Insights into Ecommerce In Australia for Cross-Border Brands

Australia, a country of 25.7 million people1 and a GDP of US$1.2 trillion, has the 10th highest real GDP per capita in the world, coming in at US$57,5912 and increasing at a rate of 2.6% pa to 2024. It is the eleventh-largest ecommerce market in the world, with 18.3 million ecommerce shoppers3 – expected to reach 20.7 million by 2025, approximately 77% of the population.

Average revenue per user is US$1,492, which is anticipated to reach US$1,689 by 2025 and overall revenues are anticipated4 to reach US$32 billion by 2023, representing a year on year increase of 15.5%.

As with many nations, Covid-19 has accelerated ecommerce in the market with the Holiday Insights Hub and 2020 Holiday Predictions report showing Australia and New Zealand’s ecommerce growth is the highest in the world at 108% in Q2, and 107% in Q3 20205. In April 2020 alone, there were 200,000 new online shoppers in Australia with online spending growing 80% YOY in the same month6.

Ecommerce brands selling into the Australian market will find that there is a strong appetite for cross-border shopping, given its somewhat isolated location, strong internet and smartphone penetration and keen online shopping population.

Australian Demographics

Australia’s 25.7 million people are split almost evenly between the genders with slightly more women than men (12.79 million to 12.6 million, as of 2019, latest data7). The population is anticipated8 to reach between 37.4 and 49.2 million by 2066.

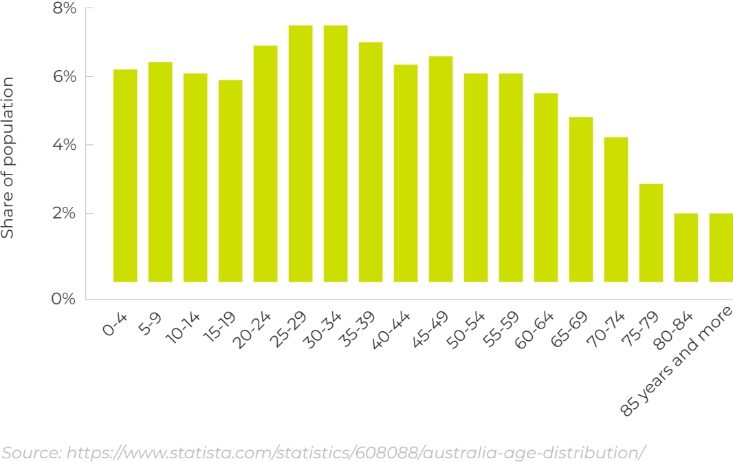

The population is an older one9 with only 15% between 25 and 34 years old. Life expectancy is high at 80 years old for males and 85 years old for females on average.

population distribution in australia

(in 2019, by age)

ESW’s Insights into Australian Shopping Habits

ESW recently conducted a global survey of over 22,000 consumers in 11 countries10 to understand cross-border shopper behaviour. Globally, digital transformation has accelerated, thanks in part to Covid-19, and cross-border ecommerce has become even more important as part of a global retail strategy.

The report featured many interesting insights into shopper behaviour globally and from a generational perspective and took a deep dive into each specific country. Here are a few key highlights of how and why Australian shoppers shop cross-border.

Most-purchased categories

In Australia, the top categories purchased cross-border were clothing (23%), jewellery (11%), toys (11%), footwear (12%), health and beauty (13%) and luxury goods (11%), with women buying more clothing (26% to 20% for men), although men bought more luxury goods (14% to 8% for women), toys (14% to 8%) and sporting goods (12% to 5% for women).

Age breakdown of Australian shoppers

Age makes a difference in shopping behaviour too with younger demographics (18-34) making the most cross-border purchases in every category except children’s clothing and toys (in the 18-24-year-old cohort).

Cross-border shopping increased among older shoppers with 83% of 55-64-year-olds making up to 10 international purchases, vs 76% overall. Women are more likely than men to make cross-border purchases at 80% vs 73%. 49% of respondents spent over $200 on cross-border purchases in 2020 (average online revenue11 per user in Australia for 2020 = US$1527).

Why do Australians Shop Cross-Border?

38% of Australians shop internationally because they can’t find the product in their local market. Another 38% said the cost including taxes and shipping is cheaper than what it would be domestically. 29% said that the international retailer offered more choice than what was available locally. Men are more likely to shop internationally (15% vs 10% of women).

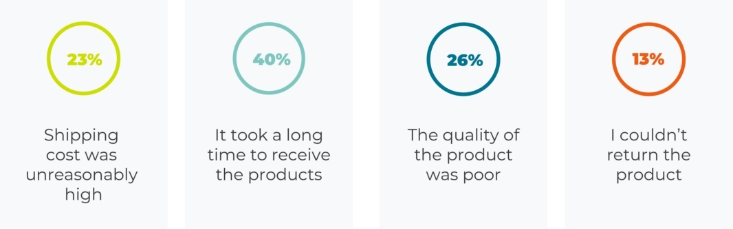

Reasons that Prevent Australians Shopping Cross-Border

Poor experiences or unforeseen costs can put shoppers off repeating a cross-border purchase or converting in the first instance. Some reasons Australians felt their cross-border experience was marred include:

How to Increase Australian Cross-Border Shopping

Brands that wish to increase their Australian customer base should provide local currency (41%), familiar payment options (37%), transparent tariffs (36%), local language (35%), clearly defined returns policy (28%) and the ability to return goods to a local address (26%).

How Do Australians Shoppers Shop Online?

Internet and smartphone penetration

Internet and smartphone penetration are high in the country at 72% and 85% respectively. Social media penetration12 is similarly high at 79.9%. Facebook is the most popular social media network in the country with 56% saying they used it most often. 21% used Instagram the most.

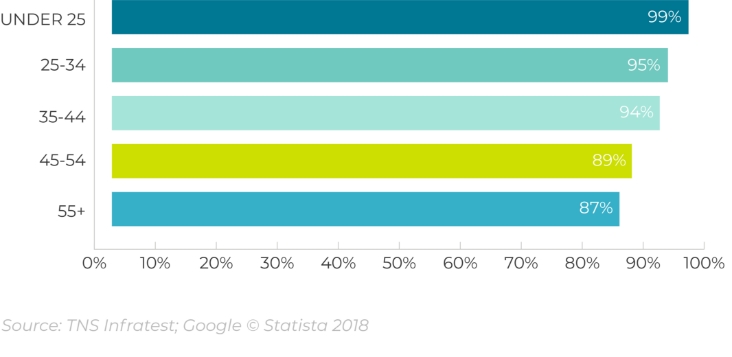

daily internet usage rate in australia

(in 2016, by age group)

Mcommerce

Almost half of Australians13 (49%) shop on their mobiles at least once a week, with the figure jumping for younger shoppers – Gen Y (66%) and Gen Z (65%). 39% of Australians browse for products, reviews or to save items to a wishlist daily, although again the figure is higher for younger shoppers (Gen Z – 44%, and 51% of Gen Y). Spending on mobile13 is increasing slightly year on year with the average monthly spend in 2020 being $272, an increase of $2 YOY from $270 in 2019. However, Gen Z’s average monthly spend on mobile jumped from $52 to $259 in 2020. Expectations for mobile-optimised sites13 are high from Australian shoppers with 57% saying security and trust issues would make them less likely to purchase from a business on mobile. 29% have abandoned a purchase on payment on mobile because it was too difficult, with 26% abandoning because it took too long.

Social Shopping

With such a high social media penetration in the country – 71% of Australians14 use social media for 2 hours or more per day – it’s no surprise that social shopping, shopping via social media apps, is on the rise. 31% of 18-34-year-olds, 28% of 35-54-year-olds and 10% of 55-year-olds and older made a purchase via social media in Australia in the last six months of 202015.

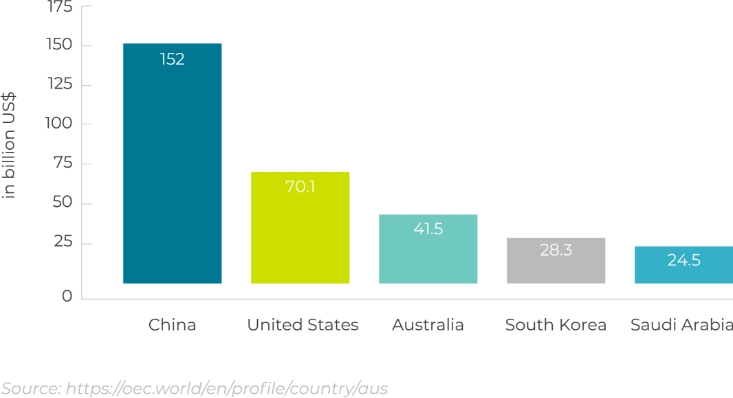

top 5 countries australia imports from

(in billion usD)

Australian Online Shopper Behaviour

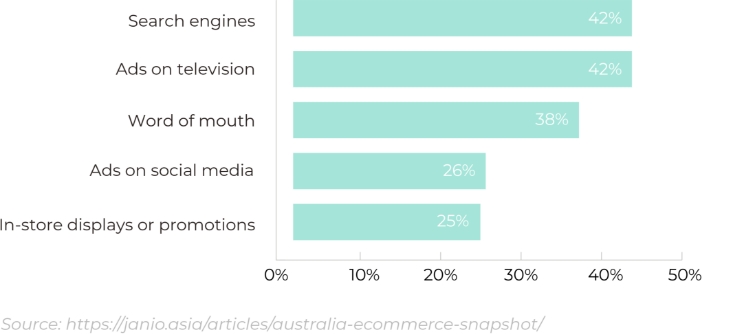

Australians are not only strong online shoppers but are also keen to shop cross-border too. They love bargains and use search engines (42%), ads on television (42%), word of mouth (38%), ads in social media (27%) and in-store displays or promotions to discover new brands6. A recent Statista survey17 showed that 55% of shoppers will always research a major purchase online first, 38% want to see an item before they buy, and 36% will research and buy on smartphone or tablet. Cross-border ecommerce brands selling into the country should ensure that their mcommerce offerings are excellent in order to capture these shoppers.

Being bargain hunters, November is a big month for Australian shoppers6 whose online purchases for Black Friday and Cyber Monday beat sales for the Christmas period. According to Australia Post’s Inside Australian Online Shopping18, New South Wales19 had the highest percentage of ecommerce purchases in the country at 34% in December 2020, although experts suggest this was lockdown related.

how DO australians discover new brands?

(percentage of internet users)

Throughout the year, Australian shoppers will look for bargains20, sales or discount codes with 59% using online discounts or promo codes, a figure that jumps to 73% for Gen Z shoppers. 14% of shoppers have even bought an unfamiliar brand due to a discount or promotional code. Another interesting insight from the Statista survey shows that 11% of respondents will ‘sometimes deliberately order more than I want to keep’. Brands will need to ensure strong and clear shipping, returns and refunds processes including potentially a minimum delivery threshold for free delivery. International retailers would also benefit from having local returns hubs in Australia to verify returns and facilitate faster refunds.

Marketing to the Australian Shopper

Even before Covid-19, two-thirds of the marketing budget21 among Australian small businesses was spent on digital advertising, and this has increased since the pandemic hit. Current advertising spend22 in the market is expected to reach US$8.3 billion by end of 2021. The largest segment is search advertising, with a market volume of US$3 billion in 2021. Spending across all segments is steadily increasing but social media advertising is seeing the highest expected increase from USS$101 average ad spend per user in 2021 to US$123 average ad spend by user by 2025. Spending is split almost evenly between desktop (47%) and mobile (53%) although mobile spend22 is increasing and expected to reach 60% by 2025. With 54% of shoppers constantly20 looking for sales or discount codes and more than a quarter (28%) anticipating more sales post Covid-19, cross-border brands will capture a willing marketing by providing sales or loyalty discounts to their Australian customers.

High Expectations

Australian shoppers have high expectations of ecommerce retailers23 with 16% saying they would be ‘turned off by a brand that doesn’t offer free returns and is the driving factor for not making a purchase. A further 14 per cent said they would avoid shopping with a retailer that didn’t offer free deliveries, saying it would be their biggest deal-breaker.’

Following the pandemic, these expectations have only increased23 with 20% of shoppers saying they now care more about having a good customer experience and may be driven away if a retailer doesn’t offer a selection of payment options and plans.

Personalisation

Australian shoppers expect a lot from their online experience and personalisation is a key aspect of this with 33% of shoppers abandoning relationships with businesses due to a lack of personalisation24.

Localisation

Localization is key for all markets and can range from website language translation to specific address formats, to providing country-specific payment methods or localizing currency25 (92% of shoppers globally prefer to shop in their own currency with 33% considering abandonment if US dollars are the only option).

Australian shoppers Localisation expectactions

Digital Payment Preferences

In 2020, 63% of Australian online shoppers used an online payment method26 such as PayPal to pay for online purchases, followed by debit card (49%), direct debit (48%), and credit card (47%).

Other methods of paying for online purchases include vouchers/prepaid cards (20%), invoices (14%) and cash on delivery (14%). Cash in advance is also used in a small number of payments (9%).

For the first time in 5 years, from 2016 to 2020, payments by mobile device27 decreased in Australia, from an average of 72% to 55% in 2020, possibly due to Covid-1920.

Buy Now Pay Later28 is a popular alternative payment method in Australia with market leader Afterpay seeing a 15% increase during 2020. With Buy Now Pay Later, shoppers can pay in instalments rather than upfront min one payment.

Fashion and Apparel Sales in Australia

Revenue in the Apparel market in Australia reached US$19 billion in 2021, and the market is expected to grow by 5.19% annually. Women’s apparel is the largest segment, accounting for US$10 billion. The average shopper in the apparel market purchases 57 pieces per year, equaling a revenue of approximately US$752 per person. 20% of apparel sales are made online, which means that ecommerce brands have a huge opportunity to capture shoppers in the market.

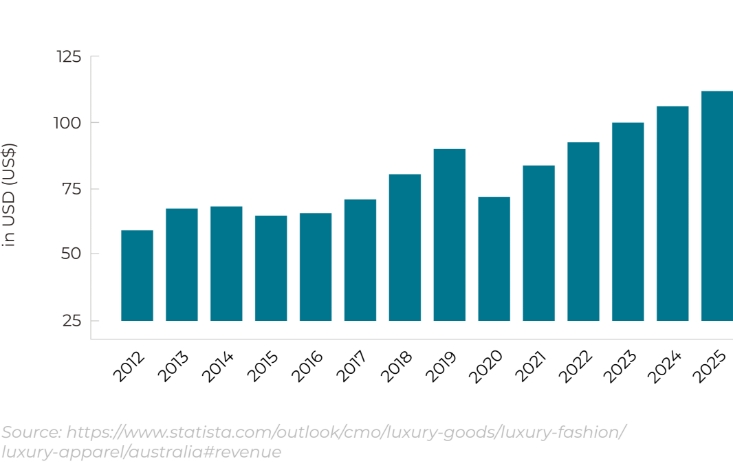

Luxury Apparel

Luxury apparel (designer clothing and clothing accessories (scarves, belts, hats etc.) that are made “ready-to-wear”) in Australia accounts for US$2.3 billion and is growing at a rate of 6.77% per year29.

Luxury Apparel – Average Revenue per Capita

(in USD)

Importance of Sustainability to the Australian Shopper

Sustainability is important to Australian shoppers with 87% saying they’re more likely to buy30 products that are ethically and sustainably produced, with 85% saying they want to see brands and retailers be more transparent about the origins and sustainability of their products, as well as whether they are operating ethically.

Cross-border ecommerce brands need to be cognisant of these expectations and assuage shopper concerns by implementing measures to be as sustainable and carbon-neutral as possible. Making it clear to shoppers that green measures are top of mind for the brand and having clear communications on site will help mitigate sustainability concerns for Australian shoppers. Some measures could include using local hubs for returns and consolidating returns in larger shipments which will lead to reducing fuel usage; providing slower (and cheaper) delivery options (ship rather than air freight); or offsetting the company’s carbon footprint31. Additionally, brands should consider regional or local fulfilment, particularly using their stores as inventory pools, should they have an in-country presence.

Supply Chain and Logistics Delivery Demands

Australia is a vast country, but the population tends to be primarily in a number of capital cities across the country making logistics not quite as difficult as it may have seemed at first.

Sustainability is important to Australian shoppers and should be top of mind for cross-border ecommerce brands entering the market. In 2020, the Australian Retailers Association32 said ‘our delivery options will also have to meet higher environmental standards. Australia Post has already begun investing in this area for customers via the launch of the Australia Post Collect & Return service earlier this year. This adds supermarkets, pharmacies, department stores, shopping centres, and banks to its 3,500 strong retail store network to enable consumers to pick up (or return) their online shopping from a place that suits them.’

While ten years ago ‘free and fast’32 was a key converter for ecommerce brands, it was incredibly costly. Australian retailers are now trying to provide ‘fast and free’ fulfilment through ‘click and collect’ in-store for free.

Some retailers provide three-hour delivery33 in certain metro areas such as Sydney and Melbourne, leading shoppers in those areas to consider same-delivery as a near-standard, and a low cost.

Free or low-cost delivery is a conversion driver for 60% of Australian shoppers21 so providing multiple delivery options including click and collect, or ‘buy online pick up in store’ (BUPO), as well as express (paid) delivery and slower, cheaper options33, are all ways that brands can provide the best possible and most cost-effective delivery options to shoppers.

Rating Returns

41% of shoppers32 have stopped shopping with a retailer after a bad returns experience, proving that providing excellent post-purchase experiences are just as important for shopper retention. A clear returns process with a refund timeline outlined will help Australian shoppers to understand exactly how long their refund will take and should help prevent calls or emails to customer service, freeing up their time also.

Brands should use returns data to identify whether returns are because of products, sizing, imagery or fraudulent behaviour. Utilising this data – by providing better product descriptions or imagery for example – will help the shopper select better and be less likely to return items, reducing returns and refunds costs for the brand.

Conclusion

Australia is an exciting market for cross-border brands to explore, with a digitally-savvy, high-spending population ready to shop internationally. Providing an excellent, personalised shopping experience through every step of the process, including post-purchase, is key to capturing the Australian shopper. Mcommerce and social shopping are important areas to optimize as Australians will quickly abandon purchases that take too long or don’t appear to be secure.

Fast and cheap or free delivery is a key conversion driver for the Australian shopper, and the bar is high with three-hour delivery being the norm in some metro areas. Providing an optimized end to end shopping experience for Australian shoppers is key to gathering and retaining online customers.

Cross-border ecommerce brands considering selling into the market will find Australians to be savvy online shoppers, eager for bargains and ready to shop.

Sources

- https://data.worldbank.org/country/australia

- https://www.statista.com/statistics/263740/total-population-of-australia/ 3

- https://www.statista.com/outlook/243/107/e-commerce/australia#market-users

- https://www.trade.gov/market-intelligence/australia-ecommerce

- https://www.cmo.com.au/article/685305/soaring-ecommerce-take-up-australia-2020-signals-more-come/

- https://janio.asia/articles/australia-ecommerce-snapshot/

- https://www.statista.com/statistics/608530/australia-population-by-gender/

- https://www.abs.gov.au/statistics/people/population

- https://www.statista.com/statistics/608088/australia-age-distribution/

- https://www.statista.com/outlook/dmo/ecommerce/australia#revenue

- https://www.statista.com/statistics/680201/australia-social-media-penetration/

- https://newsroom.au.paypal-corp.com/Mobile_commerce_and_COVID-19

- https://wearesocial.com/au/digital-2020-australia

- https://www.statista.com/statistics/1192455/share-of-people-who-purchased-goods-on-social-media-by-age-group/

- https://www.trade.gov/market-intelligence/australia-ecommerce

- https://www.statista.com/forecasts/1004174/attitudes-towards-online-shopping-in-australia

- https://auspost.com.au/content/dam/auspost_corp/media/documents/inside-australian-online-shopping-update-feb-2021.pdf

- https://www.statista.com/statistics/1219789/australia-share-of-online-purchases-by-state/

- https://www.paypalobjects.com/marketing/brc/au/paypal-2020-ecommerce-index.pdf

- https://www.consultancy.com.au/news/3093/online-and-e-commerce-the-future-for-australian-small-businesses

- https://www.statista.com/outlook/dmo/digital-advertising/australia

- https://powerretail.com.au/in-focus/aussie-online-shopping-expectations-are-rapidly-changing/

- https://www.comestri.com/wp-content/uploads/2020/11/2021-Trends-in-Ecommerce-AU.pdf

- https://www.plytix.com/blog/ecommerce-challenges-for-2020

- https://www.statista.com/forecasts/1004164/online-payments-by-type-in-australia

- https://www.statista.com/statistics/1228714/australia-mobile-payments-among-consumers/

- https://auspost.com.au/content/dam/auspost_corp/media/documents/ecommerce-industry-report-2021.pdf

- https://www.statista.com/outlook/cmo/luxury-goods/luxury-fashion/luxury-apparel/australia

- https://www.couriersplease.com.au/about/media-release

- https://www.climatecare.org/calculator/carbon-offsetting/

- https://blog.retail.org.au/newsandinsights/deliveries-in-the-future-and-what-they-will-look-like

- https://www.transdirect.com.au/what-customers-want-fast-free-delivery