Cross-border ecommerce brands will find the Southeast Asia market to be a strong opportunity with lots of room for growth.

Southeast Asia comprises 11 countries, although ecommerce in the region is dominated by six – Thailand, Vietnam, Malaysia, Singapore, Indonesia and the Philippines. Accounting for 8.58% of the global population and with a GDP of approximately US$3.1 trillion, the region is showing strong demand and significant potential for cross-border ecommerce.

In 1967, the Association of Southeast Asian Nations (ASEAN) comprising Indonesia, Malaysia, the Philippines, Singapore, and Thailand, was formed to promote cultural development and social structures in the region, and also allow the collaborating nations to have more autonomy and influence on the global market. Since then five more nations have joined – Brunei, Cambodia, Laos, Myanmar and Vietnam.

Ecommerce in Southeast Asia

As with many other global regions, Covid-19 has affected the economies of the Southeast Asian region – although usually with the positive side effect of accelerating a shift into digital channels and increasing revenue in the ecommerce channel. Many of the nations in this report are world leaders in adoption of ecommerce and mcommerce, or have government-backed initiatives to increase digital infrastructure with a goal to become world leaders.

Shoppers in Southeast Asia have high expectations of ecommerce sites and while many nations are devoted shoppers of foreign sites, they are easily put off by poor experiences. Cross-border brands wishing to sell into these markets will find a digitally-savvy ecommerce and mcommerce-positive population, eager to buy foreign brands but with high expectations of their experience.

Mcommerce in Southeast Asia

Similar to almost every other country globally, mcommerce is on the rise across Asia, with a number of nations such as Singapore and Indonesia leading the way with the highest mcommerce adoption and promotion in the world. Cross-border brands considering selling into these markets should include mobile optimized sites and apps as a key element of their strategies.

Localization

Every nation in Southeast Asia has not only its own language and currency, but also operational and behavioural idiosyncrasies across the online experience, not least in the checkout, where local address field formats and payment methods are key. Brands considering selling into these nations must understand and optimize their localization efforts to capture and convert new shoppers – who expect a frictionless shopping experience no matter what device or site they use.

Thailand

Thailand has a population of nearly 70 million people and more than half of these (36.6 million) are online shoppers, spending an average of US$243.17 each. Ecommerce shoppers are expected to increase to 43 million users, spending US$283.33 by 2025.

Ecommerce in Thailand

In 2018, Thai ecommerce grew the most of all Association of Southeast Asian Nations (ASEAN) , with online revenue doubling from 2018 to 2020, and expected to increase from from US$8.9 billion to US12.3 billion by 2025. The country has the second-largest economy in Southeast Asia, after Indonesia. 60% of ecommerce shoppers shop online once or twice a week, with almost a quarter shopping online weekly.

In Thailand, the government is pushing ecommerce, under the Thailand 4.0 scheme which is ‘an economic model that aims to unlock the country from several economic challenges resulting from past economic development models…’. Key to this model is the development of technology clusters and future-looking industries that focus on (amongst others) smart services, Digital, IOT and embedded technology start-ups and innovations.

This push to become a developed, innovative economy with a focus on digital technologies and increasing digital penetration, means it’s a great time for cross-border ecommerce brands to explore the opportunity and establish a strong brand presence. With smart phone penetration at 79%, expected to reach 83% by 2025, and internet penetration at 78%, to reach 87% by 2025, Thailand is a strong candidate for cross-border ecommerce brands.

Mcommerce

Mcommerce, or purchasing on mobile devices, saw a 51% increase in growth in 2018, and while subsequent years haven’t seen as strong a jump, growth is still increasing over 20% year after year. Mcommerce’s share of B2C ecommerce sales in Thailand has increased steadily with 2020 seeing it account for 52%.

Thai shopper behaviour and shopping preferences

Millennials make up 32% of the Thai population and are the most active ecommerce shoppers. As more rural areas get to access the internet, thanks to a program to set up broadband networks in the provinces, ecommerce is set to grow even faster.

The most popular sectors in Thai ecommerce are Food and Personal Care at US$3.1 billion, followed by Electronics and Media at US$2.6 billion. Toys, Hobbies and DIY are in third place at US$1.7 billion. In 2025, the sectors will rank in the same order with US$4.6 billion, US$3 billion and US$2.6 billion respectively.

During the initial stages of Covid-19(May 2020) clothing, apparel and fashion were bought by 45% of online shoppers with food and groceries the next most popular category (40%), then cosmetics and beauty products (37%) and personal hygiene products (29%).

Payment method preferences

In Thailand paying with cash is still the predominant way to pay for online purchases (60%) with card payments next at 26%.

Fashion sales in Thailand

The total fashion category in Thailand is worth US$844 million, with apparel the largest segment – worth US$525 million. Over 50% of online shoppers are between 25-44 years. Online fashion sales only account for 5% of this number, predicted to rise to 6% in 2022, which suggests that cross-border ecommerce brands that provide an excellent end-to-end shopper experience will capture a market that’s both fashion and ecommerce-forward and be well-placed to capitalize on a growing ecommerce economy over the next number of years.

Luxury apparel sales

In Thailand, luxury fashion is a growing sector, worth US$503 million and expected to grow by 7.86% annually. Of luxury fashion, the largest segment is apparel with a market volume of US$415 million in 2021, with footwear making up the balance.

Vietnam

Vietnam has a population of 96.4 million people with a GDP per capita of US$3943. There are currently 51.8 million ecommerce shoppers in the country, expected to rise to 70 million by 2025.

Ecommerce in Vietnam

Vietnam is considered to be one of the fastest-growing ecommerce markets in Southeast Asia, with an average annual growth rate of more than 25%. Ecommerce in Vietnam has increased rapidly from 28% of the population shopping online in 2017, to half of the population being ecommerce shoppers in 2020. Revenue currently stands at US$7 billion, expected to reach US$8.7 billion by 2025.

Internet penetration stands at 68% currently, expected to reach 75% by 2023, and smartphone penetration is equally high at 73%, expected to reach 81% by 2025.

One challenge to ecommerce in Vietnam for brands to be aware of is last mile delivery, especially to more rural areas where it can take between 3-7 days for customers to receive their orders. However, clear on-site communications, alerts of any expected delays, parcel tracking and post-purchase outreach should mitigate this by managing shopper expectations.

Mcommerce

Mcommerce is on the rise in Vietnam with sales from 2018 to 2021 increasing by 59% (from US$1.14 billion to US$1.82 billion) and anticipated to reach over US$2 billion by 2022.

Vietnamese shopper behaviour and shopping preferences

Social media is a popular marketing channel for business in Vietnam, with 26% selling via social networks with ‘high efficiency’. Vietnamese shoppers find new brands by search engines (40%), ads on television (30%), tv shows or films (30%), consumer review websites (30%), brand or product websites (29%) and ads on websites (28%) amongst other methods such as ads on social media (26%) and brands on social media (28%).

Payment preferences

In Vietnam, as in many countries, Covid-19 has pushed the demand for contactless payments. Online payments are predominantly still made by credit card at 37%, with bank transfer the next most popular method (30%), then cash (17%), then ewallet (11%).

Fashion appetite in Vietnam

Revenue in Vietnam’s apparel market is currently US$6 billion, growing at 9.24% annually, and predicted to reach US$8.5 billion by 2025. Women’s apparel is the strongest segment, at US$3 billion.

Luxury shopping Vietnam

Vietnam’s revenue for Luxury Fashion stands at US$297 million in 2021, expected to reach US$397 million by 2025, with apparel the strongest segment at US$184 million.

Malaysia

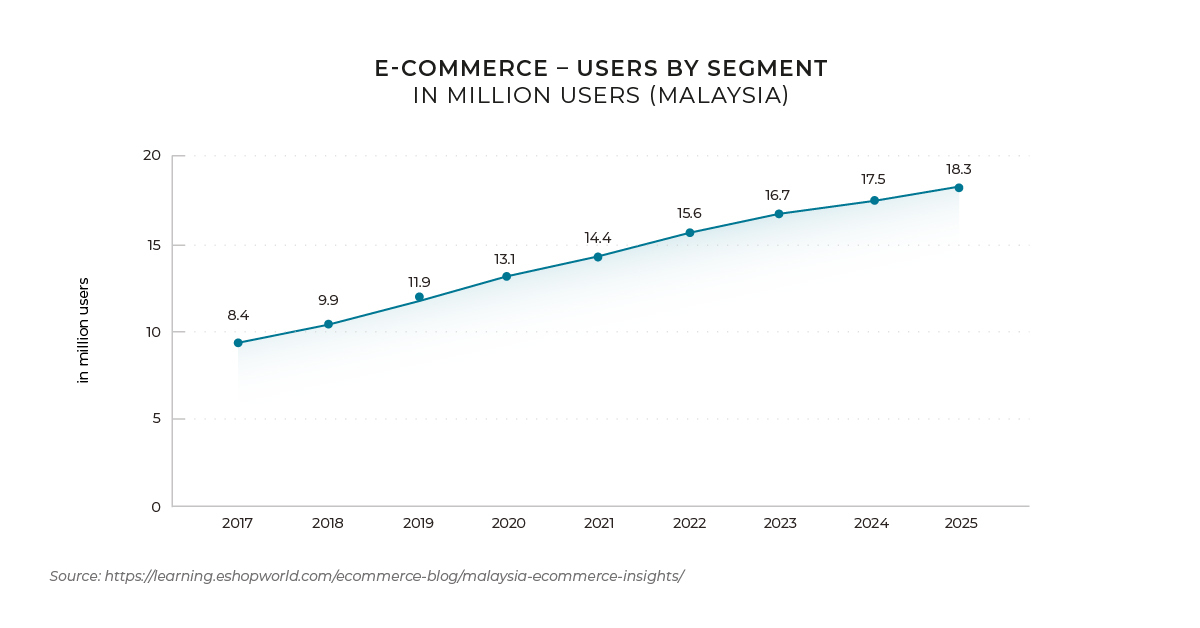

Malaysia has a population of almost 32 million people, of which 14.4 million are ecommerce shoppers, a number expected to increase by 4 million by 2025. The digital sector is expected to make up 20% of the GDP by 2025. Malaysia has the highest rate of smartphone ownership in ASEAN at 144 per 100 people. Increasing ecommerce is part of the government’s post Covid-19 recovery plan with two separate state investment campaigns launched in 2020 totaling US$33 million.

Ecommerce growth and insights for Malaysia

Ecommerce is a growing sector in Malaysia with sales increasing from US$1.6 billion in 2017 to US$5.5 billion in 2021 and expected to reach US$9.6 billion by 2025. Malaysia has a strong delivery infrastructure and cross-border spending is popular, accounting for 44% of all ecommerce sales, with 52% of Malaysian shoppers spending cross-border.

With 96% internet penetration – higher than many other Southeast Asian countries – and smartphone penetration at 96.89%, the country is an excellent opportunity for cross-border ecommerce brands to sell into. According to a recent report by JP Morgan, 2020 E-commerce Payments Trends Report: Malaysia, basket spend, or Average Order Value (AOV) is significantly increasing in the country.

Mcommerce opportunity and growth in Malaysia

With such a strong smartphone ownership rate, it’s no surprise that mcommerce is an important aspect of online shopping in Malaysia, and is expanding faster than ecommerce at a rate of 19.7% annually to reach US$8.9 billion by 2023. Shopping online via mobile devices accounts for 47% of all ecommerce transactions.

Shopper behaviour and preferences

Malaysians shop online for foreign brands with foreign sales outperforming domestic by 31.2%.

Social media is very popular in Malaysia. One in six Malaysians spend more than nine hours a day on social media, with Facebook the most popular platform followed by Instagram, Facebook Messenger and LinkedIn. Apps are the most popular mobile sales channel, used in 62% of transactions.

Payment preferences

Bank transfers are the preferred method of payment for ecommerce purchases at 44%. Domestic banks have a number of own-brand bank transfer options such as Maybank2u and CIMB Clicks which are generally used to pay domestic bills. Cards are the next most popular option at 36% with debit cards slightly more popular at 1.3 per person compared with 0.32 credit cards per person.

Fashion in Malaysia

Fashion is worth US$1.8 billion and expected to grow to almost US$3.5 billion by 2025. Apparel is the largest segment, worth US$1.15 billion.

Luxury Fashion

Revenue in the Luxury Fashion segment is currently US$597 million and expected to grow annually by 6.39%. Luxury apparel is the largest segment within this, worth US$376 million in 2021.

Singapore

Singapore is home to 5.6 million people, of which more than half are ecommerce shoppers – 3.07 million – expected to reach over 4 million by 2025. Internet penetration is at 82% and due to increase to 83% by 2025, and smartphone penetration is equally high at 82%.

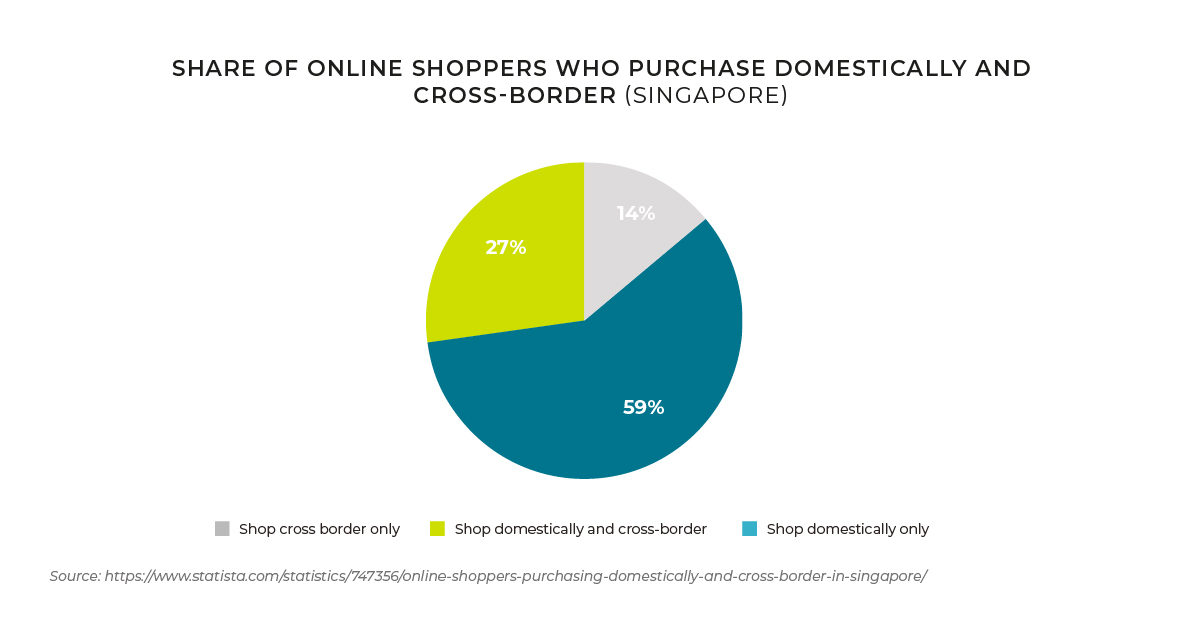

Ecommerce in Singapore

The ecommerce market in Singapore is worth US$4.9 billion, and is expected to grow at 8.35% per year. Singapore is a powerhouse ecommerce market despite its small size, with the average online annual spend at US$1456 per person.

While consumers spent more online during Covid-19, a study found that 40% were not satisfied with the shopping experience and 78% said they were more likely to support homegrown brands in future – a clear sign to cross-border ecommerce brands to ensure to provide a localized experience to Singaporean shoppers.

Mcommerce

The mcommerce market is worth US$2.1 billion and, according to Worldpay, is the world leader with mcommerce the most popular channel in the country as of 2019.

Singaporean Shopper behaviour

Singaporeans have quickly adopted ecommerce and mcommerce, with 60% of the population buying one or more products online each month and 38% purchasing through their smartphone once a month – higher than the global average (28%) and Southeast Asia’s average (37%).

Social media is a huge influencer of online shopping in Singapore. With more than 2 million active social media users of which 57% use social media sites such as Facebook, Instagram and Twitter to read reviews, do product research and access promotional offerings, brands selling into the country should ensure they have a strong social media presence.

Cost is a key concern for Singaporean shoppers who do a lot of research before buying with 55% preferring to buy products online because they are often better priced/cheaper.

69% of Millennials have shopped cross-border in the last year. This segment of the population values speed and convenience and expects frictionless and fast shopping experiences both from local and foreign ecommerce sites. Free shipping (65%) and fast delivery (49%) attract Millennials to cross-border sites.

Payment preferences

Singapore is the highest user of ePayments amongst all of the Southeast Asian countries. With 30% using their mobile devices to make a purchase at least once a week. 56% of online payments were made by card and 18% by digital/mobile wallets. Integrating payment methods will help to convert Singaporean shoppers as usage rate is high with DBS PayLah! At 62% and PayPal and GrabPay at 51%. Other significant ePayment options include Apple Pay and Google Pay.51%.

78% of Millennials in Singapore use PayPal for their online payments and Buy Now Pay Later methods are becoming more popular for both Millennials and Gen Z. Allowing shoppers to pay over time has led to bigger order values and better conversions for brands.

Fashion market in Singapore

Per capita spending on clothing and footwear in Singapore is one of the highest in Asia, with the apparel market worth US$2.3 billion and expected to grow by 4.51% annually. Women’s apparel is the largest segment at US$1.2 billion. With mandated lockdowns from January to June 2020, Singaporeans shifted to online shopping and their average order value increased on average by 51% compared to the same time in 2019.

Singapore’s online fashion consumers tend to be millennials (24.7%), have high expectations of a seamless, mobile-first retail experience and spend US$367 each per year. There is an almost equal split between male (32%) and female shoppers (38%), so ecommerce brands should ensure to target both segments equally.

In good news for cross-border apparel brands, 73% of Singapore’s online shoppers bought from overseas in 2018, making them second in Asia Pacific for buying online from overseas, so providing a localized, seamless end to end shopping experience to these shoppers should result in excellent returns.

Luxury fashion

The luxury fashion market in Singapore is worth US$891 million and expected to grow by 6.63% annually. Of this, luxury apparel is worth US$534 million and footwear worth US$357 million. This is expected to reach US$695 million for apparel, and US$457million for footwear by 2025. Luxury is a growing segment of the apparel market, increasing from 16% in 2012 to 24% of all apparel sales by 2025.

Indonesia

Indonesia has a population of 272 million, of which 158 million are ecommerce users – a penetration of 57%, expected to reach 77% by 2025. Indonesia has seen exponential growth in the ecommerce segment – increasing from US$13.6 billion in 2018 to US$38.1 billion in 2021 and expected to reach US$56 billion by 2024.

Ecommerce in Indonesia

The average revenue per user is US$240. Ecommerce in Indonesia is increasing at rate of 34.6% per annum and with internet (76%) and smartphone penetration (76%) and (76%) high and increasing to almost 90% each by 2025 there is a strong and growing appetite for both ecommerce and mcommerce.

Mcommerce

In 2017, Indonesia was the world’s third-largest mcommerce market after China and India. Although Singapore has now moved ahead of the country, the high usage of mcommerce means that brands that wish to sell into Indonesia need to optimize for the mobile channel. As with other Asian nations, Indonesians shop on mobile and smartphones and expect a frictionless experience end-to-end.

Shopper behaviour

Indonesia’s exceptional ecommerce growth is attributed to four factors – a growing middle class, high internet and mobile penetration rates, growing number of fintech and alternative finance and ecommerce tech investments.

Over half of Indonesia’s online shoppers are Millennials (25-34), Gen Z comprise 31% and Gen X comprise 16%, meaning this youthful shopping population is digitally savvy with high expectations of their shopping experience both online and on mobile.

Social media usage in Indonesia is amongst the highest in the world with 98% of internet users having social media accounts.

Apparel market

Revenue in the Apparel market is worth US$16 billion in 2021 and is growing at a rate of 8.72%. Women’s apparel is the largest segment, worth US$7.8 billion.

Luxury fashion in Indonesia

Luxury Fashion is worth US$576 million in Indonesia in 2021, and is growing at a rate of 6.29%, with Luxury Apparel the largest segment at over 50% and worth US$357 million.

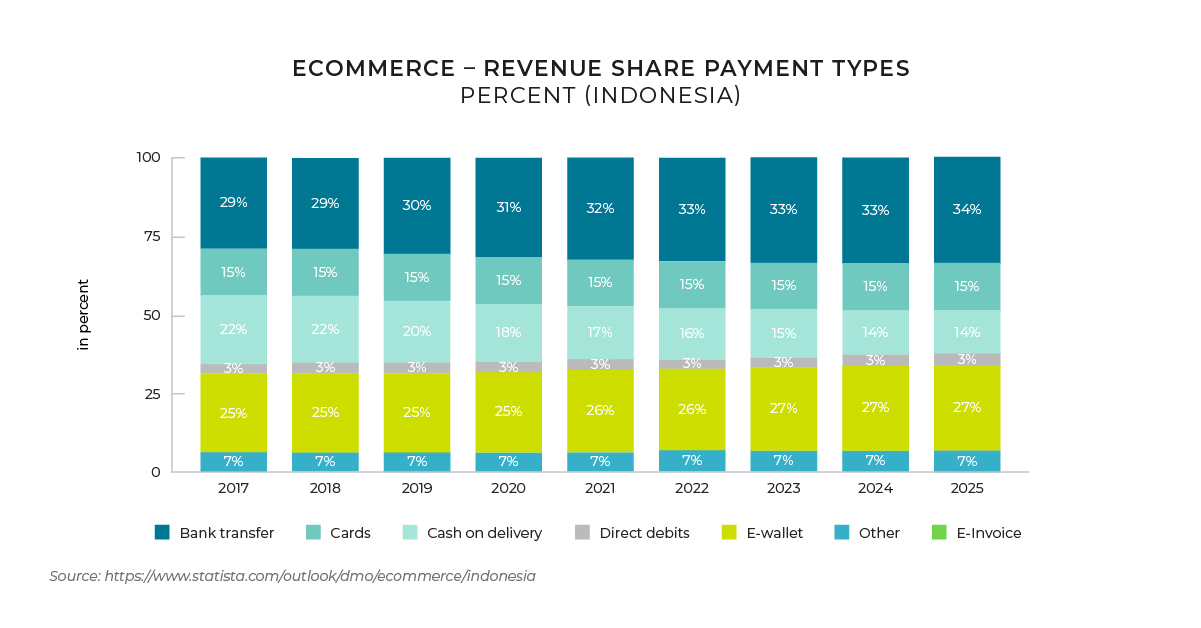

Payment method preferences for online purchases

Indonesia is a primarily cash-based society with only an estimated 4% of Indonesians owning credit cards and half not having bank accounts. This has led to a push to develop digital wallets which are the most popular cashless payment method in the country.

Online payment methods are increasingly popular in Indonesia with PayPal and Amazon Pay accounting for 50% of payments made online. Debit cards are the next most popular method (45%) although Cash on Delivery is also a frequently used method (44%) so ecommerce brands should facilitate this method of payment to increase conversions.

Logistics

With 17,508 islands, of which 6000 are inhabited, Indonesia presents a unique challenge for ecommerce brands to quickly and successfully deliver packages. While 56% of the population resides in urban areas, there is often duplication of street names and the state-owned national postal service PT Post Indonesia is struggling with infrastructure.

Cross-border brands entering Indonesia

Indonesia allows direct cross-border ecommerce sales, meaning that foreign companies can directly sell to local shoppers without establishing legal entities in Indonesia.

The Philippines

The Philippines has a population of nearly 108 million people, of which 38.9 million are ecommerce users. With 54% of the population in the 0-24 year old age group the country has a youthful, digitally savvy population whose interest and reliance on ecommerce will only grow in the coming years, creating a strong ecommerce market for cross-border brands to sell into.

Ecommerce in Indonesia

With ecommerce users expected to reach 55.8 million by 2025, representing 51% of the population, and increasing internet and smartphone penetration, the Philippines is a growing ecommerce market for cross-border ecommerce brands to explore.

Mcommerce

According to a recent report in Euromonitor International, ‘Thailand and Philippines: New Hotspots for M-Commerce’ the Philippines (and Thailand) are leading the Southeast Asian region in terms of mcommerce retail value. Thanks to a young digitally connected population with better payment options, the markets are poised to be the leader in internet retailing in the region.

Shopper behaviour

52% of online shoppers are in the 25-34 year old age group, followed by 18-24 year olds comprising 26%, and 35-54 year olds comprising 13%.

The shopping experience is very important to Filipino consumers who value going to the mall not only to purchase but also as a social activity. Ensuring that the shopper journey is excellent end-to-end for the Filipino shopper is key to enticing them away from shopping physically. Online shopping is increasingly popular amongst younger shoppers, who are driving the growth of ecommerce and mcommerce in the country. Filipino shoppers are also very socially conscious with 86% willing to pay extra for products and services provided by companies committed to positive social and environmental impact.

Apparel market

In the Philippines the Apparel market is worth US$2.1 billion and expected to grow by 8.31% annually. The largest segment is Women’s apparel worth nearly US$1 billion. Fashion is worth US$749 million in 2021 and growing at a rate of 18.14%.

Luxury market

Luxury Fashion amounts to US$212 million in 2021, growing at a rate of 7.48% annually to reach US$283 million in 2025. Of this, Luxury Apparel is currently worth US$177 million, expected to reach US$236 million by 2025.

Payment preferences

Cash is the most popular method of paying for online purchases in 2020 at 37%, with credit card accounting for 22% of purchases. Bank transfer was also popular, accounting for 29% of recent online payments.

Conclusion

Southeast Asia is an exciting, but complex region for cross-border ecommerce brands to sell into. While each country has its own requirements from language to localization, the growth in ecommerce and mcommerce, and having digitally-savvy populations means that there is a large and active market waiting to be captured by incoming brands.

Providing excellent shopper journey at every stage and ensuring to have fully optimized mobile versions of the sites will help to convert Southeast Asian shoppers, who have high standards and expectations for ecommerce offerings. Cross-border brands seeking to sell into the region will benefit from working with a localization expert who understands each nation’s unique shopper behaviour, provides country-specific payment methods, and that can expertly guide them entering the market.