The Challenges of Cross-border Duties and Taxes

Ecommerce brands selling into international markets need to navigate the duties, taxes and customs requirements of these countries to be legally compliant and ensure there are no delays to deliveries or additional costs to shoppers.

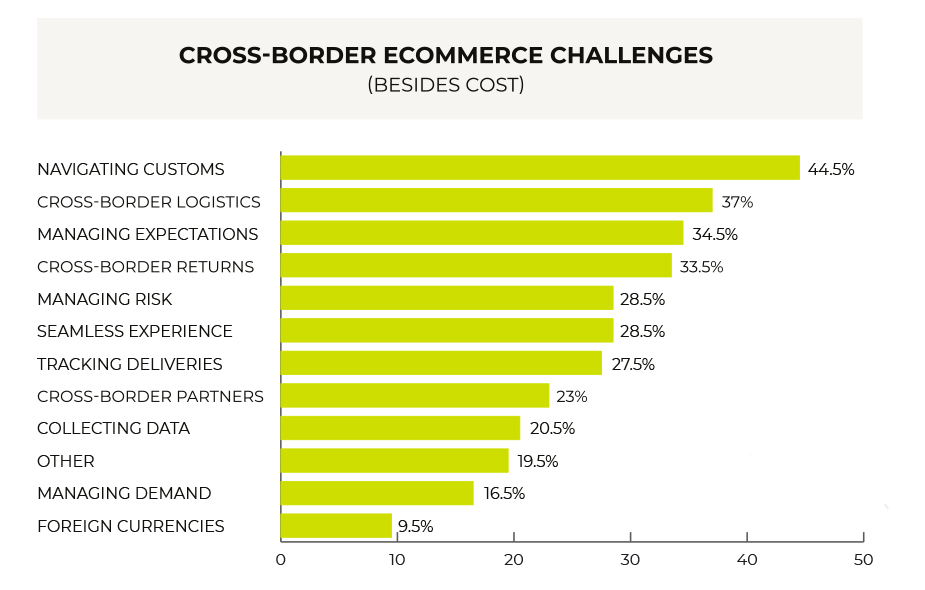

Nearly half of cross-border ecommerce brands report that navigating customs compliance is the most difficult aspect of operating internationally ‑ even above logistics, returns, and processing foreign currencies.

Brands and retailers are legally required to be compliant with trade regulations in all countries and territories they import into. But proper compliance is also about ensuring a good customer experience. Minimizing any shopper disruption due to non-compliant goods or insufficient paperwork will increase customer confidence and brand loyalty. Goods that are held by customs or incur an additional charge to the shopper could damage the brand or reduce the chances of a repeat purchase.

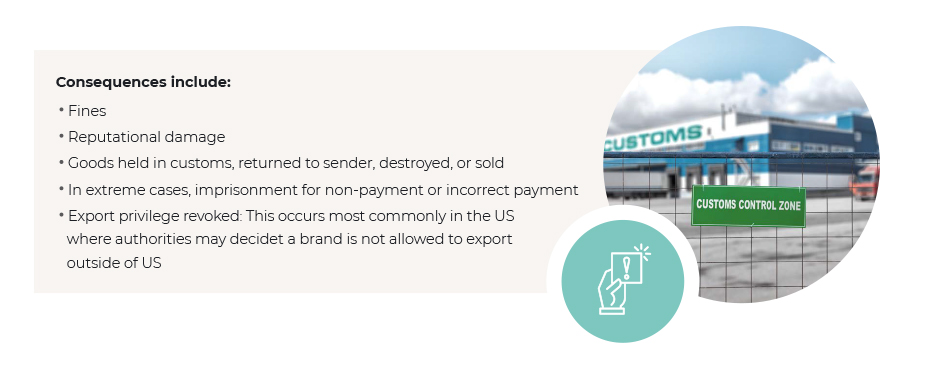

The varying tax laws in each country as well as the frequent changes to these rules can be a nightmare for brands and retailers. Changes can be introduced before they are published or occasionally not published at all. Retailers may find themselves unknowingly miscalculating duties and taxes that they are later penalized for. In addition to customers not receiving their items on time (or ever), authorities may issue fines or revoke export privileges. Partnering with an experienced provider not only saves time otherwise spent researching changes and adjusting logistical processes, but also eliminates risk of non-compliance.

Consequences of Non-Compliance

Penalties for non-compliance are steep and are put in place by the country of destination. Sanctions can be imposed on any member of the transaction, be it the importer, exporter, carrier, or broker.

Agreements Between Countries and Territories

Different types of agreements govern trade between countries, helping to determine which rates of duties and taxes are applied to imports.

Free trade agreements (FTAS)

An agreement between two countries or regions. Reduced duty rates for all or certain products.

Most favored nation (MFNS)

This is a favorable duty rate that pertains to a certain set of duties applicable between World Trade Organization (WTO) countries.

Preferential non-preferential country of origin

The country of origin of goods is a factor in determining the amount of duty payable. Other factors include the type and value of the goods which will influence the amount of duty payable upon import.

CALCULATION AND COLLECTION OF IMPORT DUTIES AND TAXES FOR BRANDS

Duties are determined by the country of import. However, they can be influenced by any customs union (such as the EU), or agreements such as MFN or FTA. If a country is part of the WTO, then it must apply the same duty rate to goods coming from any other country that is also part of the WTO.

Duties are collected by customs agents at the point of entry into the country of import. Brands selling cross-border may be obligated to have a broker to manage and pay the customs due on shipments, who will then invoice the company for payment. Depending on the Incoterm (international commerce terms, or rules that govern a transaction between importer and exporter) chosen, either the duties and taxes are paid at checkout or by the shopper on receipt of goods.

DDP (delivery duty paid) is the only incoterm that allows duties and taxes to be paid at checkout and is best practice for ecommerce brands, as it is a superior experience for the shopper.

There are several different ways to calculate duties, including:

- As a percentage of imported item value

- On a per product rate – eg $3 per pair of shoes

- Per pound/kilo rate – pay by weight

- Compounded duty – where it is calculated as a percentage with a minimum threshold.

CALCULATING IMPORT DUTIES AND TAXES FOR SHOPPERS

In order to calculate the correct duties and taxes for shoppers, brands need to know the duties applicable for each product in each country that they are shipping to. In line with best practice, this calculation is added to the order value at checkout. To determine the accurate duty amount per item, brands must know the precise HS Code, the particular agreement between import and export country, and sometimes freight and insurance (if the country calculates on a Cost, Insurance & Freight (CIF) basis). Certain countries may add further customs fees to the calculation.

Tax Registration Requirements

A tax registration is required before selling into many countries. Brands and retailers wanting to expand their global footprint will likely have to file in multiple countries. The process is cumbersome, requiring extensive details including company structure, signatures of directors, and sending notarized copies or original passports to the authorities in each location. Approval can take 3-6 months, which can delay a retailer entering a new market.

Once registered, entities are charged value added tax (VAT) from the first sale. These charges and the subsequent payments must be recorded for the purpose of auditing and any verification. The specific requirements for reporting also vary by region, making it challenging to manage.

Payment of duties and taxes may then be required by the tax authorities to be made in the local currency. Certain countries will also insist that the retailer has an in-country presence to ensure the proper payment is made.

Varying Complexities by Country

Keeping up to date with the tax rules in each country is a complicated and time-consuming endeavor for retailers. As well as learning unfamiliar regulations when looking to enter new markets, retailers must adapt processes quickly in response to changes in existing markets. The following are some of the ways that rules and rates vary between region:

Australia & New Zealand

SPECIFIC TAX RULES

In general, goods imported into Australia by consumers are subject to Goods and Services Tax (GST) on importation.

However, goods with a customs value of AUD$1,000 or less, known as low value imported goods (LVIGs), are not subject to GST on importation. Instead, the GST due on these goods is collected at the point of sale.

If the right declarations are not properly prepared, there is a risk that the LVIGs will be charged GST again on import.

This approach is growing in popularity with New Zealand and other countries, such as Switzerland and Norway, adopting a similar approach to Australia for the importation of LVIGs.

ESW SOLUTION

As the entity facilitating the sale and delivery of LVIGs to end consumers, ESW takes on the responsibility of collecting, reporting and paying the GST to the relevant tax authority.

ESW completes the appropriate declarations and supplies them to the relevant customs authority to prevent the LVIGs being taxed again on import.

It is likely that many other countries will follow this example. ESW monitors developments in various countries to ensure compliance with any new importation rules.

Hungary

SPECIFIC TAX RULES

Hungary has introduced a new real-time reporting requirement for VAT. To comply with this requirement, retailers must provide certain information about invoices and credit notes issued to Hungarian customers directly to the Hungarian tax authorities on a real time basis.

ESW SOLUTION

Where retailers’ sales in Hungary are carried out via ESW, ESW handles providing the Hungarian tax authorities with the relevant information.

Portugal

SPECIFIC TAX RULES

Portugal has also introduced new requirements that apply to sales to Portuguese consumers. All invoices/credit notes issued to Portuguese consumers must be generated on invoicing software that has been certified by the Portuguese tax authorities.

Many other countries in the EU, such as Spain, Italy and Greece have already started implementing similar changes to VAT reporting and invoicing on a phased basis.

ESW SOLUTION

ESW ensures that these requirements are adhered to and compliant invoices are generated.

United Kingdom

SPECIFIC TAX RULES

Goods imported by UK consumers with a value exceeding £135 are subject to UK import VAT and duty on importation. Goods valued at less than £135 will not be subject to this import charge, but VAT will be collected at the point of sale and paid over to the tax authorities, as opposed to customs.

ESW SOLUTION

The VAT due on goods valued at £135 or less will be collected, reported and paid to the UK tax authorities by ESW.

HOW DOES BREXIT IMPACT CROSSBORDER RETAILERS AROUND THE GLOBE? FIND OUT BY READING, A GUIDE TO BREXIT FOR GLOBAL ECOMMERCE RETAILERS.

EU

SPECIFIC TAX RULES

From July 1st, 2021, the EU is removing the VAT de minimus. VAT will be levied on all goods imported to the EU from all non-EU countries and regions. This is a change to the previous threshold of €22, under which goods were exempt from VAT.

To remain compliant, retailers will need to calculate, collect and remit the appropriate VAT amount.

ESW SOLUTION

ESW will update calculations to apply VAT on all consignments into the EU following the abolition of the low value consignment relief.

Understanding the 2021 EU VAT Reform

Coinciding with the new EU tax is the introduction of the Import One Stop Shop (IOSS) which is intended to simplify VAT collection on the importation of parcels into the EU (for consumers) from non-EU jurisdictions. IOSS will enable online retailers and platforms to charge a VAT-inclusive price on imports to consumers for all consignments valued at less than €150 and remit this VAT through their IOSS return. Where IOSS is correctly applied, no additional VAT should be collected at the point of import by the shipping agent on behalf of the customer.

To use IOSS, a retailer must register for IOSS in any EU country. The retailer will then be given an IOSS number which is valid across all EU countries.

POTENTIAL ADVANTAGES OF IOSS

TIME EFFICIENCY

The European Commission’s stated intention is that where IOSS is used the goods should be cleared in reduced time and with less administrative difficulty as no additional VAT is due to be collected.

FULL LANDED PRICE

Another intended benefit is that the supplier would sell to the customer at a VAT- inclusive price and there would be no hidden charges for the customer or the supplier on importation of the goods, reducing the likelihood of returned or non-accepted goods.

FILINGS

All VAT on any relevant transactions can be remitted through a monthly IOSS return rather than having to pay same VAT on the importation of each consignment.

POTENTIAL DISADVANTAGES OF IOSS

BUSINESS SYSTEMS CHALLENGES: Businesses will need to invest in technology changes to be able to operate the IOSS.

GOVERNMENT SYSTEMS CHALLENGES: A number of countries, such as the Netherlands and Germany, have stated that they will not have their systems ready in time for July 2021.

RISK OF DOUBLE TAXATION: There is a risk that VAT could be collected at both the checkout and point of import. For example, if a consignment is valued under €150 (based on FX exchange) at the point of sale but is valued over €150 at the point of import, the customs authorities may seek payment of VAT again even if has previously been paid.

RISK OF FRAUD: There is a potential risk that fraudsters could obtain another party’s IOSS number and use that to send packages into the EU without the payment of VAT. The risk is that the holder of the valid IOSS number could be held liable for the VAT unless they can demonstrate that they did not know and should not have known of the fraudulent use of the number.

EUBASED REPRESENTATIVE: A non-EU supplier wishing to register for IOSS must appoint an EU representative in the country of import who has joint and several liability. An exception may arise if the EU has a mutual agreement with the country of the seller, although this currently only applies to Norway.

ESW IS REGISTERED FOR IOSS SO RETAILERS USING ESW ARE NOT REQUIRED TO SIGN UP FOR IOSS. RETAILERS NOT USING ESW SHOULD EVALUATE THEIR ORDER VOLUME INTO EU COUNTRIES AND DETERMINE IF IT MAKES SENSE TO REGISTER.

Save Time and Eliminate Risk with a Cross-Border Expert

Navigating customs compliance for shipping goods into multiple countries is not an easy task for brands but is essential to remaining legally compliant and creating an excellent shopper experience.

By acting as the entity and staying aware of the frequent changes, ESW puts in place appropriate duties and taxes processes for each market. ESW will ensure-

- The appropriate and relevant information is handed over to the authorities

- All guidelines are adhered to

- Accurate VAT/GST is collected, reported and paid

- Appropriate declarations are completed and supplied to the relevant customs authority to demonstrate that VAT/GST has already been paid on the imported goods

- Brands are kept aware of any regulatory changes that would affect tax rate/payments

Glossary of Terms

Below is a guide to the common terms used in duties and taxes compliance.

CIF ‑ Under the Incoterms 2020 rules, CIF means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, insurance to that point, and when required, the export declaration. CIF applies to marine freight only and is one of only two Incoterms 2020 rules that identify which of the parties must purchase insurance.

CITES CERTIFICATION ‑ This is a specific document related to the Washington convention for the protection of flora and fauna. In most case, the seller will need to have a CITES certificate for export of products that may contain materials derived from some protected flora and fauna, eg crocodile leather.

COUNTRY OF ORIGIN ‑ Is where the good has been wholly obtained or where the last substantial transformation of the product has been carried out. This can have duties and tax implications for the brand. If for example a material is sourced in China but manufactured in Vietnam, then the brand will be charged duties related to the agreement that Vietnam has with the importing country, not China. If the product were made in China but finished in Vietnam (with no significant transformation), then the duties would be related to the agreement between China and the country of import.

DANGEROUS GOODS ‑ There are a number of products that are considered ‘dangerous goods’ such as lithium ion batteries, powder cosmetics and anything that contains liquids or alcohol such as perfume or nail varnish.

DE MINIMUS ‑ Value under which duty or duty and tax are not payable.

DOCUMENTATION ‑ Any product being imported into a country needs to be accompanied with specific documentation that details the specific HS codes for the product in that country – for example if you import HTS 420221 (leather handbags) into Australia the specific requirements may include an Import Permit for Wildlife and Wildlife Products document.

FOB ‑ Free on board (applies to marine freight only) – this means the seller has fulfilled its obligation when the goods are loaded on the vessel nominated by the buyer at the named port of shipment. With FOB, the seller is responsible for loading the goods on the transport, while the buyer is responsible for everything else necessary to get the goods to the final destination.

HS CODES ‑ HS Codes are a worldwide agreed classification for all products to determine what product is being imported or exported and what conditions and taxes are applicable. The first six digits are the same worldwide, but countries are free to further classify products by appending subsequent digits to identify the product in more detail and assign a duty rate accordingly.

INCOTERMS ‑ International commerce terms: represent a universal term that defines a transaction between importer and exporter, so that both parties understand their tasks, costs, risks and responsibilities. They do not determine the ownership of the goods (a widely held belief), and are not a requirement. It’s important to also note that incoterms can be superseded by local regulations.