommerce Promotions

In India there are five major festivals that impact ecommerce sales:

- Diwali – Festival of Lights.

- Navratri – a Hindu festival that spans nine nights (and ten days).

- Durga Puja – the annual celebration of Hindu goddess Durga, is one of India’s grandest festivals.

- Dusshera – a holiday marking the triumph of Rama.

- Christmas.

Diwali, or the Festival of Lights, falls in October or November each year and the month before is the country’s busiest shopping period with spend in 2020 reaching US$9.7 billion, up from US$3 billion in 2018.

Other days that are popular18 in India include Valentine’s Day, Eid, Republic Day (26th January) and Independence Day (15th August). Black Friday and Cyber Monday are also gaining traction in the nation with Indian consumers anticipated to spend US$70 each on the day19.

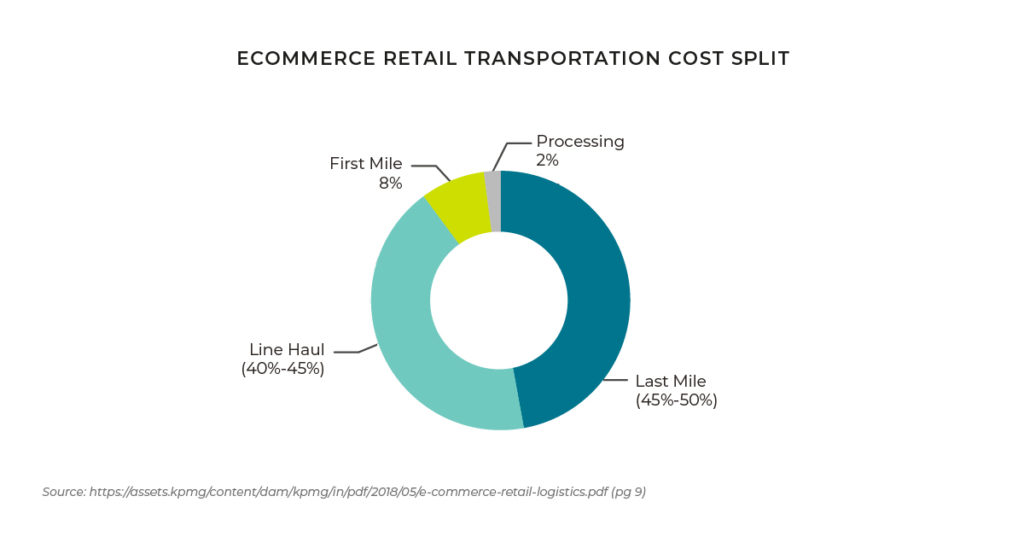

Mastering the Complicated Supply Chain and Logistics Landscape

With the growth in ecommerce in India comes the requisite logistics challenges.

As demand rises for same-day delivery, other factors such as high costs pressures, high return rates and inadequate physical infrastructures are all impacting logistics in India.14

ASSISTED ECOMMERCE MODELS

Due to low internet penetration, poor logistics and delivery infrastructure as well

as a lack of regional language support in some areas of the country there has

been a slower uptake in ecommerce in some regions. To mitigate this, a solution has evolved where the retailer at local stores uses internet-abled devices to order products for the shopper, which are then delivered to the retailer which plays a dual role of cash collection and pick up point for the end customer.<sup>14</sup>

RETURNS

In India, there is a high rate of returns – at approximately 20% of total shipments – generally falling under these three types: Customer-initiated returns, a return due to order cancellation before first delivery attempt, or delivery failure of a 3PL. Delivery failures are often due to poor address capturing, so cross-border brands selling into India must ensure that their checkout address capture is formatted to an India- specific layout, to decrease the risk of delivery failure by final mile carriers.

RETAILERS WILL NEED TO IMPLEMENT EXCELLENT REVERSE LOGISTICS TO MINIMISE THE COSTS OF RETURNS AS FAR AS POSSIBLE WHILE STILL PROVIDING SUPERIOR SERVICE.

Customer Experience Is the Key to Capturing the Indian Shopper

According to a 2016 EY report20, 80% of CXOs (Chief Experience Officers) believed that the customer experience provided in India was ‘worse’ or ‘far worse’ than the best in the world with complexity/too many touchpoints, lack of overall strategy/ vision, poor organizational structure and insufficient customer data leading the list of factors.

There are a number of ways that cross-border ecommerce brands can improve the Indian customer experience including providing clear terms and conditions around common areas such as delivery and returns, localizing currency, language localization, providing clear FAQs, providing clear channels of communications, removing unnecessary clicks on mobile, and providing as frictionless an experience as possible.

Conclusion

INDIA IS AN EXCITING OPPORTUNITY FOR CROSS-BORDER ECOMMERCE BRANDS TO ENTER WITH HUGE POTENTIAL FOR GROWTH AND EXPANSION.

As disposable income and internet access increases, the reach of brands with excellent m-commerce and ecommerce offerings will also expand, and brands with insight into the Indian shopper and their preferences will reap the benefit when entering this market.

While there are complicating factors to consider such as language localization, the scope of logistics for a nation of its size, and the sometimes inadequate physical infrastructure of certain regions, the scope for success in the nation is exceedingly high.

SOURCES

- Ecommerce ARPU in India 2024; Statista

- https://www.statista.com/study/48366/india/

- https://santandertrade.com/en/portal/analyse-markets/india/reaching-the-consumers

- https://www.statista.com/statistics/792047/india-e-commerce-market-size/

- https://www.statista.com/statistics/263771/gross-domestic-product-gdp-in-india/

- https://www.statista.com/statistics/320776/contribution-of-indian-it-industry-to-india-s-gdp/

- https://ecommercedb.com/en/blogPost/2461/top-10-online-stores-india?utm_source=ecommerceDB&utm_campaign=66ceb7252d-All_ecommerceNews043_monthly_EN_PM_ KW24_2020&utm_medium=email&utm_term=0_f632f18f44-66ceb7252d-306941465

- https://assets.kpmg/content/dam/kpmg/in/pdf/2018/05/IndiaTrends2018-Trends-shaping-Digital-India-Internet.pdf

- Forrester: The State Of Digital Retail Payments In Asia Pacific

- Indian Languages – Defining India’s Internet, A study by KPMG in India and Google, April 2017 from https://assets.kpmg/content/dam/kpmg/in/pdf/2018/05/e-commerce-retail-logistics.pdf

- https://www.financialexpress.com/industry/sme/small-town-shoppers-more-inclined-to-shift-to-e-commerce-than-tier-i-cities-says-kpmg-report/2031906/

- https://www.bcg.com/publications/2017/five-surprises-indians-shop-online-offline

- https://brandequity.economictimes.indiatimes.com/news/business-of-brands/how-the-new-indian-consumer-shops-gfk/70353653

- https://assets.kpmg/content/dam/kpmg/in/pdf/2018/05/e-commerce-retail-logistics.pdf

- https://www.businesswire.com/news/home/20191022005786/en/Indian-Consumers-Prefer-Digital-Payments-Over-Cash-this-Festival-Season-Embracing-UPI-and-Digital-Wallets-for-Merchant-Spending

- https://www.statista.com/statistics/1176683/india-payment-methods-online-transactions/

- ESW Data from Noelle

- https://indianonlineseller.com/2016/03/holidays-events-occasions-that-impact-ecommerce-sellers-in-india

- https://www.statista.com/chart/16157/black-friday-spend/

- https://blog.sprinklr.com/indian-companies-improve-customer-experience/