Luxury’s Digital Makeover

Ecommerce has become an essential channel for luxury brands, who have historically been slow to move online, as COVID has shuttered stores and kept shoppers at home. For many shoppers, the move online will be a permanent one.

30% OF LUXURY SHOPPING WILL BE DONE ONLINE BY 2025 VS. 22% IN 2020.1

In 2021, luxury brands will look to quickly reconnect with customers across geographies by bringing their VIP customer experience to the online world. Continued economic uncertainty means a response to recent industry changes is imperative. Not doing so would risk further loss of customers and revenue.

Brands who already had an ecommerce channel, or who set one up quickly in 2020, were better equipped to mitigate the effects of COVID on their business. So too were those with a geographically diverse offering.

Many brands that embraced cross-border ecommerce saw impressive results as demand popped up in unexpected markets. Taking advantage of this momentum of change is imperative for brands to recover. The challenge will be to swiftly expand their digital offering while maintaining the high-quality service level that is fundamental to the luxury market.

Brands need a solution that will enable rapid entrance to new markets, offering a domestic-equivalent experience that is personalized and friction-free. Navigating the complexities of doing so can be daunting, but these brands will be in a better position to recover from 2020 and weather future economic uncertainty.

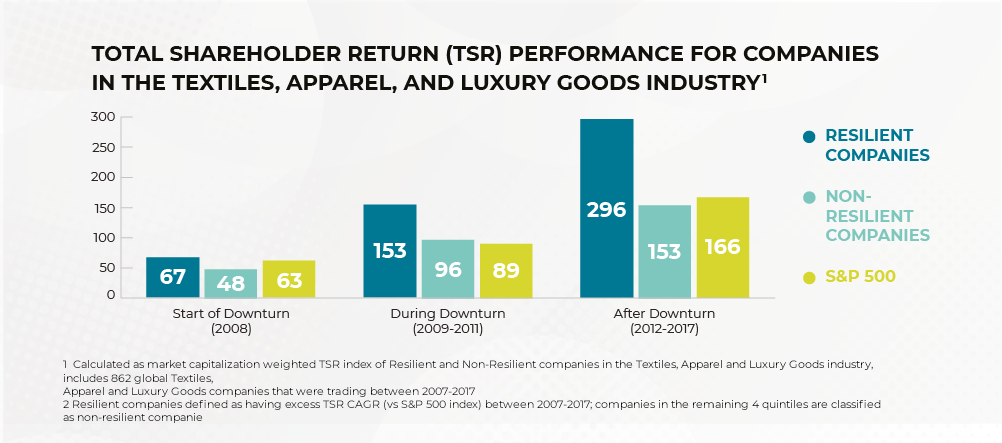

Resilient Brands Act Fast During Economic Slowdowns

IN 2021, WE WILL SEE BUSINESSES WORKING HARD TO RECOVER FROM THE ECONOMIC BLOW CAUSED BY THE PANDEMIC

With extended lockdowns, store closures, travel restrictions, and the reopening of stores still unpredictable, brands and retailers must embrace changing consumer behaviors and make quick, bold decisions. Investing in top-line growth as early as possible accelerated the rebound of resilient brands after the 2008 financial crisis and led to revenue increases of up to 30% compared with those of non-resilient brands.2

Even as the vaccine is rolled out around the world, the future of in-store shopping is uncertain. Today, more than 80% of leaders at consumer and retail companies report that they are making and implementing major decisions faster than before.3 Best-in-class retailers know that to recover from 2020 and be in a strong position for the future, they need to think creatively about identifying revenue opportunities.

The Global Growth Opportunity

CROSS-BORDER GROWTH HAS ACCELERATED BEYOND ALL EXPECTATIONS

In 2018, cross-border ecommerce was a $175 billion market and was on track to grow to US$423 billion by 2023. Cross-border shopping is now projected to make up 17% of ecommerce in 2023, with sales of US$736 billion globally.5

The need for luxury houses to invest in cross-border ecommerce is undeniable.

SAME-STORE YEAR-OVER-YEAR GROWTH

Brands and retailers partnering with ESW saw explosive growth in 2020 in multiple and often surprising markets, with same-store order volumes up 82% in 2020 vs. 2019.7

While the total luxury market decreased by an average of 30% in 2020, luxury brands providing cross-border shopping through ESW saw an average of 58% ecommerce growth in Q4.8

2021 Luxury Industry Trends

TRAVEL SLOWDOWNS

The luxury sector’s reliance on retail tourism

has emphasized the need for digital channels as travel restrictions persist. Sixty-six per cent of fashion executives don’t expect travel retail sales to recover their former growth levels for 2-3 years.9

Brands will need to think creatively in their approach to converting new customers and unlocking revenue opportunities. As well as engaging with local customers, brands may look to new markets where recovery is accelerating at a greater pace. To have a strong position in the future, providing a domestic-equivalent experience in all cross-border markets should be a priority.

PERSONALIZATION GOES OMNICHANNEL

To satisfy top spenders, the luxury industry has long been the leading retail sector for innovations in personalization. Even as they move online, luxury customers expect experiences like virtual personal shopping and video shopping assistance to keep the human element in the transaction.

Another growing trend is the popularity of virtual try-on technologies. Brands are see- ing virtual try-on tools like Zeekit increase conversion rates by as much as 5x and re- duce return rates.11 These will be particularly important for Gen Zers who are digitally savvy and a critical demographic for luxury.

2021 Consumer Trends

CROSS-BORDER SHOPPING

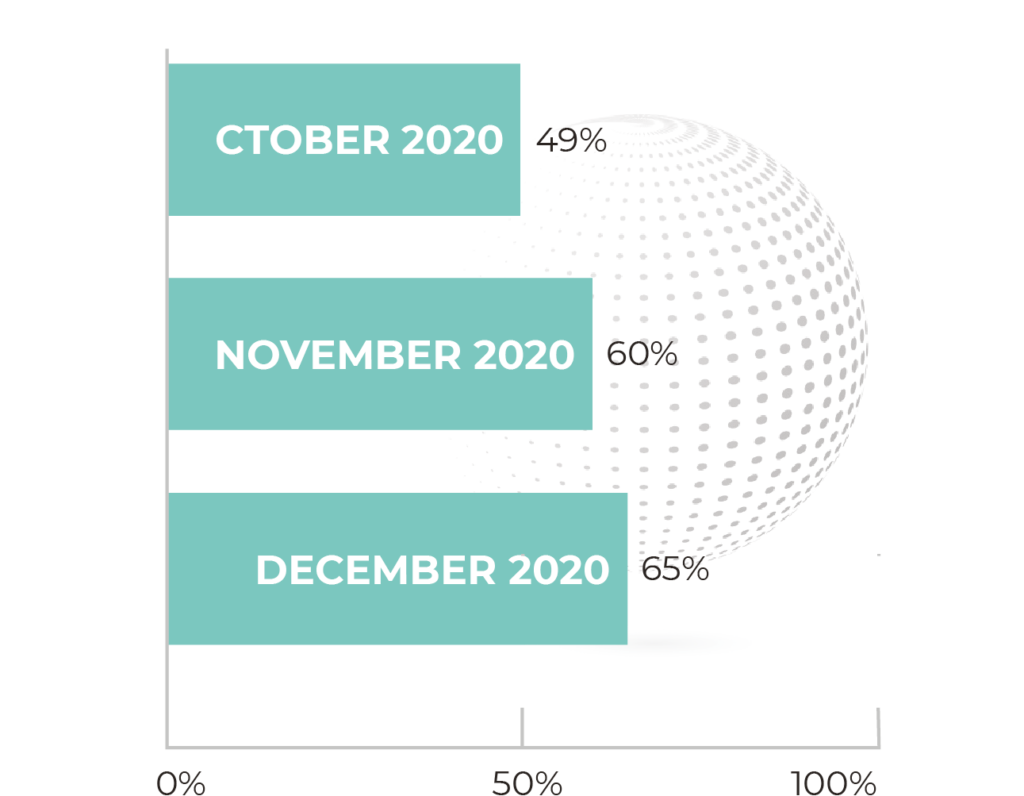

After a year of social distancing, consumers in all demographics have become more confident purchasing online, in many cases regardless of geography. In a December 2020 global survey, 68% of all consumers had shopped cross-border in the past six months. More than half of those (52%) said they had made more than six or more purchases from a website outside their own country.12

Luxury houses can capitalize on this growth by building localized ecommerce experiences in key markets.

OMNICHANNEL

Without ready access to in-store shopping, and with the heightened need for contactless transactions, many consumer behavior trends that accelerated as a result of COV-ID are here to stay.

The retail industry is responding by shifting towards more holistic strategies that acknowledge consumer interactions across entire retail ecosystems, blending offline and online channels into an omnichannel strategy in which all consumer touchpoints hold equal weight.

THE CHALLENGE IS TO ENSURE THAT CONSUMERS ARE GETTING THE SAME LEVEL OF LUXURY SERVICE THEY HAVE COME TO EXPECT FROM BRICK-AND-MORTARS.

THE CONSCIOUS CONSUMER

The rise of the socially conscious shopper also continued in 2020. Issues such as employee working conditions and a brand’s environmental impact became factors in the buying decision for many consumers.

THE FASTEST-GROWING LUXURY SEGMENT:

Digitally-Savvy Gen Z

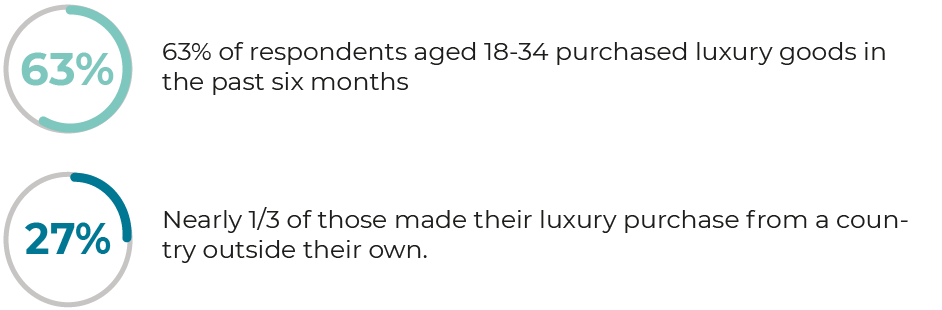

GEN Z CURRENTLY ACCOUNTS FOR 30% OF LUXURY SPENDING, AND BY 2030, THEY WILL DETHRONE MILLENNIALS AS THE MOST IMPORTANT LUXURY CONSUMERS.19 IN A RECENT SURVEY, ESW FOUND

LIFE IN DIGITAL

Gen Zers grew up as digital natives. They are the first generation to experience a lifestyle that is about social currency, social scores, and social recognition.

EXPERIENCE AS DIFFERENTIATOR

Authentic, branded experiences are more important than anything else. Gen Z expects quality, but they’re also fickle and expect that something better will be along soon, especially where technology is concerned. Experiences will be a competitive advantage for luxury brands

Unlock CrossBorder Demand for Your Brand: A To-Do List

- Identify your most profitable markets and find a way to scale them. Can you optimize current markets, or are there regions where you are receiving web traffic but currently not set up for ecommerce?

- Look at your shopper experience in existing markets and identify ways to optimize it. Can you add more local payment options? Better local shipping carriers? A more transparent shopping experience that doesn’t surprise shoppers with duties or other fees at checkout?

- Build internal teams as well as partnerships with multiple vendors to handle cross-border complexities, including local demand generation, omnichannel, compliance, payment, returns, and customer service, while maintaining a consistent brand experience across markets.

Partnering With a Solution Provider is the Fastest, Most Cost-effective Way to Achieve Your Goals of Cross-Border Expansion

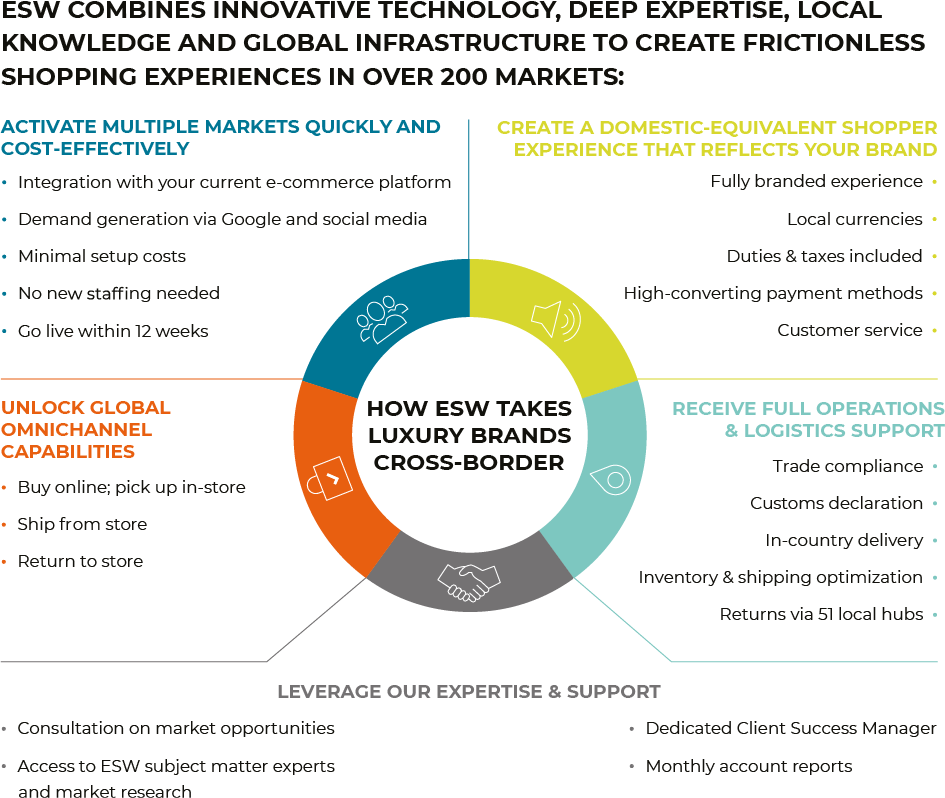

ESW COMBINES INNOVATIVE TECHNOLOGY, DEEP EXPERTISE, LOCAL KNOWLEDGE AND GLOBAL INFRASTRUCTURE TO CREATE FRICTIONLESS SHOPPING EXPERIENCES IN OVER 200 MARKETS:

SOURCES

- Bain & Company

- McKinsey

- McKinsey

- Digital Commerce 360

- Forrester

- McKinsey

- ESW Data

- ESW Data

- McKinsey

- BCG

- Washington Post

- ESW Data

- ESW Data

- eMarketer

- CommerceHub

- GlobalWebIndex

- eMarketer

- McKinsey

- Forbes