Japan is the third-largest economy in the world1 with a GDP of US$5 trillion2. GDP per capita3 is US$42,927 in 2021, predicted to reach US$51,620 by 2026. Japan is the fourth-largest ecommerce market in the world behind the UK, China, and the US4.

Ecommerce growth in the market is at approximately 6.24% per annum and estimated to be worth US$143 billion by 20255. Food and Personal Care is the largest segment at US$28 billion in 2021, with Fashion and Beauty5 the second strongest category, worth US$25 billion, and Toys, DIY and Hobbies (US$21 billion) then Electronics and Media (US$18.9 billion) next.

The Ministry of Internal Affairs and Communications6 surveys online expenditures and services of Japanese shoppers monthly with a recent report showing a 13.7% increase from January 2018 to January 2020, and households shopping online increasing from 36.3% to 42.8%.

Covid-19 effect on Japanese online shopping

Like most other nations, Covid-19 pushed Japanese shoppers online7, with 45% of respondents of a 2021 survey8 reporting an increase of online purchases.

Even before the state of emergency in Tokyo and other metropolitan areas was declared (April 2020), brick and mortar department stores saw a drop in sales but were reporting higher online revenue particularly in the beauty category. After the state of emergency was lifted in May 2020, 46% of consumers said they would continue or increase online clothing purchases9.

Researchers at the Nomura Research Institute7 expect that after Covid ‘calms down’ more people will be and remain online in Japan. As with other nations, the shoppers moving online thanks to the pandemic tended to be older first-time shoppers, initially reluctant to shop online but forced to due to shortages, lockdowns, or product availability, who have now become happy online shoppers and likely to stay online post-pandemic.

Internet and Digital Device Penetration

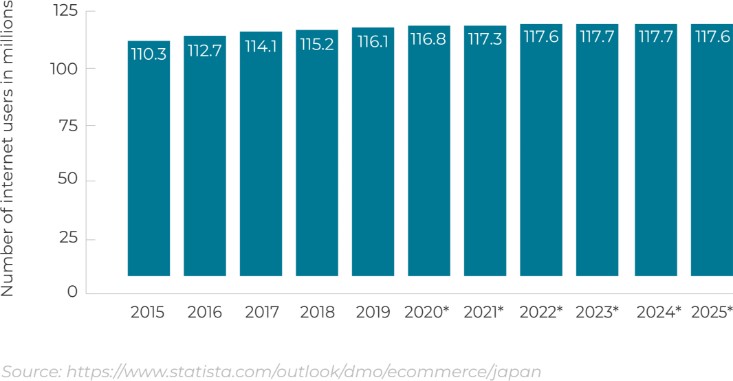

There are 117.4 million internet users in Japan10, and internet penetration is at 93% as of January 2021. Internet penetration11 in Japan is highest in the age groups between 20-59 (all over 97%), with 60-69-year-olds at 90.5% and dropping somewhat in the next age group (70-79) to 74%. Smartphone penetration12 is similarly high at 82% overall, with 20-29-year-olds the age group with the highest penetration at 93%, and dropping sharply after 59 years of age, with 60-69-year-olds at 64% smartphone penetration, and 70-79-year-olds at 33%. As many people have more than one mobile connection the penetration rate is currently 159.3%.

Social media penetration is also strong with 93.8 million users – an increase of 4.4 million from 2020 to 2021 – and a penetration rate of 87%13.

number of internet users in japan from 2015 to 2019 with a forecast until 2025 (in millions)

Mcommerce Japan

Buying on mobile, or mcommerce, is popular in Japan and revenue is rapidly increasing year on year from US$9 billion in 2010 to US$41.5 billion in 201914. Currently, (2021) mcommerce accounts for 45.5% of all ecommerce sales15.

Preferred ecommerce methods

(in billion US$)

Social commerce

According to a 2019 PayPal report16, 73% of mobile commerce users prefer using a mobile shopping app, spending approximately US$79 each per month. 20% of users purchase electronic products and fashion through overseas online stores.

Many Japanese brands use social media to connect with their shoppers and often use influencers to promote products usually through a variety of videos. 34% of Gen Z shop through Instagram, YouTube and Twitter16.

Japan’s Demographics

The Japanese population19 is one of the oldest in the world with a median age of 48.4 years in 2020, and is decreasing at a rate of 0.3% per year. The number of people in a household is similarly declining with the latest average at 2.3 people per household. Approximately 60% are couples with or without children, with 35% being one-person households.

The country’s population10 is 51.2% female and 91.8% live in urban areas. Cities Tokyo, Kanagawa, Osaka, Aichi and Saitama account for 36.4% of the population. Education levels in the country are high with approx. 62% of 25-34 year olds having a third-level education.

How Do Japanese Shoppers Shop Online?

Japanese shoppers are discriminating20, make purchase decisions based on value, quality and style, and like to have a lot of information17 before they make a purchase. While there is strong mobile penetration, Japanese shoppers often use mobile to research purchases, but move to a PC to complete the sale21.

Quality over quantity19 is important to Japanese shoppers, with the average order value higher in Japan than in Western countries, typically. Traditionally, Japanese shoppers prefer to spend more to save time, but since the pandemic this trend has reversed for a percentage of the population who now prefer to take more time to spend less, especially with food and eating at home19.

However, this adherence to quality over quantity is changing with younger generations happy to shop cheaper and seeking to reduce costs, and discount stores and online retailers seeing an influx of shoppers22.

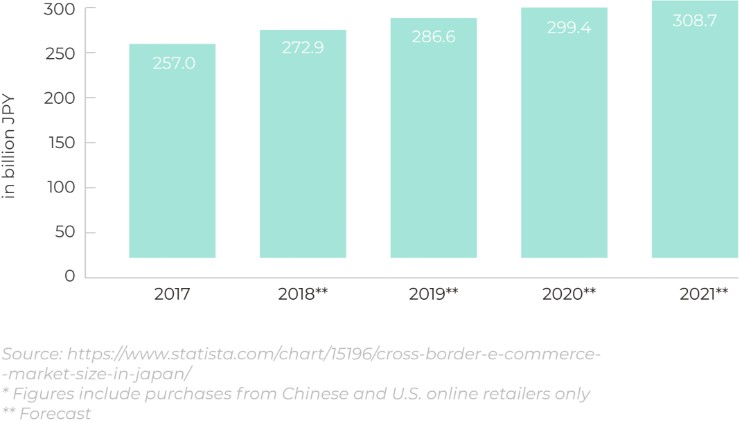

cross-border e-commerce market size in japan from fiscal year 2017 to 2021 (in billion jpy)*

Japanese are loyal shoppers19, although younger generations don’t tend to be as brand loyal as older shoppers. New products and brand innovations are popular with shoppers, and half of the population uses social media, so an important channel for cross-border ecommerce brands to optimise. 44% do use comparison sites regularly23.

Aftersales care is an important feature expected by shoppers in Japan so cross-border ecommerce brands should provide a robust customer care offering24.

While Japanese shoppers are not particularly strong cross-border shoppers as a nation currently, the number is increasing year on year and the market is worth ¥308 billion25 (approx. US$2.83 billion) in 2021, an increase of 19.84% in four years. However, Japanese shoppers are happy to buy cross-border for ‘specialised’ goods specific to a country such as Swiss watches or French wines19.

Japan’s Online Shoppers Behaviour Reaching the Japanese Shopper

As a nation where 99% of the population26 only speak their native language, it will be a competitive advantage for cross-border ecommerce brands to develop sites that are easy for citizens to access and navigate.

Website design and translation

Japanese websites look different to ‘Western’ websites due to Japanese shoppers liking a lot of information before making a purchase, which means product listings are text-heavy18, primarily due to the nature of the Japanese language and characters which can look dense to a non-Japanese speaker, but is not to Japanese shoppers.

Proper translation is essential as is working with native Japanese speakers17 to translate content and understand keywords, word order and writing systems. Clear communication is an essential part of ecommerce generally and can help to reduce outreach to customer services if FAQs are addressed on site, delays or issues are relayed quickly, and if shoppers do reach out to customer service that they are addressed quickly.

Marketing

The digital advertising market in Japan27 is the fifth-largest in the world with Google, Facebook and Yahoo Japan major players. Search and display ads are used by brands and agencies primarily with product feeds and shopping ads usually used by marketplaces18 such as Rakuten, Yahoo! Shopping and Amazon.

The Japanese audience is receptive to advertising and accustomed to seeing ads on a daily basis on billboards, street corners and public transport as well as television and on the internet.

Celebrity endorsements and animated characters are frequently seen on traditional and digital media28.

Search advertising takes the highest cut of the digital advertising spend in Japan which reached US$17 billion in 202128. In Japan, Google is not the only major search engine. Yahoo! Japan is another search engine that claims 18.3% of the market, is particularly good for increasing brand awareness, and is the preferred search engine of PC users28.

Japanese shoppers are not particularly concerned about big data due to the legislation in force there, and are happy to receive regular tailored and promotional offers.

Social media marketing

Sponsored content, working with influencers and celebrities, and ads on social media are all good ways of promoting a brand in Japan and helping to build an online community. While Japan has global social media platforms such as Twitter and Facebook its predominant social media network is LINE which is an app similar to WeChat or WhatsApp with multiple features28.

Spend on social media is steadily increasing reaching ¥544 billion (US$4.95 billion) in 2020 and expected to more than double to ¥1104 billion (approx. US$10.05 billion) by 202430. Influencer marketing is still popular, particularly on Instagram and TikTok29.

Payment Preferences

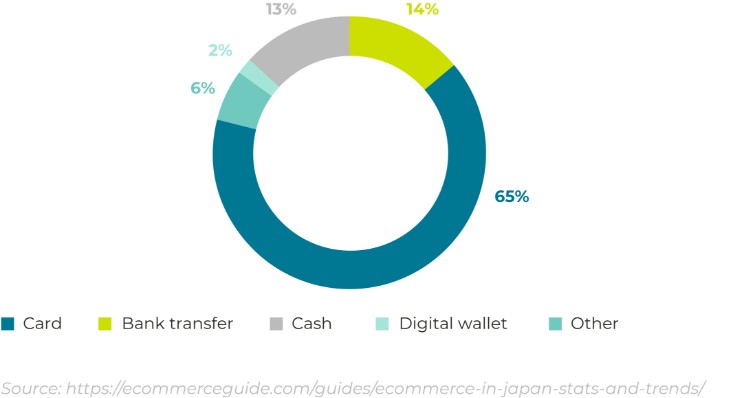

Historically, Japan is primarily and still a cash-based nation with cash the preferred method31 of payment at 90% for all (online and offline) purchases.

Credit and debit cards32 are the most used payment methods for online purchases among digital buyers at 75%. Paying at convenience stores, or konbini, accounts for 38.4% and can be found at 55,000 locations nationwide. It is particularly popular with teenagers without bank accounts or access to credit. Cash on delivery is still relatively high at 24%, particularly as it carries a cultural perception of security and anonymity when purchasing online. Digital wallets are not yet popular, accounting for 2% of sales in 201933.

Electronic money (e-money) is another widespread form of cashless payment34 used in Japan, with transactions using electronic reaching 6 trillion Japanese yen (approximately US$55 billion).

Prepaid cards35 are popular in Japan, and brands include BitCash and Mint. Bank transfers, known as furikomi, are also a popular payment method and include PayEasy, a domestic bank transfer service, which offers shoppers the ability to pay t post office, banks and ATMs.

Ecommerce payment method

Duties and Taxes in Japan

Japan has Economic Partnership Agreements (EPAs) in place with Australia, Chile, India, Mexico, Mongolia, Peru, Switzerland, and ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.) In October 2019 the US and Japan signed the US-Japan Trade Agreement and the US-Japan Digital Trade Agreement which went into force 1 January 2020. On 23rd October 2020, Japan and the UK signed a Comprehensive Economic Partnership Agreement (CEPA) largely based on the Japan-European Union Economic Partnership Agreement, which went into force 1 January 2021 following Brexit.

For cross-border ecommerce brands considering selling into Japan, import duties36 are relatively low – in the 5%-10% range for typical candidate categories and with a relatively high minimum duty threshold of ¥10,000 (approx. US$91) below which the rate is ‘effectively zero’.

Japan uses the global standard HS coding system for classifying products and assessing tax rates and made its official documentation process and HS tariff rates available in English.

Luxury in Japan

Japan is one of the largest luxury markets in the world with Bulgari, Salvatore Ferragamo, and Gucci earning 27% of their global revenue in this market alone, and Louis Vuitton earning half its global profits from its 60 stores there19.

Fashion and Apparel Sales in Japan

Revenue in the apparel market37 in Japan is worth US$77 billion of which online sales account for 16% and luxury accounts for 8%. Online shopping has increased steadily over the previous number of years and is expected to increase slightly to 17% by 2023.

Women’s apparel is the strongest segment at US$42 billion, with Men’s (US$6.9 billion) and Children’s (US$7.5 billion) following. Average revenue per capita breaks down to women spending US$340 on average per year, men spending US$214, and children spending (or someone spending for them) US$60.

Supply Chain and Logistics

Japan is a highly urbanized country and is ranked 12th in the World Bank Global Logistics38 Ranking. Speed of delivery is important to Japanese shoppers and one-day delivery is almost standard.

The top three shipping service providers39 in Japan are Yamato Transport, Sagawa Express, and Japan Post for online stores. Such is the demand for ecommerce delivery in Japan that Yamato Transport and Sagawa Express have had to limit the number of packages they handle40 and cut back on some services such as ‘redelivery’, where an uncollected package is redelivered to the destination address repeatedly until it is successfully collected. Final mile carriers UPS, DHL and Fedex36 are operating in Japan also.

Drone delivery35 is being trialed in Japan in a partnership between China’s JD.com and Rakuten.

Conclusion

Japan is a market primed for cross-border ecommerce brands to sell into, due to it being such a strong ecommerce and mcommerce market with a digitally savvy population that is increasing in cross-border shopping. Localising the experience properly, including true and accurate language translation, website design, product listings, and providing stellar customer support are all ways that cross-border ecommerce brands will find success in the market.

Sources

- https://www.focus-economics.com/blog/the-largest-economies-in-the-world

- https://countryeconomy.com/gdp/japan

- https://www.statista.com/statistics/263596/gross-domestic-product-gdp-per-capita-in-japan/

- https://www.paymentssource.com/list/how-e-commerce-is-disrupting-japans-love-of-cash

- https://www.statista.com/outlook/dmo/ecommerce/japan#revenue

- For cross-border ecommerce brands considering selling into Japan, import duties are relatively low – in the 5%-10% range for typical candidate categories and with a relatively high minimum duty threshold of ¥10,000 (approx. US$91) below which the rate is ‘effectively zero’. Japan uses the global standard HS coding system for classifying products and assessing tax rates and made its official documentation process and HS tariff rates available in English.

- https://www.japantimes.co.jp/news/2020/04/10/business/coronavirus-japan-shoppers-buy-online/

- https://www.statista.com/statistics/1127680/japan-online-purchase-behavior-covid-19/

- https://www.warc.com/newsandopinion/news/japans-household-spending-remains-weak-as-e-commerce-growth-lags/44216

- https://datareportal.com/reports/digital-2021-japan

- https://www.statista.com/statistics/759869/japan-internet-penetration-by-age-group/

- https://www.statista.com/statistics/687678/japan-smartphone-penetration-rate-by-age/

- https://www.statista.com/statistics/278994/number-of-social-network-users-in-japan/

- https://www.statista.com/statistics/807299/japan-mobile-commerce-market-size/

- https://chart-na1.emarketer.com/215650/retail-mcommerce-sales-japan-2016-2021-billions-change-of-retail-ecommerce-sales

- https://www.nativex.com/en/blog/apac-market-spotlight-uniting-characteristics-of-japanese-mobile-shoppers

- https://www.clickz.com/a-comprehensive-guide-to-the-japanese-ecommerce-market/260277/

- https://pages.contentive.com/rs/243-MRR-459/images/Cracking%20the%20Japanese%20Market%20-%20Ebook.pdf?mkt_tok=MjQzLU1SUi00NTkAAAF9Qt-OxTxU4J_h3fGNvFUwXX1LhqtPFkCnvejIT3BJEjOU1JQdoOpAZGax6CsTcvBa1_-zodtqGu6s20d2Lm0zSmUULXVcocNWtmMMcYSnCeO7lUc

- https://santandertrade.com/en/portal/analyse-markets/japan/reaching-the-consumers

- https://www.trade.gov/market-intelligence/japan-growth-ecommerce

- https://digiday.com/sponsored/amazonbcs-say-mcommerce-hindi-mobile-shopping-looks-like-emerging-world/

- https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/the-new-japanese-consumer#

- https://www.practicalecommerce.com/japan-is-a-enticing-market-for-cross-border-ecommerce

- https://www.trade.gov/market-intelligence/japan-growth-ecommerce

- https://www.statista.com/chart/15196/cross-border-e-commerce-market-size-in-japan/

- https://www.jpmorgan.com/merchant-services/insights/reports/japan

- https://www.statista.com/outlook/216/121/digital-advertising/japan

- https://www.digitalmarketingforasia.com/everything-you-need-to-know-about-japanese-online-advertising/

- https://www.digitalmarketingforasia.com/a-complete-guide-to-social-media-in-japan/

- https://chart-na1.emarketer.com/240724/social-media-marketing-spending-japan-2018-2025-billions-of-change

- https://www.statista.com/statistics/1041522/japan-preferred-payment-methods/

- https://www.statista.com/statistics/754875/japan-online-payment-methods-digital-buyers/

- https://ecommerceguide.com/guides/ecommerce-in-japan-stats-and-trends/

- https://www.statista.com/statistics/878347/japan-e-money-settlement-amount/

- https://www.jpmorgan.com/merchant-services/insights/reports/japan

- https://www.statista.com/outlook/cmo/apparel/japan#revenue

- https://marketfinder.thinkwithgoogle.com/intl/en_ie/guide/ingram-japan-guide/#expanding-business-to-japan

- https://ecommercedb.com/en/markets/jp/all#

- https://medium.com/flagshipblog/an-introduction-to-shipping-for-e-commerce-in-japan-afbb748a6244