What do cross-border ecommerce brands need to know about Latin American ecommerce?

Latin America is a growing opportunity that has huge potential for cross-border ecommerce brands due to a strong market primed for ecommerce.

Brands will find key insights into seven different Latin American countries, how to market to Latin American shoppers, the growth and opportunities of ecommerce and mcommerce and more ways to successfully sell into this market.

An Overview of the Latin American Market and Ecommerce Opportunities

Latin America comprises more than 20 countries subdivided into four regions, according to their geographical position. This report will focus on seven countries – Mexico, Brazil, Argentina, Chile, Colombia, Peru and Uruguay and the opportunities for cross-border ecommerce brands in those markets.

Latin America accounts for 8.53% of the global population and is home to 643 million people – fewer than Europe, despite a bigger geographical area. The predominant languages are Spanish and Portuguese.

Economically, the various countries this report covers are performing differently – some on the cusp of or in a recession, some impacted by COVID-19 – but all of them have strong ecommerce markets, often growing stronger thanks to the pandemic and its shifting of shoppers to online channels.

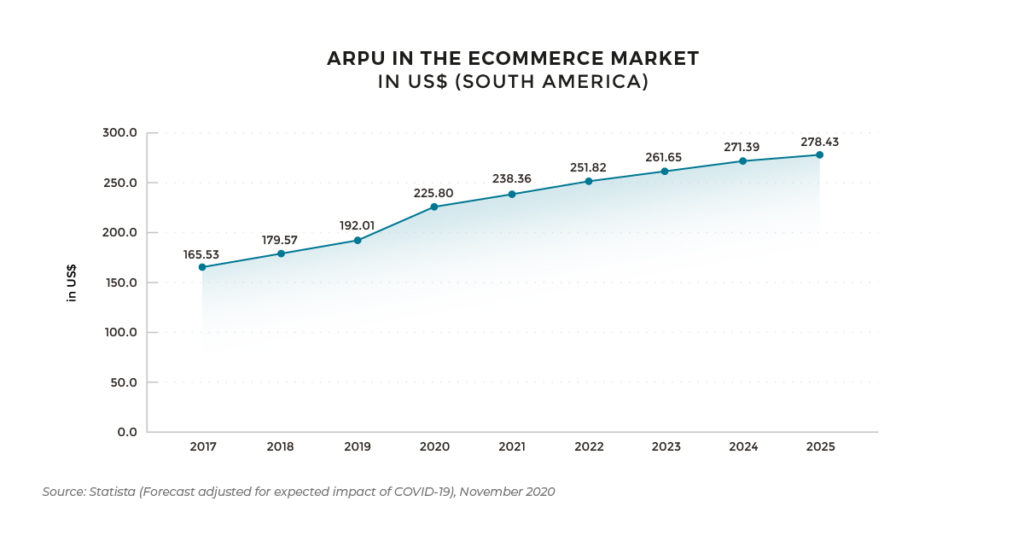

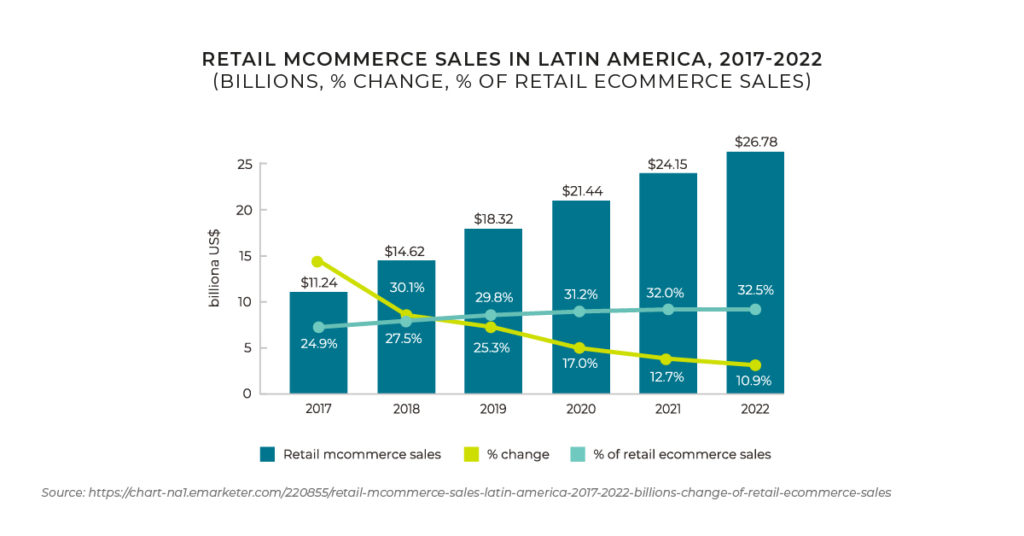

Mcommerce in Latin America is rapidly becoming more popular, with some countries in particular embracing it. Predictions estimate that m-commerce revenue in Brazil, Colombia and Mexico will at least double from 2019 to 2023, and Peru, Chile and Argentina will see at least a tripling of m-commerce revenue in these four years.

While each country is a separate market that should be approached with awareness of its unique population and preferences, cross-border ecommerce brands considering selling into these markets will find a lot of similarities and cross-over that can be applied and replicated across different markets.

Localisation is the most important factor when entering a new market and comprises more than translating a website. From currency to communications, payment methods to post-purchase outreach, checkouts to address capture, there are many facets that must be considered to ensure a successful entry into a new market.

This report will give economic and ecommerce insights into key Latin American markets that are primed for cross-border ecommerce brands to enter.

Mexico

Mexico has the 11th largest economy in the world, with a population of 123 million, and is the 15th largest exporter – mainly of oil –, but its economy has effectively stalled in recent years. COVID-19 also impacted the country, with the projected 2020 GDP forecast decreasing 10.5%, however the country still retains the second-highest GDP in Latin America at US$1258 billion.

Due to uncertain trade relations with the US and Canada in 2019, GDP growth dropped to 0.4%, although Mexico’s strategic location beside the US, growing domestic market, and trade agreements bode well for the country’s economic future.

Ecommerce in Mexico

The ecommerce market in Mexico is strong and growing stronger, with revenue estimated to reach US$21 billion by the end of 2021 at an annual growth rate of 3.8%, and projected market volume to reach US$24 billion by 2024. With internet penetration currently at 64% and expected to reach 70% by 2025 and with 40% of the population aged between 25-54 years old, there is scope for even more growth.

With 50 million ecommerce users currently, expected to increase to 77 million by 2025, it’s clear that online shopping is popular in the country. While cross-border shopping only stands at 5% of shoppers, those who shop domestically and cross-border is at 56% so ecommerce brands who provide a localised experience to the market will be able to capture an already-primed segment of the online shopping population.

The most popular category for online shoppers in Mexico is currently Electronics and Media (US$6.42 billion), then Fashion (US$5.2 billion), and both look set to remain in those positions in 2025 with US$7.1 billion and US$6.4 billion predicted respectively.

Over 80% of Mexican online shoppers are under 44 years old and the gender split is almost equal at 51.4% male to 48.6% female.

Social Media and Mcommerce in Mexico

81 million Mexicans have access to mobile phones, of which 80% are smartphones. M-commerce in Mexico is worth US$2.3 billion (2020) and predicted to increase to US$2.93 by 2022. Younger shoppers are more comfortable shopping on mobile devices so cross-border ecommerce brands should ensure their m-commerce offerings in Mexico are localized and frictionless. Facebook, WhatsApp, YouTube and Instagram are the most popular social media networks in Mexico.

Popular Payment Methods

Credit cards are still the most popular way to pay at 61%, although Mexico has a bespoke method of over the counter (OTC) payment through the Oxxo store network and e-wallets are increasing in popularity, expected to reach 31% by 2025. With a third of the population not having access to a bank account, paying with cash or Oxxo remains a popular option that ecommerce brands should consider implementing to increase conversion.

Luxury Market in Mexico

Luxury is a growing segment in Mexico that is currently worth approximately US$4 billion, with revenue in the Luxury Fashion category projected to reach US$545m by end of 2021. The largest section is Prestige Cosmetics and Fragrances with a market volume of US$1.2 billion in 2021.

Apparel in Mexico

Revenue in the Apparel market is projected to reach US$24 billion in 2021 and the market is expected to grow annually by 11.4% (CAGR 2021-2025). Men’s apparel is the highest segment of this category at US$10 billion with women’s not far behind at US4.89 billion. The Average Revenue per User (ARPU) is US$185.46, expected to increase to US$275.13 by 2025.

Argentina

Argentina is the eighth-largest country in the world, and the second-largest in South America, with the third-highest GDP in Latin America at US$449 billion. The country has rich natural resources and a highly literate population. While the country entered a recession in 2019 and COVID-19 has negatively affected the country’s economy, ecommerce has increased significantly and continues to be strong even in the face of these challenges.

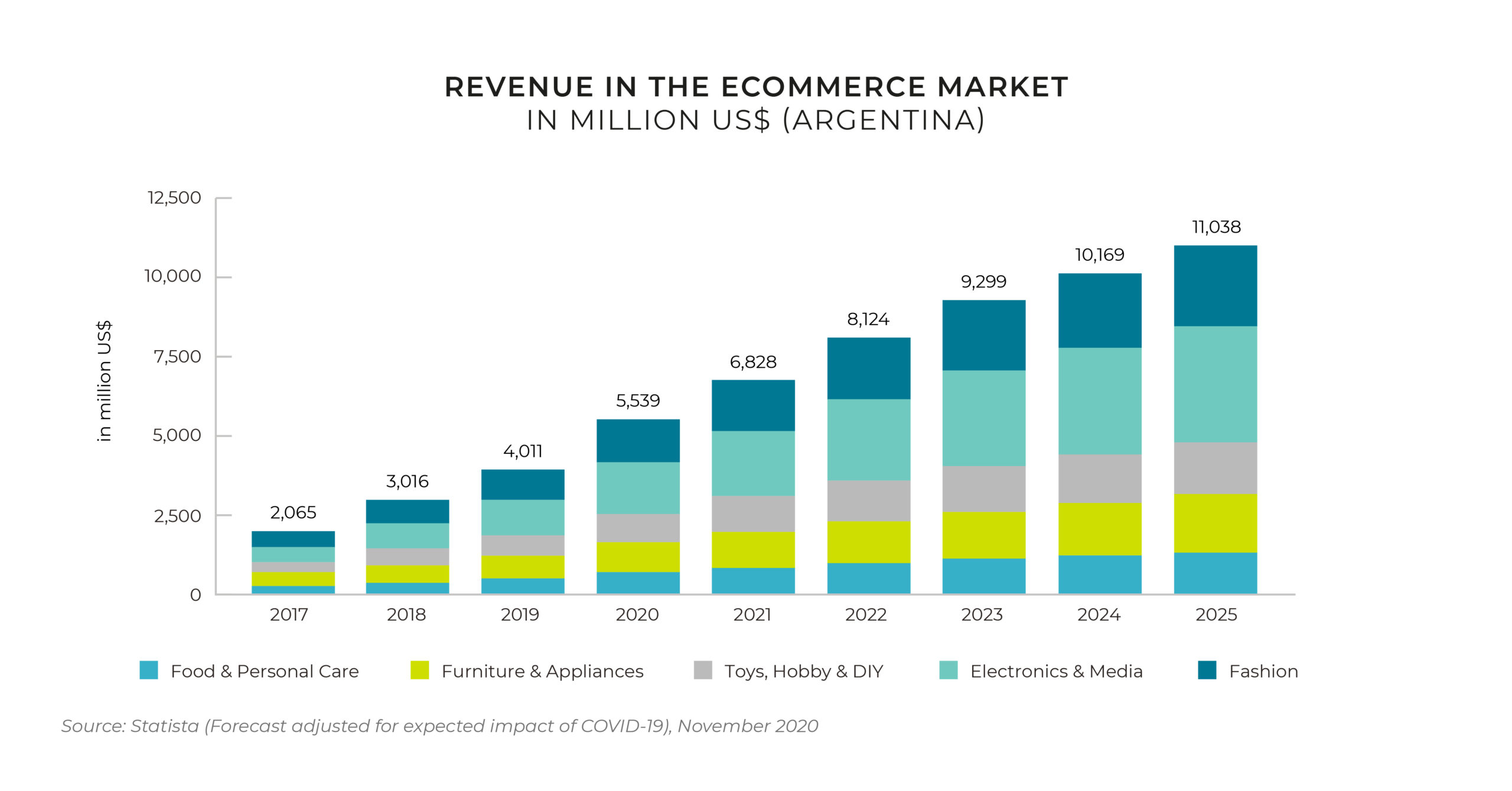

Ecommerce in Argentina

Ecommerce in Argentina is strong and predicted to be one of the fastest-growing in the next four years. It has grown tenfold since 2000, and grew 76% during 2019 (US$16.4 billion), following a 64% increase in 2018 (US$14.4 billion) and estimated to reach US$29.4 billion by 2025.

Argentina has a population of nearly 45 million of which 26 million are digital users. 90% of these users have made at least one online purchase. Digital users are predicted to reach almost 30 million by 2025, showing great growth and potential in the market. 80% of commerce consumers are under 25 years old.

The country is 91% urbanized with a global logistics ranking of 2.89 placing 61st in the world. Due to the availability of products being more limited outside the Buenos Aires province, online sales are more prevalent outside this area. In 2020, Argentina’s mail service, Correo Argenino, launched a new online retail platform called ‘Compra Correo’.

Social Media and Mcommerce in Argentina

Mcommerce is popular in Argentina and expected to surpass desktop usage in the next 12 months. For this reason, brands wishing to sell into the market must ensure their m-commerce offerings are as frictionless as possible to encourage conversion. According to a Gartner report, Argentina ranks second in Latin America on technology adoption, in terms of Internet usage, mobile penetration, and development of cloud services.

Social media usage in Argentina is popular with 32.4 million users. The most used networks include Facebook, Instagram and Twitter.

Marketing to Argentine Ecommerce Shoppers

Argentine shoppers are already eager to buy from international brands. Variety and competitive prices are strong considerations when choosing where to buy from and having local payment methods such as local cards (Naranja, Cabal, Tarjeta Shopping, Argencard, Censosud), instalments or cash payment methods (PagoFacil, Cobro Express and RapiPago) incentivises conversions.

Luxury Market in Argentina

Luxury is an important market segment in Argentina, worth US$1.2 billion in 2020 and predicted to rise to US$1.4 billion by 2025. Luxury fashion is the most popular category at US$572 million in 2021, followed by Watches and Jewellery (US$113 million), showing a strong opportunity for luxury apparel and watch brands to enter the market.

Apparel in Argentina

While Electronics and Media is the strongest market segment in ecommerce, accounting for US$1.5 billion in 2020, and predicted to reach US$3.6 by 2025, it’s closely followed by Fashion at US$1.4 billion, to reach US$2.6 billion by 2025. Argentina is 12th in the world in worldwide revenue of children’s apparel at almost US$6 billion dollars (2019 – latest data).

Brazil

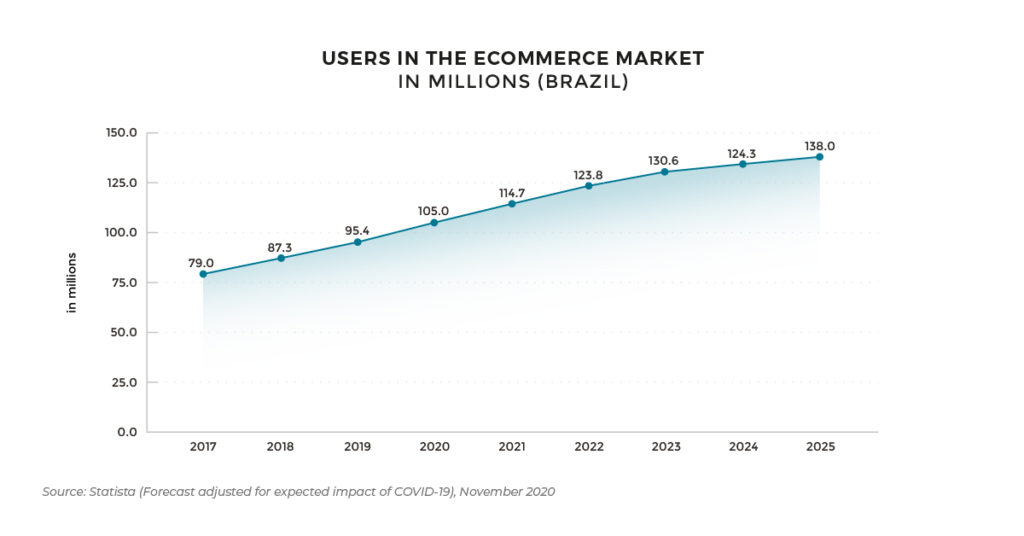

Brazil is the fifth-largest country in the world, with a population of 210 million. It has the eighth-largest economy in the world although after a period of strong growth in 2014 has experienced a downturn in economic activity, further impacted by COVID-19. The GDP is forecast to increase by 2.3% from 2019 to 2024. Despite this downturn, ecommerce is growing yearly and currently 40% of shoppers buying online will purchase both cross-border and domestically with 8% shopping only cross-border.

Ecommerce in Brazil

Brazil has the largest share of ecommerce in Latin America and the market was worth US$19.6 billion in 2020, comprising 53.5% market share. This is predicted to increase to US$27 billion by 2024. Internet penetration currently stands at 67%, expected to reach 72% by 2025 and there are 98.9 mobile cellular subscriptions per 100 people.

Social Media and Mcommerce in Argentina

With such a high percentage of mobile phone users, it’s unsurprising that social media is very popular with over 66% of the population using it. Facebook, WhatsApp and Twitter are the most popular networks,

As of June 2019, 43.1% of all online shopping transactions occurred on mobile, with the most popular categories being clothing, electronics and meals. 50 million interest users in Brazil access the internet solely through their smartphones, not desktop, so it is important for ecommerce brands entering the market to ensure a strong m-commerce option.

Apparel in Brazil

In 2019, Brazil was included in the top 10 global markets for clothing and accessories – the only Latin American country to make the list, surpassing Japan and Germany in revenue. The country ranked for the ninth largest revenue of women’s and girls’ apparel in the world in the same year. In 2019, 79% of apparel shoppers bought online, a slight dip from 82% in 2017. 17% bought apparel online, an increase from 14% in 2017, showing cross-border ecommerce apparel brands that online shopping is becoming a more popular option.

Luxury Market in Brazil

The luxury fashion market in Brazil is currently worth US$1.3 billion, expected to increase to US$1.4 billion by 2025. Footwear is worth more than apparel by almost US$150 million. Luxury watches and jewellery is also a sizeable segment, projected to reach US$715 by the end of 2021, with watches accounting for more than half of that figure (US$369 million).

Marketing to the Brazilian Ecommerce Shopper

Online retail sales in Brazil reached US$16.7 billion dollars in 2020 which accounts for just 4.8% of all retail sales in the country. Brazilian shoppers use the internet for inspiration (23%), to compare prices, products or features (44%) and to look for reviews/opinions/advice online (26%). 96% of Brazilian internet users use Google at least once a month. Search engines, social networking and email marketing are the main channels used to reach online shoppers.

Chile

Chile is one of Latin America’s fastest-growing economies, although income inequality remains high. GDP is US$282.3 billion, fifth in Latin America and the Caribbean, behind Brazil, Mexico, Argentina and Columbia. The population stands at 19 million, expected to reach 20.48 million by 2025.

COVID-19 has affected the Chilean economy with the GDP decreasing by 6.3% in 2020, however estimations already show that 2021 will see a 4.5% increase and 2022 will see 4.2%.

Ecommerce in Chile

There are 12.1 million ecommerce users in Chile which has 68% digital buyer penetration, and online sales account for 11% of total retail sales. Revenue from ecommerce sales reached US$9.4 billion in 2020 and is predicted to reach US$12 billion by end of 2021. In 2020 electronics and computers was the category most purchased online (15%) followed by clothing and footwear (12%). The average revenue per user (ARPU) currently stands at US$514.78, to increase to US$652.92 by 2025.

Social Media and Mcommerce in Chile

Internet penetration in Chile is at 86% and predicted to increase to 88.5% by 2025, with smartphone penetration at 84%, predicted to rise to 88% by 2025. Social media usage has decreased slightly among young adults from 4.5 hours per day in 2015 to 4.1 in 2020.

In 2019 (latest data), mcommerce sales made up 34% of all online sales, up from 25% in 2018 and 17% in 2017, showing a clear move toward mcommerce. Due to COVID-19, 23% of shoppers say they have started to shop online more often, making it likely that even more people will shop on mobile, and brands in the market should optimise their m-commerce experience.

Luxury and Apparel Market in Chile

Apparel in Chile reached US$5.4 billion in 2021, and is expected to reach US$8.3 billion by the end of 2025. Women’s apparel is the strongest category at US$3 billion with men’s apparel reaching US$1.5 billion.

Revenue in the Luxury fashion segment in Chile is worth US$202 and is expected to grow annually by 3.9%, reaching US$235 by 2025. Prestige cosmetics and fragrances are also a strong segment in Luxury Goods, with sales of US$246 million in 2021, predicted to reach US$282 million by 2025. 23% of both male and female shoppers say they ‘always’ purchase luxury cosmetics and fragrances.

Marketing to the Chilean Ecommerce Shopper

In line with Chilean shoppers are moving increasingly online and m-commerce is also a popular method of purchasing, digital advertising spend is increasing as is mobile internet advertising spend. In 2018, spending on mobile advertising in Chile was US$85 million, but predicted to reach US$209 million by 2022. Similarly, digital advertising has increased from US$270 million in 2019 to US$300 million in 2021 and a predicted increase to US$330 million by 2023.

Popular Payment Methods

Shoppers predominantly pay by credit card (70%), with bank transfers (12%) and cash payment (11%) the next most popular methods. E-Wallets are not prevalent currently at 3%, although with increased purchasing on mobile this is likely to change.

Uruguay

Uruguay has a population of 3.4 million, with a GDP of US$60 billion, and a GDP per Capita of US$17,518. The capital, Montevideo has a population of 1.8 million, and is the largest urban area in the country. The country is a high income one with a population growth of 0.3% in 2020.

Ecommerce in Uruguay

With US$630 million and a share of almost 75%, ecommerce generated the highest digital revenues in 2021. Internet penetration stands at 75% and is expected to increase to 79.6% by 2025. Smartphone users number 2.67 million in 2021, and is expected to reach 2.96 by 2025.

Uruguayans purchase over 90% of online products and services from China and the United States as often, even when including shipping costs, these products tend to cost almost half what they cost in Uruguay.

Social Media and Mcommerce in Uruguay

Currently there are 2.75 million social media users in Uruguay, projected to reach 2.95 by 2025. The most popular networks are WhatsApp, Facebook, YouTube and Instagram.

Luxury Market in Uruguay

The luxury market in Uruguay is worth US$158 million in 2021, growing at a rate of 2.9%. Of this, luxury fashion accounts for the highest proportion at US$59.5 million, prestige cosmetics and fragrances is in close second place at US$46 million and luxury leather accounts for US$27 million in 2021. By 2025, fashion will reach US$66m million, cosmetics and fragrances US$49.6 and leather US$32 million.

Uruguay’s Apparel Market

The apparel market in Uruguay is currently worth US$879 million (2021) and expected to grow at a rate of 7.5%. Women’s apparel is the largest segment, worth US$464 million. The ARPU is at US252.31 and is projected to reach US$333.51 by 2025.

Digital Ad Spending in Uruguay

Ad spending in the digital advertising market is projected to reach US$126 million by the end of 2012, with search advertising the largest segment. The split between desktop and mobile ad spend is currently 58:42 but the gap is narrowing year on year and expected to reach 55:45 by 2025.

Popular Payment Methods

Uruguayans currently pay predominantly by card for online purchases (53%), followed by cash at 26%, then bank transfer (12%) and e-wallet (8%). As with other Latin American markets as ecommerce and mcommerce become more popular, payment with e-wallets is likely to increase and brands selling into the market should partner with domestic acquirers to offer payment methods familiar to the Uruguayan shopper to decrease fraud flags and increase conversions.

Colombia

Colombia has a population of just over 50 million people, with a GDP of US$315 billion forecast to increase to US$352 billion by 2024. The GDP per capita is US$6152, to reach US $6803 by 2024. 70% of the population uses the internet – approximately 34 million – of which 22 million are expected to be digital buyers by the end of the year.

COVID-19 had an effect on the country’s economy, with lockdown and quarantines contributing to the expected 8% fall in GDP which could lead the country into its first recession in two decades, although ecommerce remains strong and has benefited from the pandemic with more shoppers switching to online shopping.

Ecommerce in Colombia

Colombia is the fourth largest ecommerce market in Latin America and is worth US$6.27 billion as of 2021. There are 25.6 million ecommerce users, which is expected to increase to 27.8 million by 2025. Digital penetration is currently at 49.5%, to reach 53% by 2024.The age group with the highest share of online shoppers 25-40 years old and female shoppers outrank males by 58% to 42%.

COVID-19 positively affected the ecommerce market in Colombia, with retail spending increasing 209% between February and May 2020.

Social Media and Mcommerce in Colombia

Columbia has the fourth highest social media penetration in North, Central and South America as of January 2021 at 76.4%. The most active age group is 25-34 years old, with the next at 18-24 years old. Facebook (51%) and Instagram (39%) are the most popular sites, with Twitter only receiving 6% of social media interactions.

Smartphone penetration in Columbia is at 72% as of 2018 (latest data), increased from 63% in 2016, showing a clear uptake, which means that shopping on mobile will become more common.

Luxury Market in Colombia

The Luxury goods market revenue is projected to reach US$738 million in 2021, growing by 3.4% annually. The largest segment is prestige cosmetics and fragrances with a market share of US$287 million. Online sales accounts for 6% of total revenue of luxury goods.

Revenue in the Luxury fashion segment will reach US$182 by the end of 2021, and the market is expected to grow by 3.2% annually.

Colombia’s Apparel Market

The apparel market will be worth US$8 billion by the end of 2021, a YOY growth of 22.8%. The ARPU is US$168.91, up 21.9% YOY. Women’s apparel is the strongest category in the segment at US$4.5 billion, with men’s second at US$2.6 billion. Online shopping accounts for only 11% of this revenue, meaning there is room for strong growth for brands selling into the market who provide an excellent end to end shopper experience.

Digital Ad Spending in Colombia

Digital advertising spending is increasing year on year, and projected to reach US$444 million by the end of 2021, up from US$383 million in 2020, and expected to reach US$562 by 2025. Spend is split 45/55% desktop to mobile, showing the importance of mobiles to the Colombian shopper. 23% of all digital spending is incurred by the retail industry.

Peru

Peru has a population of 32.5 million predicted to reach 38.6 million by 2040, with almost a third (10.7 million) in the capital city of Lima – making it the largest urban area in the country.

Ecommerce in Peru

Revenue in the ecommerce sector is expected to reach US$3 billion by the end of 2021 – a growth of 21.7% between 2019-2021, growing at an annual rate of 7.5% – one of the highest in Latin America. The largest segment is furniture and appliances, accounting for US$885 million.

There are 14.8 million ecommerce users, predicted to reach 18.9 million by 2025. The ARPU is currently US$242.14 in 2021, and will increase to US$253.81 by 2025.

Social Media and Mcommerce in Peru

There are 24 million internet users in Peru, and 19 million social media users. The most popular platform is Facebook with Instagram and Twitter next in popularity and TikTok, skewing 63% popular with 4.9 million users also gaining traction.

48% of internet users have purchased online via the internet, apps or on social media. Shoppers are evenly split between desktop and smartphone.

Luxury Market in Peru

Revenue in the Luxury Goods market is projected to reach US$505m in 2021 and the market is expected to grow annually by 3.1% (CAGR 2021-2025).

The market’s largest segment will be the segment Prestige Cosmetics & Fragrances with a market volume of US$181m in 2021.

Luxury fashion in Peru accounts for US$138 million, showing an 11.6% YOY growth and expected to continue to grow at 2.2%. Luxury apparel is the strongest segment with revenue of US$97 million with luxury footwear accounting for US$40 million.

Peru’s Apparel Market

Revenue in the Apparel market is projected to reach US$4.4 billion in 2021. The market is expected to grow annually by 11.6%. Women’s apparel is the strongest category at US$2.1 billion and men’s at US$1.7 billion. ARPU is at US$143.70 broken down into women (US$64.69), men’s (US$51.17) and children’s (US$27.85) and expected to reach US$215.45.

Digital ad spend in Peru

Ad spend in the digital advertising market will be worth US$168 million by the end of 2021, up 20.9% YOY. Ad spend skews toward desktop 51% to 40%, but by 2025 this will have switched in favour of mobile at 45% for desktop, 55% for mobile. Retail spending accounts for 24.7% with FMCG (fast moving consumer goods) accounting for an additional 12.9%.

Conclusion

Latin America is an exciting region for cross-border ecommerce brands to enter, particularly as there is such a strong appetite for apparel, luxury fashion, and prestige cosmetics. Ecommerce is strong in all the countries covered and will continue to grow as internet and smartphone penetration increases and logistics improve.

Brands wishing to sell into these markets should localize the experience for each individual country not only with language but currency, address fields, duties and tax calculations, promotions, returns polices and country-specific communications.

The key to success in cross-border markets is a seamless end to end shopper experience at every touchpoint. Providing this to shoppers will increase brand loyalty and conversions, no matter where they are in the world.